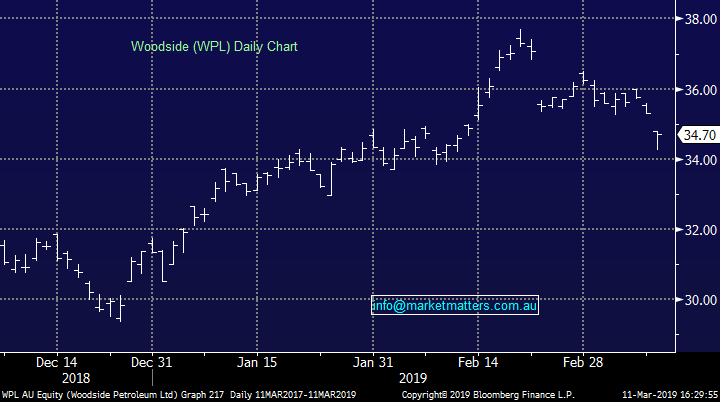

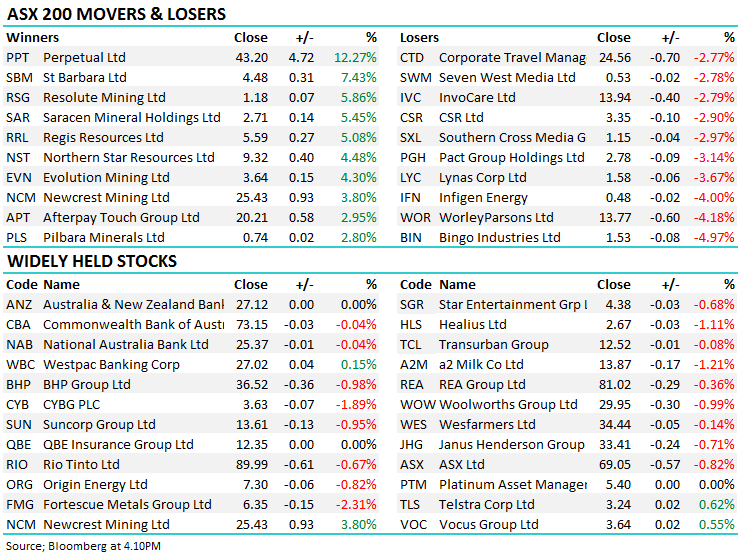

Selling targets energy stocks (WPL, SPT, IVC, MQG, NCM, APX)

WHAT MATTERED TODAY

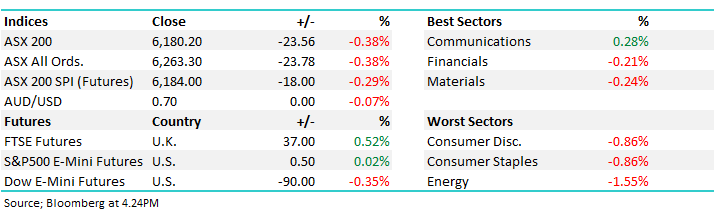

A choppy session for Aussie stocks today with the market hit by selling early and it never really managed to get off the mat US Futures were trading down for most of the session – Asia was mixed however there was a fair bit of stock / sector news bubbling away under the hood. Retail sales out tonight in the US which will be interesting…the start of the December rout in US stocks coincided with a poor retail sales print, so tonight’s read will be important, particularly given employment data was weak on Friday night.

Energy hardest hit today – we discuss why below while the banks were relative performers into weakness, a theme we think will continue.

Overall today, the ASX 200 lost -23 points or -0.38% to 6. Dow Futures are currently trading down -61pts / -0.24%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

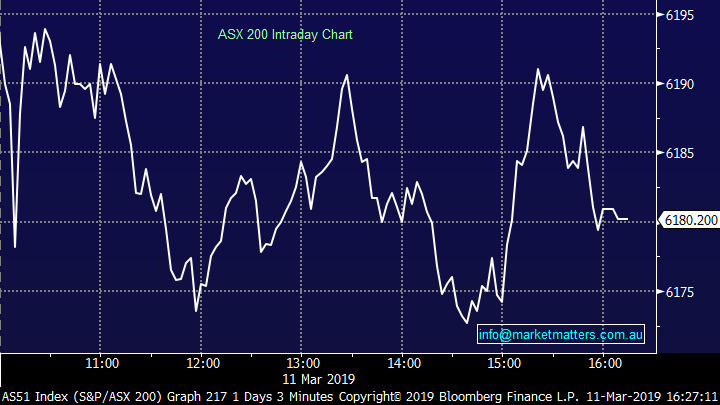

A few stocks catching my eye today, the market getting more interesting into weakness. There was a big buyer of Perpetual (PPT) in the market today – the stock doing massive volume –most volume in over a year – not sure why, no news out but someone clearly wanting to own it. 1.4m shares – nearly $60m.

We hold PPT in the income portfolio and given such significant volume, we’re inclined to let it run for now…

Perpetual (PPT) Chart

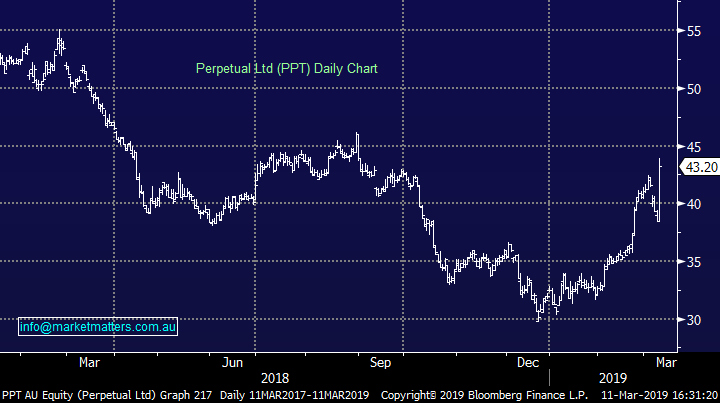

Energy stocks came under pressure – WPL down 1.73%, STO off by 2.16%, OSH fell -1.99% and BPT was off by -2.44% after Fridays news that the Norwegian sovereign wealth fund will divest $8 billion worth of oil and gas holdings, which could include stakes Woodside, Santos, Oil Search and Beach Energy. They said they would seek to phase out holdings classified as exploration and production companies from the portfolio in order to "reduce the aggregate oil price risk in the Norwegian economy". In short, Norway relies heavily on oil and gas and to then expose the sovereign wealth fund to more oil and gas doesn’t make sense. That said, it’s not completely new news, Norway's pension fund embarked on its fossil fuel divestment campaign five years ago. At the end of 2018, they owned shares in around 300 oil producers and service companies including 13.5m shares in WPL.

To give some context about the size of their wealth fund, they have stakes in more than 9000 companies worldwide and on average, the fund holds 1.4% of all of the world's listed companies, while they have about 70% of its holdings are in shares.

Woodside Petroleum (WPL) Chart

Macquarie (MQG) –2.26% was hit today after making a new all-time high of $130.88 last week – ASIC criticized them and others about the speed (or lack thereof) to complete reviews into whether more customers have been charged for services they didn’t receive. Probably simply a good excuse to take money off the table from MQG after a huge run + its obviously influenced by what’s happening in the US with markets coming off their worst week in a while + the $US pulled back on Friday on weak data. We’re negative the stock short term.

Macquarie (MQG) Chart

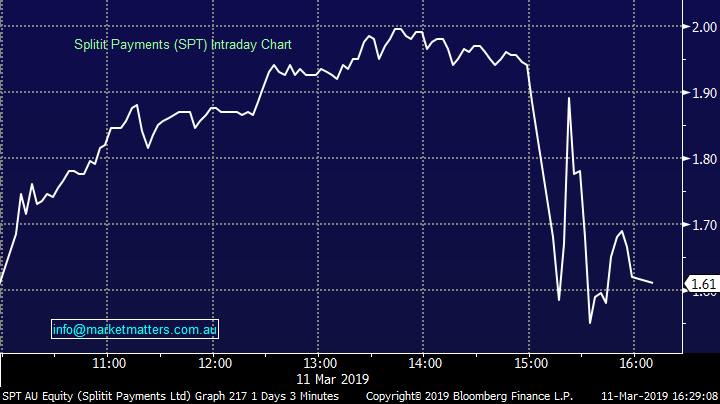

We mentioned Splitit (SPT) +2.88% in the Q & A this morning, and another massive day for the day traders – the stock traded within a ~35% range . To recap, these guys listed at 20c in January and today closed at $1.61 after hitting a $2 high.

It’s pretty clear this is now a punting / momentum stock with $54m worth of value going through today + people buying it to be the next AfterPay. To put todays volume into context , it traded more value than Telstra (TLS) and the only stocks to do more value than it were the big 4 banks+ BHP, RIO, FMG, MQG & CSL . SPT got a speeding ticket today – a query from the ASX and they went into a trading halt ‘nothing to see here’ was the response but the stock fell to $1.48 all the same. Volatile day traders stock – but phenomenal momentum / flow all the same.

Splitit (SPT) Intra-Day Chart

Invocare (IVC) -2.79%; the funeral operator we’ve flagged a few times although missed the boat ourselves is back on market today after raising capital to give them some balance sheet flexibility. A good move by IVC - since the January low of ~$10 the stock rallied to around $15 as shorts were forced to cover on better than expected results. The pop in share price has enticed them to raise capital and get their balance sheet back in order. Their net debt-to-ebitda was sitting around 3x and they need to keep it below 3.5x. The ~$85m will get that ratio back closer to 2x giving them flexibility to continue to buy smaller funeral operators. The shorts had been feasting on IVC for a while, and while they may cheer today, the rally over the past 2 months has been aggressive – that said, shorts still sitting at 11.7% of issues capital or around 13m shares.

The capital raise consists of an Institutional Placement which has raised $65 million at $14.00 with stock coming online on the 14th March, while they’ve also announced a Share Purchase Plan (SPP) for existing retail shareholders. Those who held shares on the 7th March will have the chance to buy up to $15,000 worth at $14.00, with more details to be sent to shareholders shortly.

Balance sheet capacity was one of the issues that IVC had to deal with and the pleasing aspect here is they’ve raised capital into strength. While deaths have been unusually low over the past 12 months and acknowledging we can’t predict when, we do know that these fluctuations are unfortunately temporary - death is only deferred not avoided. We like IVC into further weakness.

Invocare (IVC) Chart

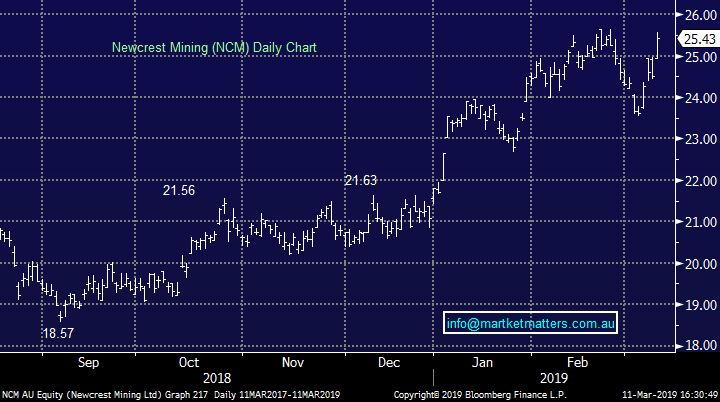

Newcrest (NCM) +3.8%; rallied today after announcing plans to buy a 70% stake in a Canadian gold & copper mine held by Imperial Metals for $US 806.5m, funded in full from cash and bank facilities – prior to the deal, NCM had $3b available to it. Imperial Metals had a very stretched balance sheet with $1.2b debt vs asset values of around $1.2b, while the company is still loss making.

The Red Chris mine currently has an expected resource of 20m ounces of gold, and 13b lbs of copper with a mine life out to 2043 and exploration of the area ongoing. The opportunity for NCM here is to employ their technical expertise to optimise the resource as they have done in previous projects. Newcrest is considered a market leader in this respect. The mine is still in Stage 1 development and will require more capital injections to get it up to full scale production, however it adds geographical & commodity diversification to Newcrest’s portfolio. The company hopes this will become its 5th tier 1 gold asset in the portfolio. We like the deal and NCM looks bullish however risk / reward doesn’t stake up. We may look to buy closer to $23 but have a close eye on other names in the space, including Northern Star Resources(NST), Evolution Mining (EVN) and Alacer Gold (AQG).

Newcrest (NCM) Chart

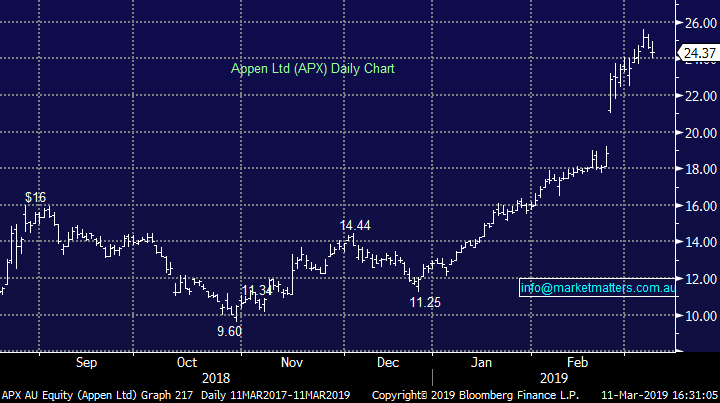

Appen (APX) – Trading Halt ; the artificial intelligence name spent the day in a trading halt this morning as they look to raise money for their next phase of expansion by acquisition. Appen has agreed to pay $249m for Figure Eight, a US based machine learning company providing another string to the company’s offering. The purchase will be funded by a $300m capital raise which was launched today. The raise will be done at $21.50/share, a ~12% discount to the last traded price.

Figure Eight uses AI to annotate data sets including text & video to complement Appen’s language technology services. The acquisition is expected to add 40-50% revenue for the year, and reduce EBITDA losses by 30-40% with great short & long term synergies and a positive breakeven EBITDA contribution by FY20. Scale is clearly an important factor for technology firms, and the deal adds scale to Appen’s existing businesses. The company expects a number of cross-selling opportunities as they look to leverage in to Figure Eight’s ~200 customers. We like Appen, but it’s not cheap. The raise seems aggressively priced given the recent performance of the stock, just 2 weeks ago was the stock below the $21.50 raise price. The pullback post raise may present an opportunity in the stock.

Appen (APX) Chart

Broker Moves

· Nufarm Upgraded to Buy at Goldman; PT A$6.90

· Hotel Property Rated New Buy at Deutsche Bank; PT A$3.44

· IPH Upgraded to Outperform at Macquarie; PT A$7.10

· Iluka Reinstated at Goldman With Neutral; PT A$8.70

· Rio Tinto Upgraded to Buy at Investec; PT 44.75 Pounds

OUR CALLS

We added Woodside (WPL) in the Income Portfolio today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.