Same Party, different Leader… AGAIN! (SGR, BXB, MPL)

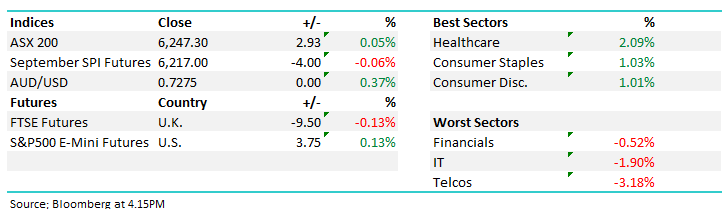

WHAT MATTERED TODAY

We end the week with a hybrid of the political volatility and domestic reporting season with a change to the Australian Prime Minister – Scott Morrison taking the Liberal Party Leadership and as a consequence, becomes the new Prime Minister of Australia.

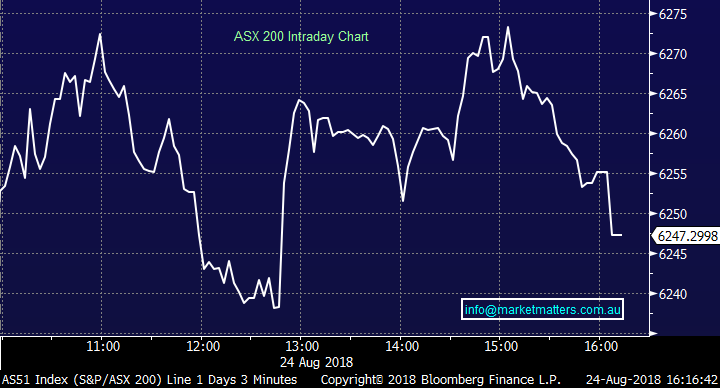

The market today was a mixed bag, optimism early, a run up after Morrison beat Dutton 45 votes to 40 before a sell off into the close.

Overall, the index closed up +2 points or +0.05% today to 6247 – down 92 points / -1.45% on the week

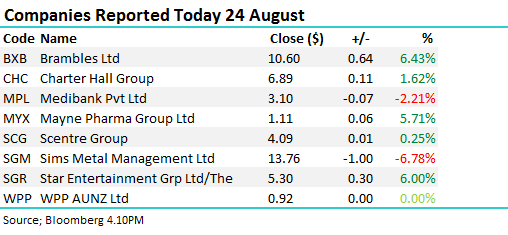

Reporting on Monday includes AX1, BKL, BLD & CTX. For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· APA Group (APA AU): Downgraded to Hold at Morgans Financial; PT A$9.36

· ARQ Group Ltd (ARQ AU): Downgraded to Hold at Bell Potter; PT A$2.35

· Afterpay Touch (APT AU): Upgraded to Add at Morgans Financial; PT A$21.65

· Cromwell Property (CMW AU): Cut to Underweight at JPMorgan; PT A$1.05

· Hotel Property (HPI AU): Downgraded to Neutral at JPMorgan; PT A$3.20

· Nanosonics (NAN AU): Reinstated Buy at William O’Neil & Co Incorporated

· Northern Star (NST AU): Upgraded to Neutral at JPMorgan; PT A$6.40

· South32 (S32 AU): South32 Upgraded to Outperform at Credit Suisse; PT A$4.10

· Webjet (WEB AU): Downgraded to Hold at Morgans Financial; PT A$17.15; Downgraded to Neutral at Credit Suisse; PT A$16

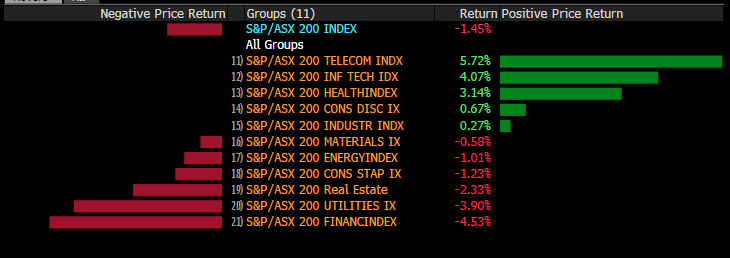

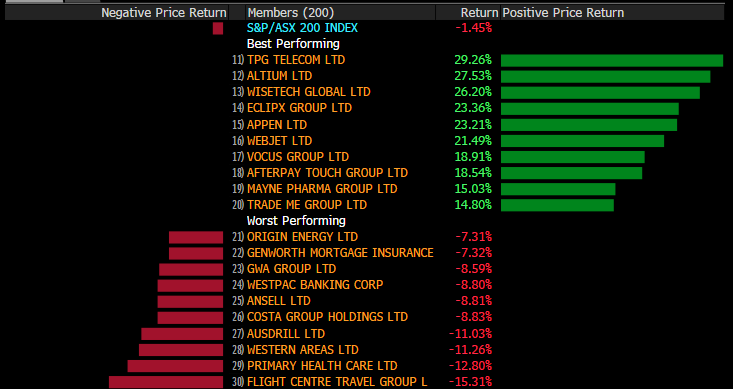

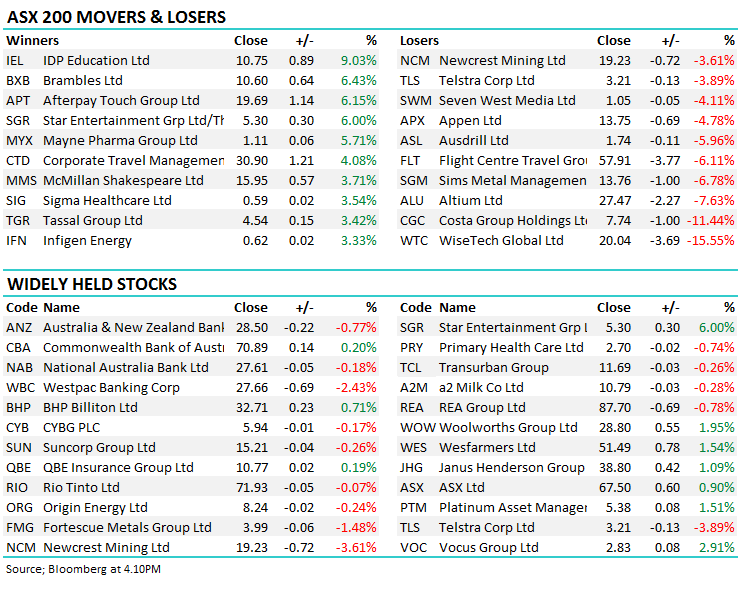

Weekly Moves – Stocks & Sectors; On a sector level, the telcos outperformed on the back of the chance of a merger between TPG Telecom (TPM) and Vodafone Australia, while general weakness in the utilities and financial sector was witnessed.

Sectors over the past Week

At a stock level, it was the reporting companies that showed the most volatility. Flight Centre (FLT) was the laggard following its earnings report, while TPG Telecom (TPM) outperformed on the basis of m&a action.

Stock moves over the week

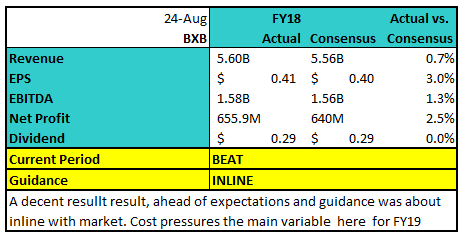

Brambles (BXB) $10.60 / +6.43%; The global logistics company posted a bumper FY18 result pre-market today which has seen the stock trade up strongly. The result was 2.5% beat at the profit line on the back of a decent top line (revenue) number. BXB has had a volatile 12 months however the trends in the business now look reasonable with price increases in the CHEP America’s operation helping the cause. Today they outlined their intention to spin out Ifco, which is a fresh food logistics business that does about $1.1bn in revenue and accounts for roughly 14% of the companies EBIT.

Brambles guided to mid-single digit top line growth in the business from the continued operations and that was in line with current market expectations which had 5.3% revenue growth in constant currency terms pencilled in. The main variable for BXB stems from rising cost pressures which is becoming a common theme during this reporting season.

Brambles (BXB) Chart

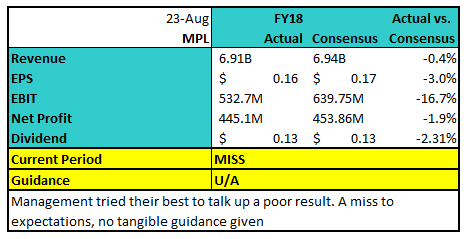

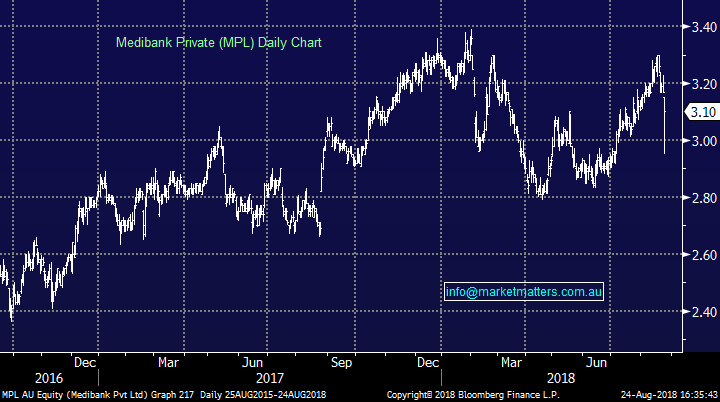

Medibank Private (MPL) $3.10 / -2.21%; The private health insurer missed expectations in their FY18 report announced this morning, doing the best they could to talk up a poor quality result. A ~2% miss at the profit line was driven by poor investment income as NPAT fell 1% over the year.

It has been a tough operating environment for private health insurers with margins coming under pressure and lower take up of cover across Australia. Medibank is trying to balance profit margins with lower premiums to drive some growth. They did receive a benefit this year with lower claims allowing the company to release provisions, however the result still fell short.

They are making an effort to deliver growth through scale announcing a small potential acquisition of ~$70mil while costs cutting and productivity measures will remain front and centre in FY19.

Medibank Private (MPL) Chart

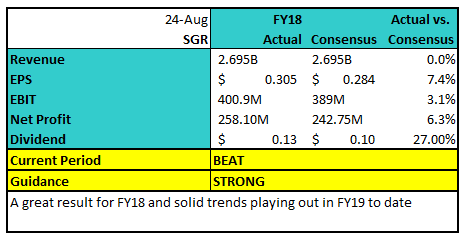

Star Entertainment (SGR) $5.30 / +6.00%; This morning Star Entertainment (ASX:SGR) reported their full year results and they were strong on a normalised basis for FY18 while they outlined some very positive trends playing out at the start of FY19. Normalised profit after tax came in at $258.1m which was well above consensus of $242.8m. They said that group domestic revenue was up +4.1% driven by a 5.5% increase in slots, QLD table revenue was up +6.3% which was a highlight and non-gaming revenue added 15.2%. Interestingly enough, VIP revenue jumped 51.8% and is now on a stronger run rate than Crown.

After a tough 12 months SGR look to have turned the corner and FY19 has started on the right foot. Whilst only early days, they say trends this year are better than last while they also guided to reduced Capex of $300-$350 which confirms that peak spending occurred in FY18.

Star Entertainment (SGR) Chart

OUR CALLS

No changes to the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here