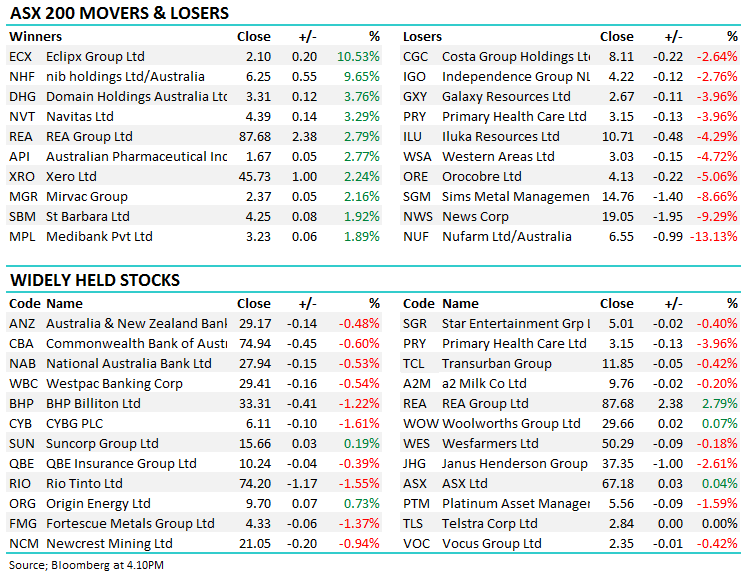

Selling hit the ASX today with money moving out of the miners (JBH, DHG, CZZ)

WHAT MATTERED TODAY

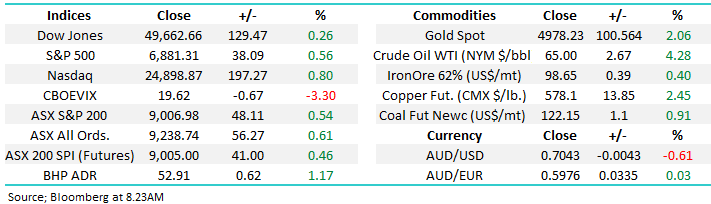

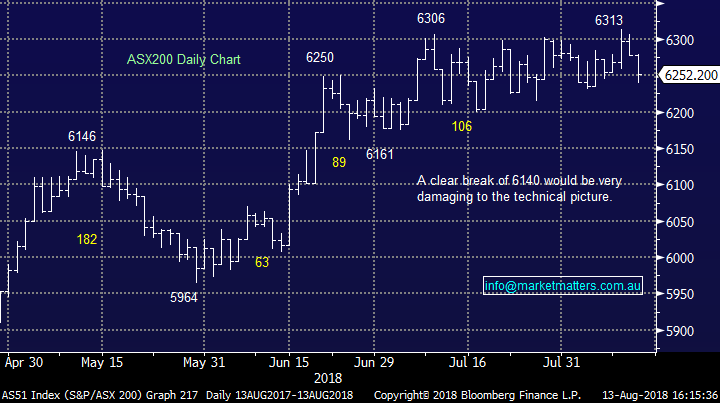

As mentioned in the AM missive today, SPI Futures were optimistic printing +10 points higher early on, however selling quickly kicked in and the market tracked lower throughout the session, the resource stocks providing the biggest drag with a few very noticeable themes;

1. The Nickel stocks were hit hard, Western Areas (WSA) down -4.72% to trade near $3, now 25% below its April highs – Independence Group (IGO) followed suit down -2.76% and sits a similar distance from its recent highs.

2. Lithium names are feeling the pinch with the argument that recent supply will outstrip near term demand clearly winning out at the moment. Kidman (KDR) pumped another -8.06% on the downside today while Orocobre (ORE) lost ~5% and is clearly causing us some pain within the Growth Portfolio

& 3. The large cap miners are now in correction mode with BHP down –1.22% to $33.31 and RIO was off 1.55% to $74.20. We’re seeing a move out of the cyclical commodity names which is unsurprising given the bullishness towards the sector only a month or so ago – seems like buying the rumour, selling the fact of the capital return story was the play. We are currently underweight the miners. On the flipside, while the banks were lower overall today, they did outperform the broader market / showed relative strength.

In terms of our positioning overall, we tossed around turning more defensive in the Growth Portfolio today even though we have negative facing ETFs (around 11% short exposure) + we also have ~15% cash in the Growth Portfolio. Ideally we’re sellers of strength however today felt wrong and given the tightening trading range of the local market – a theme we discussed in the Weekend Report, our gut feel targets a likely break to the downside – we’ll give it another day then start to take some more aggressive action with our current plan being;

1. Increase our BBUS (short US ETF) position.

2. Reduce stock exposure by reducing SUN by another 2%, and taking our medicine on Janus Henderson (JHG), selling out for a loss.

On the weekend, we mentioned about buying 1 – 2 resource stocks into ~5% weakness, one candidate is RIO but because the stock went ex-dividend $1.71 fully franked last week our interested buy level has dropped from around $74 to under $73 which will be ~16% below the highs of 2018.

Overall, the ASX200 lost -26 points today or -0.42% to close at 6252– Dow Futures are currently trading down -91pts.

Australian Reporting season is underway – for a full list of company reporting dates – click here. Tomorrow the main companies out with results are Challenger (CGF) and Whitehaven Coal (WHC). In terms of CGF, consensus for FY profit sits at A$402.4 million on EBIT of $535m and a final dividend of 0.175cps, and importantly the market for FY19 has profit growth pencilled in of 7.45% to $454m.

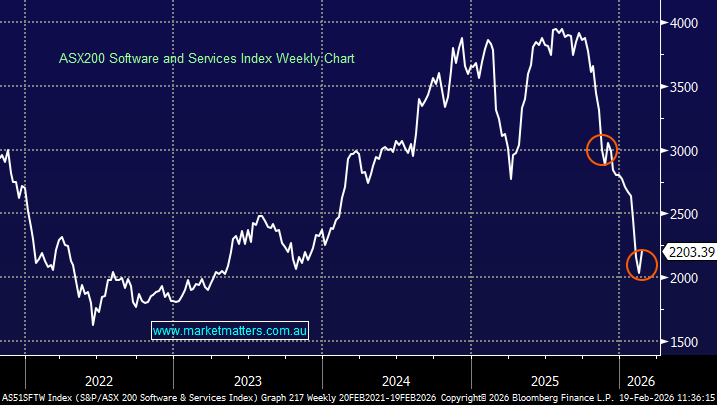

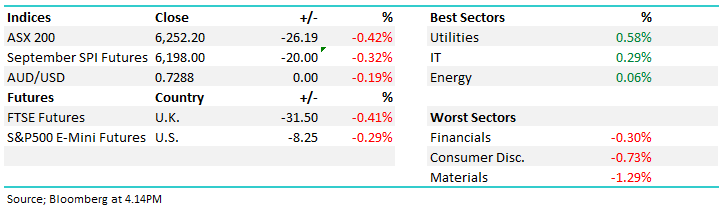

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; REA copped a few upgrades today from MQG and Morgan’s – the stock up +2.79% as a consequence.

· REA Group Upgraded to Neutral at Macquarie; PT A$90

· REA Group Upgraded to Add at Morgans Financial; PT A$95.41

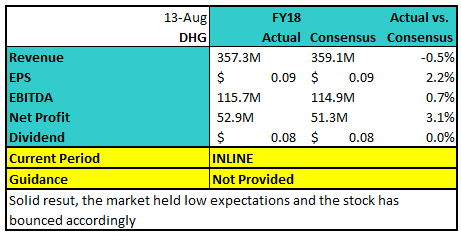

Domain Holdings (DHG) $3.31 / +3.76%; After a choppy open, the real estate listings website Domain traded higher through the day following their FY18 results announcement. The result was mostly in line for the period, however commentary was more upbeat that the market was expecting. This result was the first full year report since demerging from Fairfax late last year, whilst also the first opportunity for the market to review the company’s progress post the departure of Sam Catalano but come before new CEO Jason Pellegrino commences later this month.

The result did include some large one-off costs that skew the statutory results to a net loss of $6.2m however the market is becoming more bullish on the ability for Domain to deliver in FY19. Key to this is Jason’s expertise in growing a digital business, whilst the merger of Nine Entertainment & Domain’s majority shareholder Fairfax is seen as a positive “through additional marketing and audience reach of the combined business” the company said. Although the Nine-Fairfax merger assists the business, we see the merger as unlikely, and the potential upside to Domain limited in the short term as well as headwinds in the housing market.

Domain Holdings (DHG) Chart

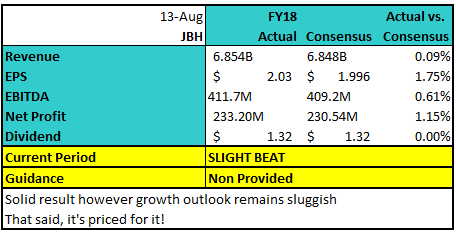

JB Hi-Fi (JBH) $23.38 / -0.38%; This morning JBH reported their full year results and they were slightly ahead of market expectations and the stock initially rallied 5.67% to an intra-day high of $24.80 before the retail bears sold the strength with the stock ending lower. Revenue was close to expectations however they’ve done a better job in terms of cost control in a tough retail environment which dropped down to a +1.15% beat at the profit line. Relative to FY17, the FY18 result showed reasonable growth in the business with earnings per share up by ~7%, and profit up by ~11% on the year.

The company was happy with the performance of the business across the board although they did note a tough second half period for the Good Guys. FY19 Guidance was thin on the ground however in terms of top line sales (revenue) they expect the group will do $7.1b, up 3.6% on the year which was close to the $7.126B the market was already expecting pre-result. In terms of current market expectation, EBITDA is expected to be $425.5m up 3.36% on the year while profit is expected to be 3.03% higher at $240.3m in FY19. The market isn’t asking a lot of JBH here, however the retail environment remains tough and store count growth has slowed significantly reducing the company’s ability to generate growth.

JB Hi-Fi (JBH) Chart

Capilano Honey (CZZ) $19.62 / +25.37%; the Australian honey company jumped on news of a takeover in a joint effort by private equity firms ROC Capital from Sydney, and Wattle Hill of Hong Kong. The deal offers cash to Capilano’s shareholders at $20.06/share – 28.2% premium to Friday’s close - or scrip into the new controlling entity. The offer has been recommended by the board, and the largest shareholder, Kerry Stokes’ investment company Wroxby has indicated that it will vote in favour of the offer.

An unusual term to the takeover deal relies on at least 15% of shareholder’s electing to take up shares in to the new entity rather than the cash offer. This, along with the involvement of ROC Capital and their backers (mostly Australian Superfunds) ensure that much of the company will remain in Australian hands. The Chinese interest for Capilano stems mostly from their manuka honey operations which the Chinese market sees medicinal benefits and the deal will likely see an increase in exports of the honey into Asia.

CZZ closed 2.2% below the offer level with the market pricing in a small discount for the risk that the deal is derailed by the FIRB.

Capilano Honey (CZZ) Chart

OUR CALLS

No trades across the MM Portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here