Santos (STO) looking to ramp up production

Stock

Santos (STO) $7.24 as at 26/09/2018Event

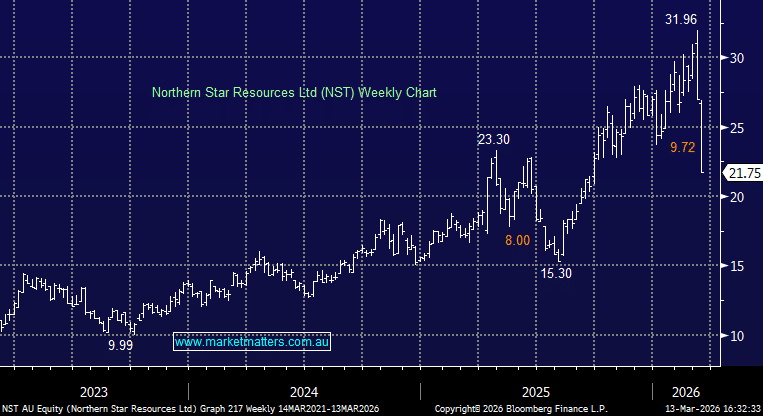

While the other energy names trade over 1% higher today, Santos is currently trading over -1% below yesterdays close while they hold their 2018 Investor Day. Their presentation showed plans to nearly double oil production over the next 7 years to produce around 100 million barrels a year while still keeping a lid on costs within the business. The acquisition of WA gas company Quadrant Energy, currently seeking regulatory approval, will go some way to bridging the gap by adding around 19 barrels of oil equivalent (boe), Santos also plans to leverage the core assets in Australia and PNG to ramp up output. While Santos is the lowest cost onshore producer, their targets could also make it one of the biggest in Australia. Santos (STO) Chart