Shares in NRW Holdings (NWH) halted pending capital raise, BGC purchase

Stock

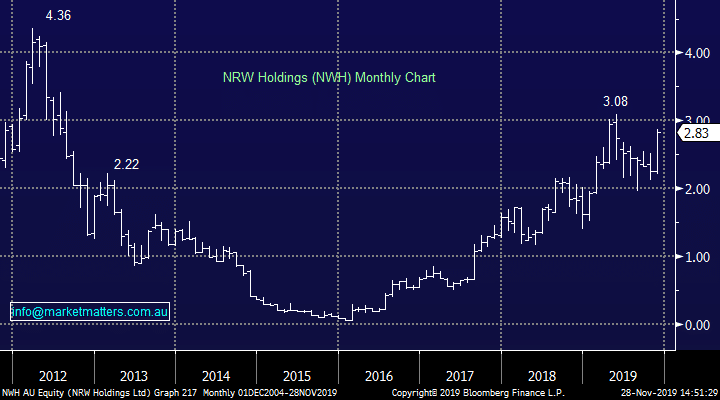

NRW Holdings (NWH) $2.83 as at 28/11/2019

Event

Shares in resource and infrastructure services company NRW Holdings will spend the rest of the week in a trading halt as the company attempts to raise $120m from investors to fund the latest acquisition after the purchase of BGC Contracting. New shares will be issued somewhere between $2.65 to $2.85 with the bottom end of the range a 6.4% discount to last close, and the top a small premium. BGC is one of the biggest privately owned companies in Australia, doing close to $2b revenue in a year.

The deal will slot in nicely alongside NRW's current businesses and is touted as being 14% EPS accretive before any synergies hit. They are also highly experienced in integrating sizable acquisitions with a number of bolt-ons joining the NRW group over the past few years, including the purchase of RCR Tomlinson’s Mining and Heat Treatment businesses off administrators earlier this year.

NRW will pay a total of $310m for the businesses, but this includes taking on around $185m of debt, paying the remainder to the shareholders of BGC. The rationale for NRW strategic fit BGC makes in the NRW suite of offerings with significant synergies created and many cross-selling opportunities available.

NRW Holdings (NWH) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook