Savage selling continues, second consecutive -100pt fall (PGH)

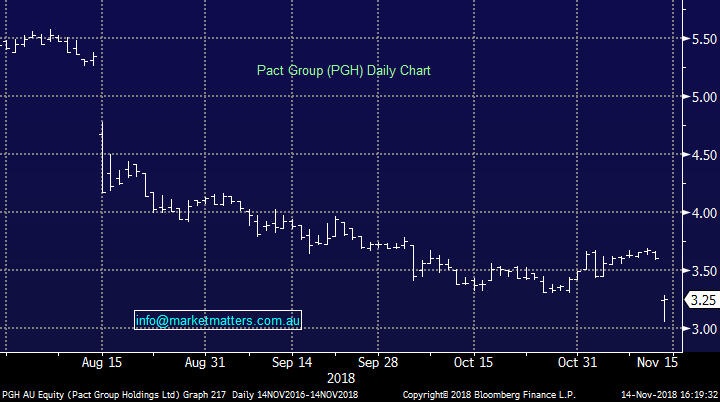

WHAT MATTERED TODAY

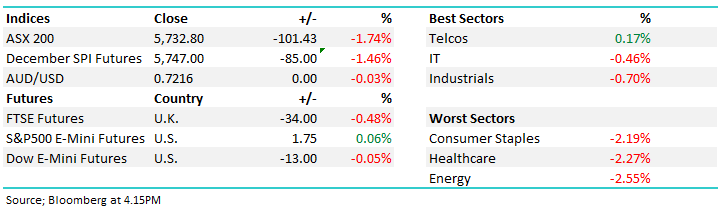

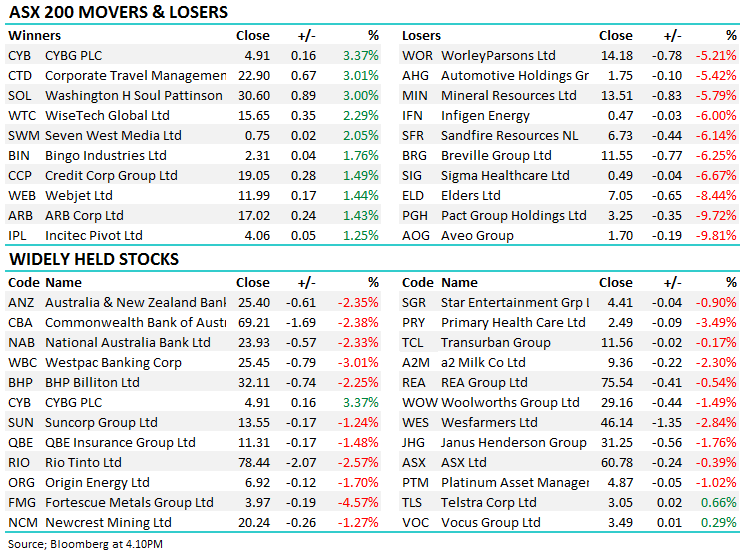

As Harry just put it….what insightful things can we write about this afternoon given the session we’ve just had? Not a bad question really as we look around the grounds and Asian markets have performed okay, U.S Futures have been mostly in the green all day yet we’ve booked our second consecutive day of -100points on the downside – the index has unwound aggressively from Mondays bullish close of 5941 to close today at 5732 and no one really knew why. The insto traders we speak with were none-the-wiser, the media were backfilling reasons however it simply seemed to be a call to sell Australia. Financials were a big weight on the market accounting for -38 points of the decline however the selling was broad based. The only sector that ended in the green today was the Telco’s thanks to Telstra (ASX:TLS) which added 2c to close at $3.05.

Energy stocks were hit hard today after crude prices fell by the most in 3 years overnight on growing fears of a supply glut – it feels like yesterday that we were seeing upgrades flow through from analysts with 12 month price assumptions around US$80/bbl , A far cry from the US$55/bbl it settled at overnight. Beach Energy (ASX: BPT) and industry contractor WorleyParsons (ASX: WOR) led the declines, down 5% and 5.21% respectively: Woodside Petroleum (ASX: WPL) ended down -2.49%, Santos (ASX: STO) lost %-5.02% and Oil Search (ASX: OSH) fell 2.61%

Overall, ASX 200 closed down -101pts or -1.74% at 5732. Dow Futures are currently down -13points or -0.05%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Not noted in the below changes, however Credit Suisse penned a bullish note on banks titled The worst is behind us - a brave day to publish that note. The analyst is now expecting earnings to be revised higher on the back remediation costs peaking and funding spreads tightening, benefitting bank margins. CS are also looking for the market to push the banks back to historical valuations noting the PE discount of banks vs industrials has reached 39% compared to the long term average of 30%.

· Northern Star Upgraded to Outperform at Macquarie; PT A$9.80

· SCA Property Downgraded to Sell at Moelis & Company; PT A$2.43

· Lendlease Upgraded to Overweight at JPMorgan; PT A$15

· Sundance Energy ADRs Rated New Buy at SunTrust; PT $9

· Western Areas Reinstated at Canaccord With Buy; PT A$3

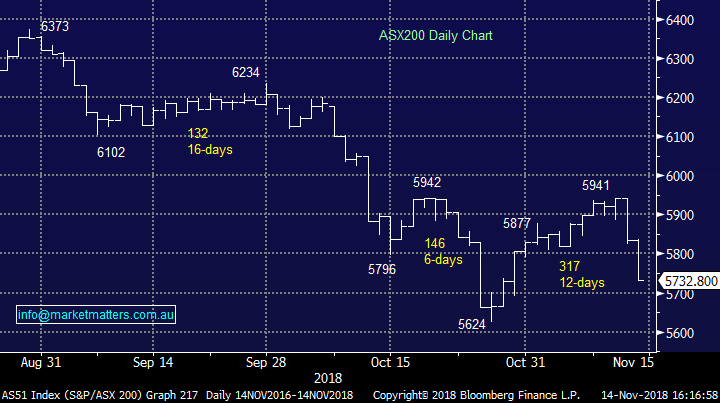

Pact Group (ASX: PGH) $3.21 / -9.72%; The packaging company plummeted today following the AGM as the market has reacted negatively to the company’s outlook which flagged a soft start to FY19 and guidance that was well below expectations for the full year. Pact Group, which supplies packaging in Australia, NZ the US and across Asia to the likes of a2 Milk & Blackmores among others, has struggled over the past few years as they grapple with rising input costs heavily impacting margins across the business. Resin prices continue to climb, which has had a material impact on the first half of FY19, which is now “expected to be weaker than pcp (previously comparable period) adversely impacted by on-going lags in recovering higher than anticipated resin costs.”

The company has been unable to pass on costs to customers as quickly as anticipated, and Pact Group now expects EBITDA for FY19 to be in the range of $245m, almost 10% below Bloomberg consensus estimate. Much of the company’s performance now relies on the integration of recent TIC Retail Accessories acquisition which was completed today.

Pact Group (ASX: PGH) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.