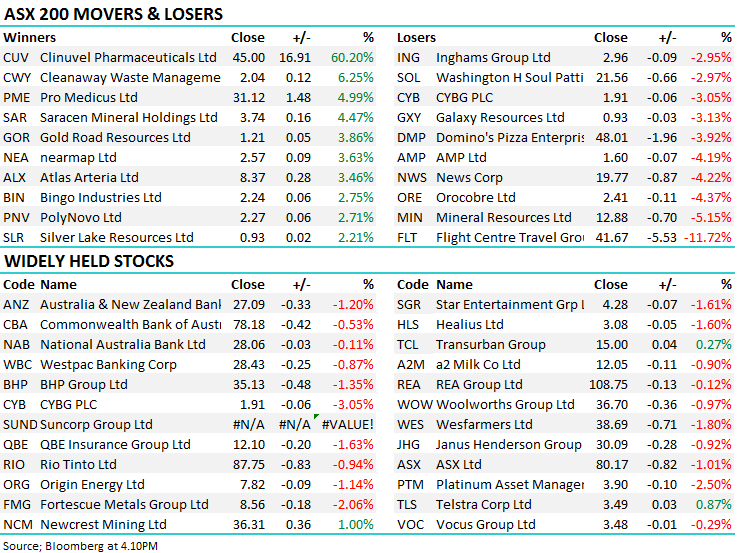

Selling resumes following US trade escalation (FLT, CUV, CWY)

WHAT MATTERED TODAY

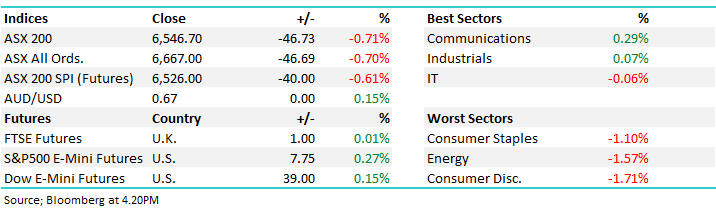

A softer session locally following weakness overseas, although we did see the worst of the session early on with the market bottoming out at 10.30am before it grinded higher throughout the day, finishing +26pts from the low. Asian markets were weaker, although not materially so while US futures traded higher during our time zone. Defensive sectors did best while an ~11% fall in Flight Centre (FLT) saw the consumer discretionary sector lead the lagers.

Overall, the ASX 200 closed lower today, down -46pts or -0.71% to 6546, Dow Futures are trading up +44pts/+0.17%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

**New CBA Hybrid** CBA this morning have a launched a new hybrid security, looking to raise ~$750m, however they’ll likely do more. This is a tier 1 security structured in a similar way to existing CBA PERLS Capital notes on issue. The margin is likely to be 3% over the 90 day bank bill rate which equates to a grossed yield of ~3.84%. We covered in more detail in today’s Income Note – Click Here to view

If subscribers would like to bid into the broker book build, we can facilitate, simply email [email protected] or call (02) 9238 1561 for details. Please note, this would be offered through Shaw and Partners and an account would need to be opened in the bidding entity.

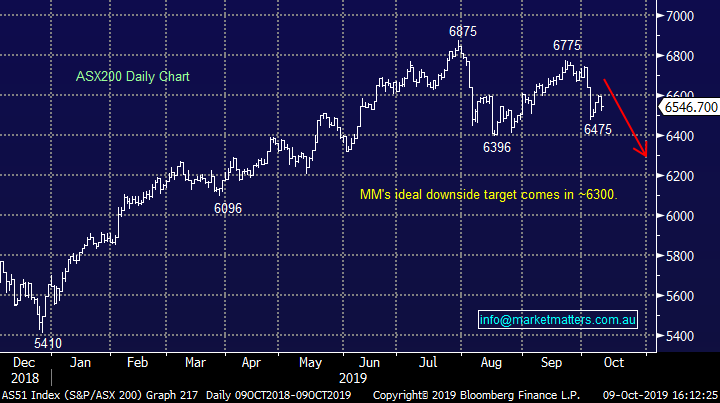

Flight Centre (FLT) –11.72%; sold off on concerns flagged in the company’s presentation at the Morgan’s conference in Queensland. According to the presentation, FLT has seen subdued trading in Australian and US leisure travel while unrest and uncertainty is also impacting transaction growth in a number of other areas including the UK. This will drop down to “underlying FY20 1H profit likely to be below $140.4m FY19 1H result.” While not exactly guidance for the full year, it doesn’t paint a confident picture as we approach the November AGM.

The company was hoping to gloss over the first half struggles by presenting upside into the back end of the year saying any improvement in global unrest should restore demand, while the Australian and US markets could see a boost from lower interest rates. Despite all this, the company is off to a slow start in a year where analysts had pencilled in ~10% growth. On our numbers, FLT will need to deliver a very big second half, up something like 27% on 2H19 to meet current consensus.

We recently sold FLT in the income portfolio for a good profit at higher levels.

Flight Centre (FLT) Chart

Clinuvel Pharma (CUV) +60%; the biotech company rocketed higher today on announcing their SCENESSE drug has been approved for use on EPP patients in the US by the FDA. EPP sufferers experience extreme pain when exposed to light which can last days or weeks. There is estimated to be up to 10,000 patients with EPP globally with Clinuvel’s injection providing up to 60 days protection. Certainly a small market but a life changing drug.

Clinuvel Pharmacutical (CUV) Chart

Cleanaway (CWY) +6.25%; rallied against the grain today on news it had finally acquired the assets of SKM which had been in the hands of receivers since August. It follows Cleanaway’s purchase of $60m of the company’s debt a few months ago, with Cleanaway now picking up 5 sites including Victoria’s biggest recycling plant. 2 of the sites, both in South Australia, have already been flagged for sale however the news is good for Victorian councils, many of which were forced to send recycling waste to landfill since the collapse. We prefer Bingo (BIN) in the space, and will be looking for an opportunity around their AGM next month to buy a pullback.

Cleanaway Waste (CWY) Chart

BROKER MOVES;

· SeaLink Raised to Buy at Baillieu Ltd; PT A$5.20

· Qantas Cut to Neutral at Goldman; PT A$6.88

· TPG Telecom Rated New Underperform at Jefferies; PT A$6.18

· Telstra Rated New Buy at Jefferies; PT A$4.08

· Vocus Rated New Hold at Jefferies; PT A$3.55

· Rio Tinto Upgraded to Buy at Renaissance Capital; PT 46 Pounds

OUR CALLS

No changes today

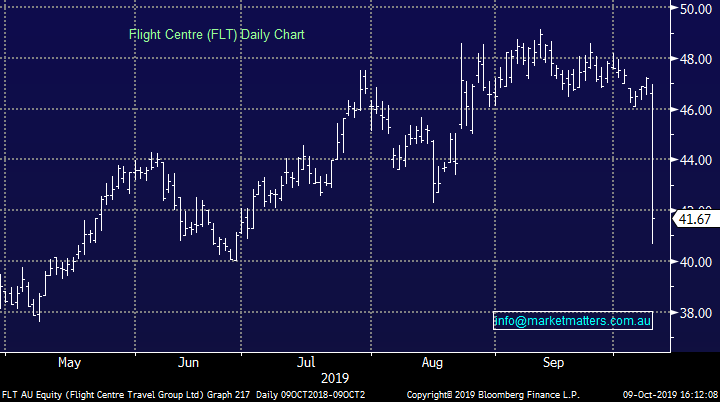

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.