September – the toughest month in the last 6 for Australian stocks (KMD, TPM)

WHAT MATTERED TODAY

Sell the rumour, buy the fact it seemed in Asia today as Donald Trump imposed another round of tariffs pre-market which sent US Futures + Asian markets lower in the first instance however they clawed back much of those losses throughout the session – ASIAN markets actually ended mostly higher. US Futures were down ~0.30% on open this morning but traded up from the lows during our time zone after DT imposed new tariffs on $US200bn worth of Chinese goods as the trade tussle escalates. We’ve had a further pop up in FUTURES since I’ve been typing away and hard not to think that traders have got a sniff of some improvements on the trade front in the last 20 mins or so - or maybe it’s DT getting set ahead of an announcement!

The latest round marks the third set of tariffs put into motion so far this year. In July, the US increased charges on $34bn worth of Chinese products before again rolling out a 25% tax on goods worth $16bn. Today’s move is clearly the most substantial to date with Trump saying…."We have been very clear about the type of changes that need to be made, and we have given China every opportunity to treat us more fairly. But, so far, China has been unwilling to change its practices." As we suggested in the AM report today, the trade tensions are ratcheting up a notch however it still seems that markets are playing down the threat.

That’s been a very common trait over recent times as the market simply fades weakness (for now). On our market today, full year results were out from Kathmandu (KMD) and they were strong, however the market bid the stock up this morning and sold it hard this afternoon – a bearish move on the day. More on that result below.

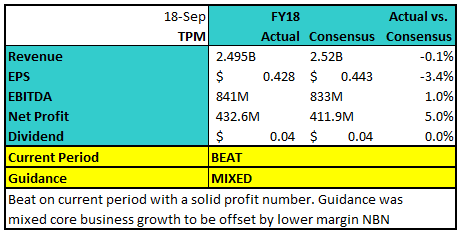

TPG Telecom (TPM) was also out with their full year numbers and the opposite played out there, an early sell off was met with decent buying with the stock’s closing slightly lower overall. They’re numbers were good and guidance at the EBITDA line was ahead of current market expectations 800-820m v the 800m consensus.

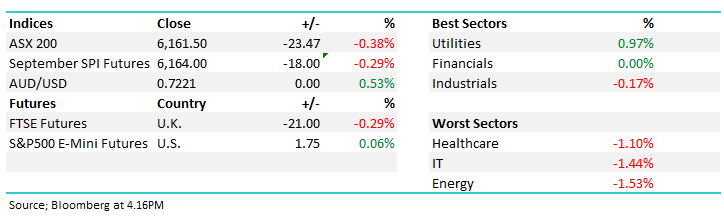

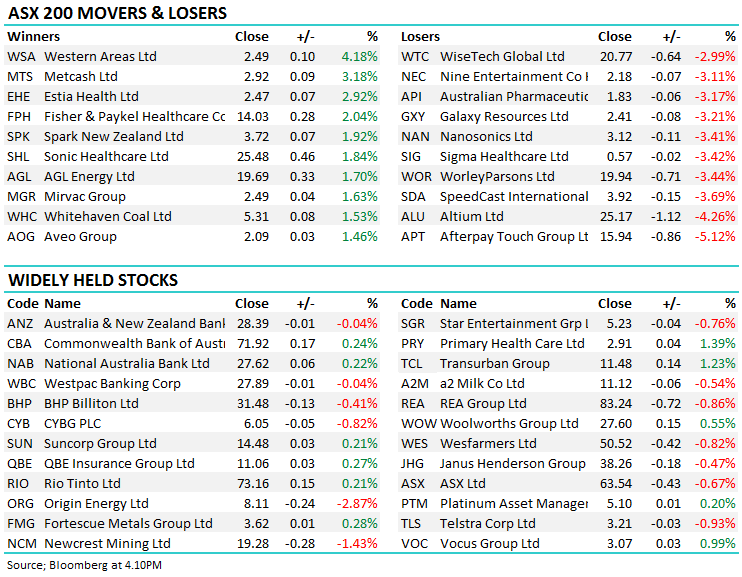

Overall, the index closed down 23 points or 0.38% today to 6161. Dow Futures are currently trading flat. In terms of the month to date for local stocks, we’ve now had the weakest month in the last 6, currently down 2.63% over the first 18 days of September with 11 of the last 14 local sessions ending in the red. We need to go back to March to find a weaker period, with the market down -4.27% that month, before bouncing hard in April by +3.88%.

The US markets have remained very resilient while we’ve struggled – lumped in as proxy for emerging markets weakness – sell Oz given it’s exposed to Asia and the big boy in the region is in a trade tussle with the US, however worth keeping in mind that the US Q3 reporting season kicks off in the first week of October – we all know these guys love to beat expectations so in the periods leading up we often get downgrades – or realignment of market expectations!!. Anyway, I’ll most likely write a report in the morning covering some overseas stocks with a focus in the US. We’ve tracked a model portfolio here for some time and will gradually increase our coverage of international opportunities in both the stock and ETF space in these notes moving forward.

ASX 200 Chart – pop higher on the match at 4.10pm

ASX 200 Chart

CATCHING OUR EYE

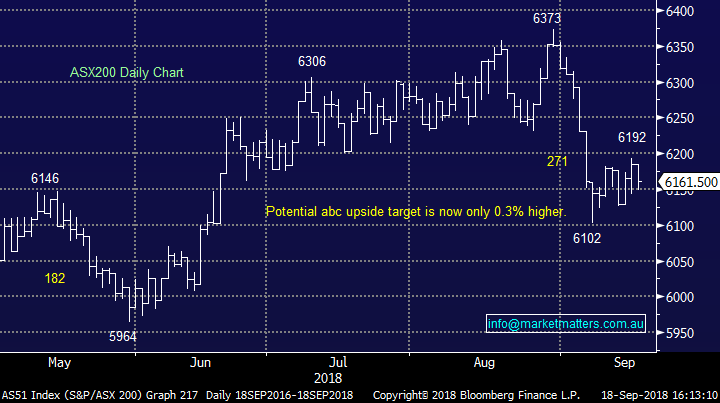

Aussie Dollar; Big bounce today in the Aussie dollar with the first leg up in early trade thanks to selling in the USD following Trumps trade antics, but then we had another 2 noticeable legs higher during the day, one at 1pm and another at 3.30pm with the currency trading from a low of 71.44 to now be trading well above the 72 handle. This is more a function of USD weakness however that theme supported a decent bounce in the local mining stocks leading into the close. The miners are heavily correlated to the AUD and any short term bounce will see money back into that sector. A theme to watch as we’re looking to up weight into current weakness.

AUDUSD Chart

Broker Moves; Macquarie have reinforced their preference for BHP over and above RIO at the moment given upside at spot prices amid a return to the earnings upgrade cycle for diversified miners – they wrote in a note out yesterday.

RATINGS CHANGES:

· Health scope Upgraded to Buy at Morningstar

· Sydney Airport Cut to Underperform at Macquarie; PT A$7.13

· Premier Investments Downgraded to Neutral at UBS; PT A$20.30

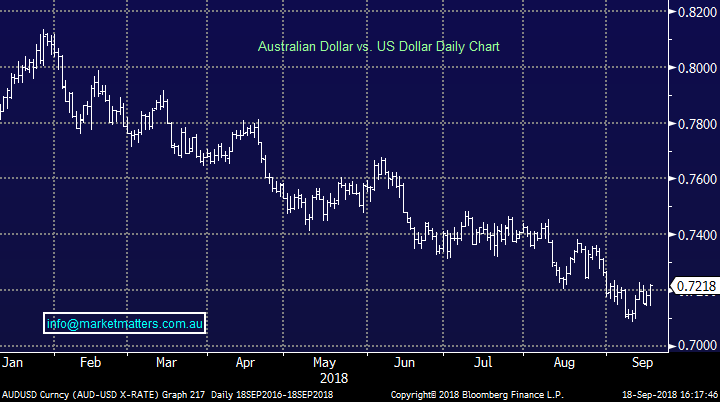

Kathmandu (KMD) $2.88 / +0.7%; the retailer delivered a stellar full year result this morning and the stock rallied, although it gave back most of the early gains. Sales beat market consensus coming in at $NZ497 versus $NZ493 while the dividend was a beat at NZ11c v NZ9c expected. While the company didn’t give guidance there were some very pleasing trends in terms of the result, specifically around gross margins which expanded after a weak FY17 period. The market is forecasting an increase in sales of ~14% in FY19 dropping down to profit growth of ~17% which for a stock trading on 12.3x (pre today’s move) and yielding ~5% fully franked, it looks attractive.

The company also gave some commentary around the acquisition of US outdoor footwear company Oboz which was completed earlier this year. Oboz has a strong customer base in North America & will provide a great platform to tap into one of the biggest outdoor wear markets as Kathmandu looks to America & Europe for growth. While the trends in KMD are looking attractive, and its valuation in far from stretched, we remain overall cautious on the retailers in the current environment, although concede that niche players such as KMD and Nick Scali for instance have continued to deliver strong numbers.

Kathmandu (KMD) Chart

TPG Telecom (TPM) $8.72 / unch; TPG’s full year result hit the boards pre-market and while the numbers looked inline to a slight beat, the market sold it off ~-4.8% initially largely on the downbeat commentary provided by the company, however the stock rallied back to trade marginally lower for the rest of the day. The telco has been facing the same problem as many others in the crowded Australian broadband market – margin pressure as customers move onto the nbn – however they still managed nearly 1% EBITDA growth over the year, while also printing well above the twice upgraded FY18 guidance. They gave guidance of FY19 EBITDA of $800M-820M, above the market’s current expectations of $800m.

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (TPM) Chart

….and just a quick one on CSL with the optimism built into the share price starting to fade - now down ~11% from its highs. This has been / is a cracking stock that we bought at good levels and sold too early however when the consensus is long and overweight, selling can often perpetuate selling…

CSL Chart

OUR CALLS

No trades across the MM Portfolio’s today – we’re watching resources here for opportunity while a stock pricking our attention in the smaller cap space is BWX after a failed management buyout.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.