Sell the rumour, buy the fact it seems!

WHAT MATTERED TODAY

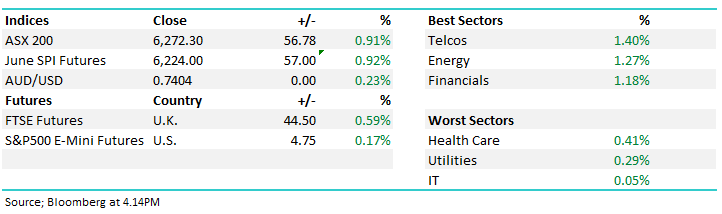

What a bullish day for a Aussie stocks despite the US trade tariffs taking affect this afternoon at 2pm – seems like a clear case of sell the rumour and buy the fact as Australian investors pushed the index sharply higher into Friday afternoon. I was on Sky Biz this morning at 10am being quizzed on the market and likely trajectory of the day’s trade, concluding that it would be unlikely for traders to have the appetite to buy stocks ahead of Friday night with non-farm payrolls out in the US and the risk of a weekend worth of Trump tweets gloating about trade…We had the first round of tweets such as the one below, however I was clearly wrong about the trajectory of the market today – a very bullish session indeed.

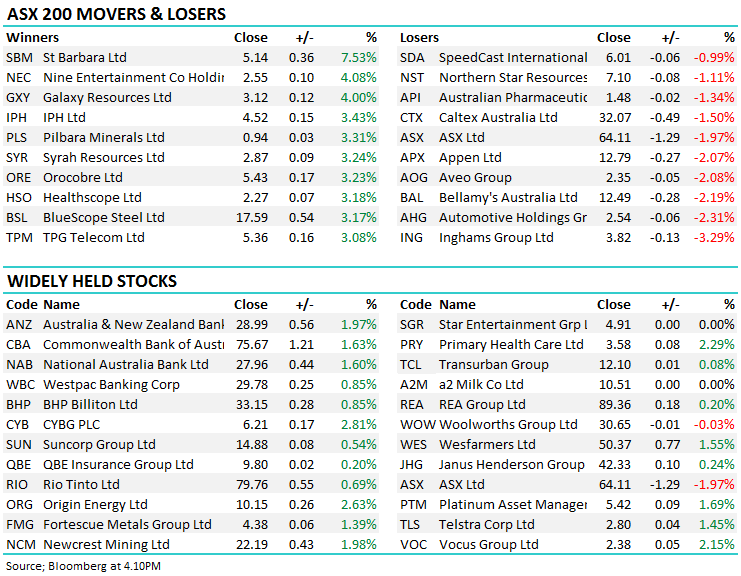

Overall today, the ASX 200 added 56 points today or (0.91%) to 6272, clearly pushing up through the 6250 region and breaking the 90pts trading range we’ve experienced since the 21st June

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

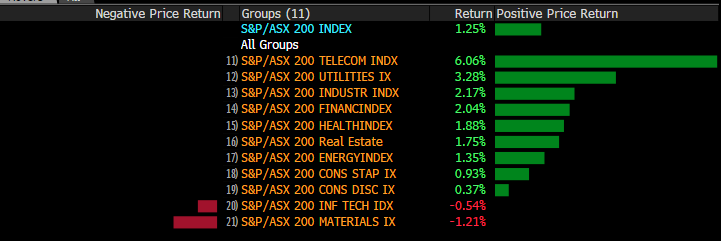

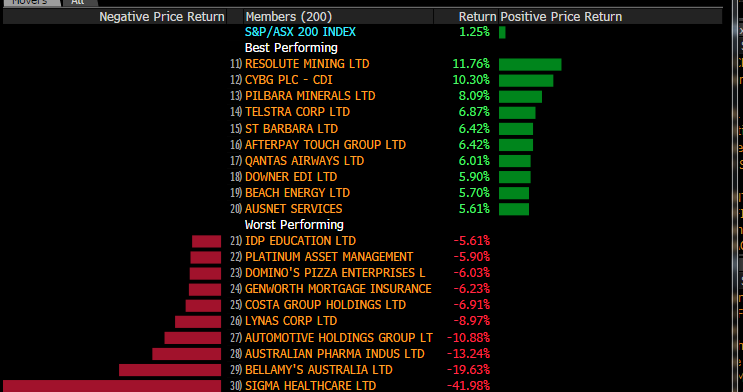

Weekly Moves – Stocks & Sectors;

Materials were the weakest link this week while some of the sectors that have lagged in recent times, picked themselves up off the matt and rallied!

Stock moves over the week; Gee….Telstra in the winner’s circle this week adding +6.87% overall (yes, coming off a low base we know!) while CYBG (CYB) was also strong adding +10% on the week .

Broker calls; Some clear behind the curve moves outlined below (bar the Citi move on WOW).

· Woolworths Group Cut to Neutral at Citi; PT Set to A$32.90

· Ingham’s Downgraded to Neutral at Credit Suisse; PT A$4.10

· Santos Upgraded to Outperform at RBC; PT A$6.50

· MyState Reinstated at Shaw and Partners With Hold; PT A$5

· CYBG Rated New Buy at Redburn

OUR CALLS

No trades in the MM Portfolio’s today

Have a great weekend and watch out for the Weekend Report on Sunday

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/7/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here