Santa…where are you? (QBE, CIM)

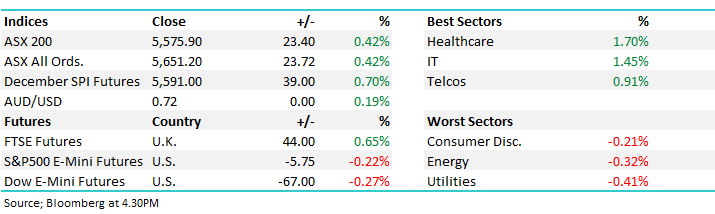

WHAT MATTERED TODAY

The market continued to feel ‘heavy’ today even though US stocks rallied hard from their intra-sessions lows overnight. The morning session was okay in Oz however once again it seemed like bigger players were simply sitting on the offer hitting large cap stocks that tried to rally. The bulls will sight the last 30 mins of trade where the market put on a short sharp ~35points as the sellers were finally overcome. From a technical standpoint, while the market didn’t rally back above 5600 on the index, afternoon buying into a strong close does warm the heart to some degree.

Statistically, we’re right in the end zone for the elusive Christmas rally to start – come on Santa!!! history showing that the low is generally put in between the 7th & 14th of December, the average gain over the past 30 years being +2.31%....that feels an unlikely scenario at the moment however lows generally form at times when the market simply feels wrong…

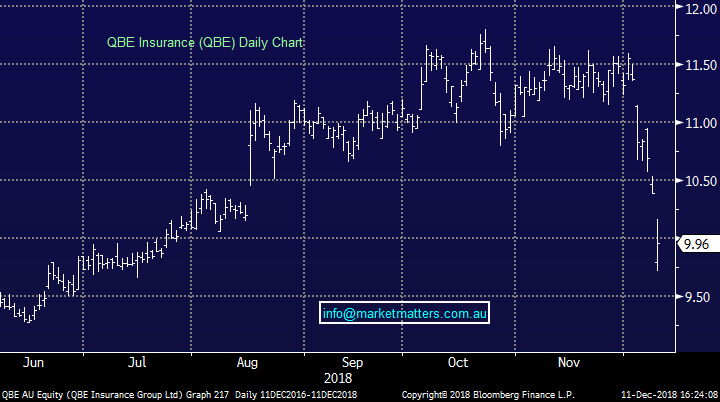

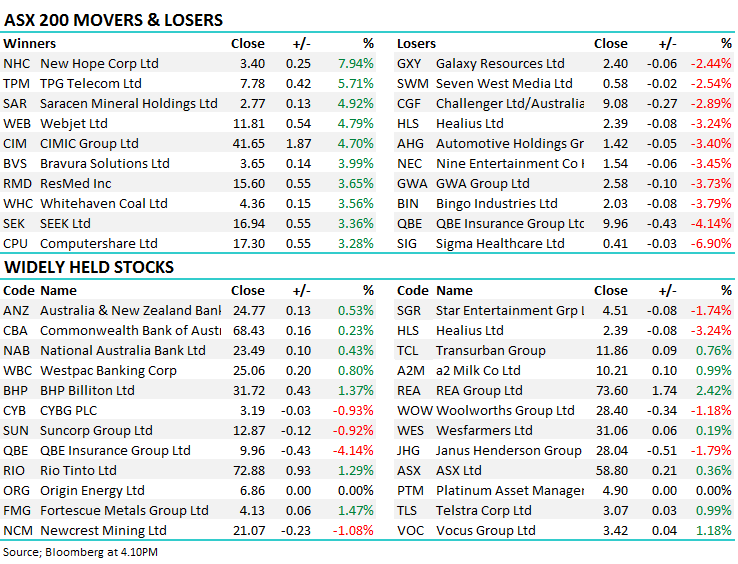

Some mixed performances today starting with QBE Insurance (ASX: QBE) on the downside as they went back to the future, downgrading near term earnings expectations but promising that outer years will benefit more from cost savings. While the FY19 earnings hit was decent, around the ~10% mark relative to consensus, they will deliver better margins in the future – if you believe them - more on that below. On the flipside, Cimic (CIM) bounced back from a terrible session yesterday adding +4.7% on a contract win while TPG Telecom (TPM) rallied after they showed their commitment to 5G, going long and strong at the 5G spectrum auction yesterday. In the MM Growth Portfolio today, we excited Newcrest (NCM) into strength this morning.

Overall, the ASX 200 closed up +23 points or +0.42% to 5575. Dow Futures are currently trading down -91 points or -0.38%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Interesting to look at the performance of managed funds during this recent market turmoil, with only 37% of funds beating the Australian benchmark in October (which was down -6.05% in accumulation terms), with most of those benefiting from high cash balances…While the market is clearly a tough place to be at the moment outperforming during weak periods is the key to longer term outperformance. Right now, the MM portfolio is certainly not immune from recent weakness however in October the Market Matters Active High Conviction SMA which is aligned with the MM Growth Portfolio was down -2.16% for the month of October, outperforming its benchmark by +3.89% and the from the stats above, outperforming a large percentage of its peer group. While ‘losing less’ is never our mantra, protecting capital through difficult periods is one of our key principles.

The funds are only new, and we are yet to market them however background information in available on the SMA website by clicking here

ELSEWHERE:

- Nine Entertainment Resumed Outperform at Macquarie; PT A$2.20

- Domain Holdings Resumed at Macquarie With Outperform; PT A$3

- Evolution Mining Rated New Market Perform at BMO; PT A$3.50

- Inghams Upgraded to Equal-weight at Morgan Stanley; PT A$4.40

- Adelaide Brighton Upgraded to Buy at Morningstar

- Adelaide Brighton Raised to Outperform at Credit Suisse

- ANZ Bank Upgraded to Buy at Morningstar

- Qantas Upgraded to Hold at Morningstar

- ResMed Upgraded to Outperform at BMO; PT $127

- Santos Upgraded to Buy at Shaw and Partners; PT A$6.90

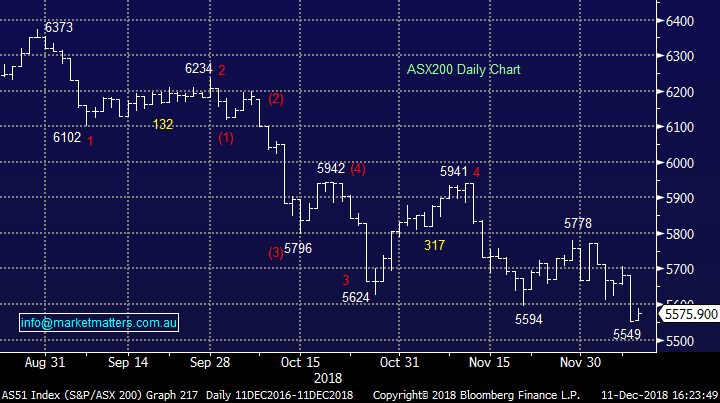

QBE Insurance (ASX: QBE) $9.96 / -4.14%; QBE slumped today after announcing the sale of another round of its Asian businesses, as well as launching a cost cutting operation that is expected to save $130m by 2021. Today letting go of Indonesian & Philippines businesses, as well as the Puerto Rican insurance arm saving the company $125m in reinsurance costs next year – however this will be more than offset by a $200m rise in the allowance for large individual risks and catastrophe claims because of “greater variability around reinsurance recoveries.” Additionally, the efficiency drive the company is embarking on will result in a $95m worth of costs to be booked over 2019/20 – the company is spending money to save money.

All-in-all, a mixed announcement. The company is clearly trying its best to be efficient and save money where it can but that has resulted in some short term pain. It comes down to whether the market will give the stock the benefit of the doubt, and based on today’s move it clearly hasn’t. QBE is known for disappointing, and while this isn’t necessarily disappointing, the announcement gives them more opportunity miss to the downside.

QBE Insurance (ASX: QBE) Chart

Cimic (ASX: CIM) $41.65 / +4.70%;The contractor rallied nicely today thanks to a contract win withUGL, CPB Contractors and Taswater intending to establish an alliance to deliver infra planning, project development and delivery of all capital works across Taswater’s regional asset network in Tasmania. The deal will generate revenue to CIMIC of more than A$600 million over an initial four-year period, which is a decent headline number however in the context of a $17.7b annual revenue, is less significant. Margins continue to be an issue for infrastructure players in Australia despite a big infrastructure spend nationally. We sold CIM recently and remain comfortable with that call…

Cimic (ASX: CIM) Chart

OUR CALLS

We sold Newcrest (ASX: NCM) from the Growth Portfolio today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.