Sellers dominate a weak session (RIO, AHY)

WHAT MATTERED TODAY

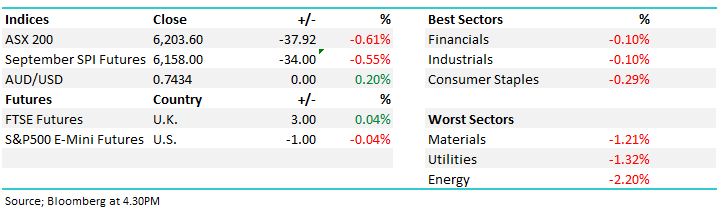

Another day of weakness across the board today with all sectors on the ASX closing in the red which simply implies broad based profit taking / risk reduction with the growth related areas hit hardest i.e. energy down -2.20% to be worst on ground. We’re now getting a chorus of more bearish views hit the boards with the CEO of the world’s largest asset manager BlackRock the latest to mirror the MM view saying that intensifying global trade tensions may spur a broad market downturn and a slowdown in the US economy. He thinks stocks could drop 10 per cent to 15 per cent as a result!

Asian markets were also soft today while US Futures ticked in and out of positive territory however it was the composition of today’s local sell off that caught our eye most i.e. the beaten down areas of the market such as the financials and some industrials outperformed into the weakness while the ‘hot sectors’ struggled. A theme we think will continue.

From an index perspective, the ASX 200 tested the 6200 region today after attempting to rally in early trade. Selling strength was the ticket which is clearly aligned with our current thinking.

Overall, the ASX200 lost -37 points, or -0.61% to close at 6203 – Dow Futures are currently trading up +6pts

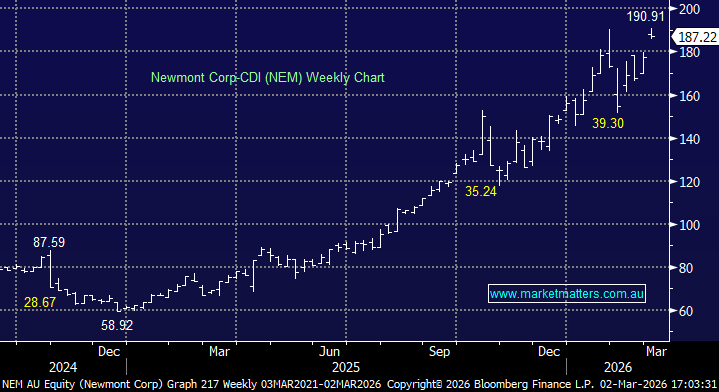

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

US Market & Reporting; The US market remains resilient however it will need another strong quarterly earnings season to underpin further gains. Netflix was interesting overnight after reporting subscriber growth of 5.2m in the 3 months to the end of June – which is massive however it was below market expectations – the stock sold off around 14% aftermarket. We say interesting as earnings were higher than expected, but growth was weaker which clearly shows the market’s focus – all about growth / blue sky etc. Netflix has clearly been a massive success story however that sort of success prompts competition, Disney the latest to enter the streaming service arena. From a risk / rewards perspective, buying US tech at current levels simply doesn’t stack up.

A number of companies report tonight in the US headlined by Goldman Sachs – that should be interesting – expectations below;

Broker Moves; Fortescue copped a double upgrade from Citi on Prices, Currency & Strategy ahead of the quarterly production numbers next week. Basically, analysts have been bearish Iron Ore prices which have remained resilient – which forces begrudging upgrades – they moved from SELL straight to a BUY – FMG added 1.14% today to end at $4.43

Elsewhere…

· IPH Downgraded to Hold at Baillieu Holst; PT A$5.10

· Cabcharge Downgraded to Sell at UBS; PT A$2.15

· Senex Upgraded to Neutral at Citi; PT A$0.45

· Monadelphous Upgraded to Hold at Deutsche Bank; PT A$13.30

· WorleyParsons Downgraded to Hold at Deutsche Bank; PT A$18.10

· Fortescue Upgraded to Buy at Citi; PT A$4.90

· Whitehaven Downgraded to Neutral at Credit Suisse; PT A$5

· Spark Infrastructure Cut to Hold at Morgans Financial; PT A$2.20

· Charter Hall Long Downgraded to Neutral at JPMorgan; PT A$4.30

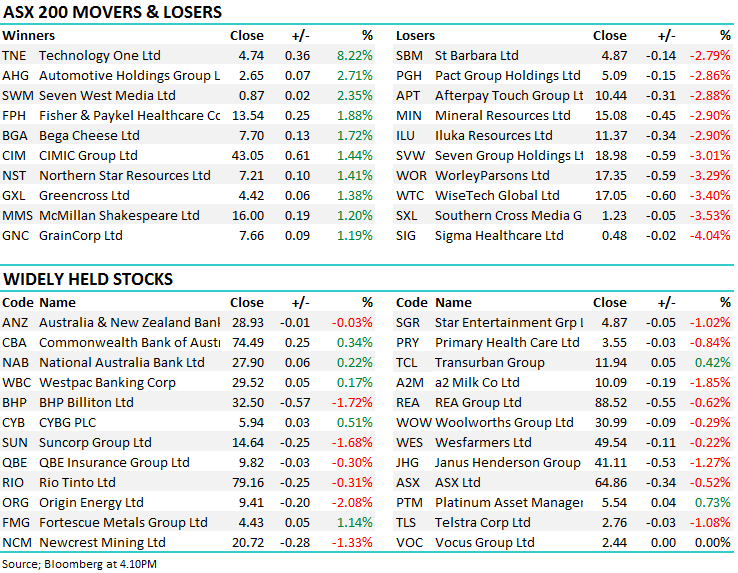

Rio Tinto (RIO) $79.16 / -0.31%; Today Rio Tinto (RIO) posted its January Quarter (JQ) production results and all in all, they were good with almost all key numbers / assets producing as per programmed. We see 4 key areas in the result.

1. Iron ore was strong – This is a known known given the accuracy of shipping data these days, however RIO shipped 88.5mt in the JQ and 168.8mt in 1H18. Annualised shipping rates indicate FY guidance of 330-340mt is very likely easily covered (RIO steered guidance to high end of range) with JQ annualised at 354mt and 1H annualised at ~340mt.

2. Copper up as Escondida does more – production up sharply YoY and the QoQ and the trend continues to be positive here (expect more on this from BHP tomorrow)

3. Minerals sands segment slump – A range of safety and labour relations issues across the two sites in this business unit (South Africa and Canada) has seen guidance steered lower to “1.1 to 1.2 million tonnes (previously 1.1 to 1.3 million tonnes), to reflect the operational and labour disruptions encountered in the first half. Guidance may be further updated to reflect the ongoing disruptions mentioned above.” While mineral sands are but a small component of the business, this could be v’good for other mineral sands producers such as Iluka (ILU)

4. Bauxite exports up 10% on firm demand – an important area of focus for RIO with the AMRUN expansion project due to kick in next year – with a key target of export sales – so good news to see export sales up ~10% YoY citing “firm demand”. = Good for Alumina (AWC) as well

While the JQ production numbers were inline with expectations, the recent strength in the sector renders us neutral/bearish in the short term, targeting a test of ~$74, or ~7% lower for Rio Tinto.

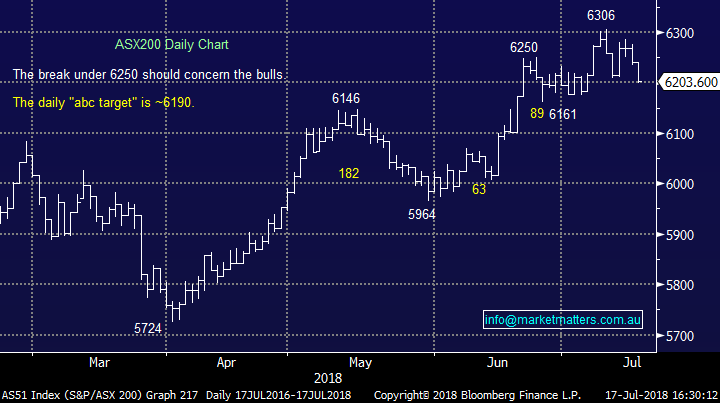

Rio Tinto (RIO) Chart

Asaleo Care (AHY) 85c / -34.87%; The personal hygiene company today pre-released a disappointing first half result and lowered expectations for the full year, causing ~30% of the company’s value to be wiped from the market. Asaleo saw costs rise and sales fall in the half, and the headwinds are likely to continue throughout the year. The company, which owns brands such as Sorbent and Libra, posted an underlying first half EBITDA of $46.3 mil, 24% below last year’s first half. Guidance for the year has been reduced ~29%, down from $113-$119 mil, to $80-$85 mil. Asaleo have raised prices across most products, and concedes sales volumes will fall as competitors have so far failed to follow suit.

Clearly AHY is coming under pressure from a number of fronts, competition appears to be growing and while Asaleo raises prices to offset input costs, volumes will continue to fall. This is not the first time the company had missed or reduced guidance, and the trend will continue unless changes take place. MM are not interested at these levels.

Asaleo (AHY) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here