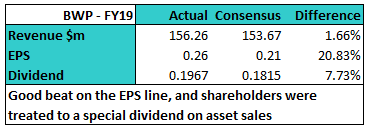

Risk off continues for stocks as US labels China currency manipulators (BIN, FMG, PNI)

WHAT MATTERED TODAY

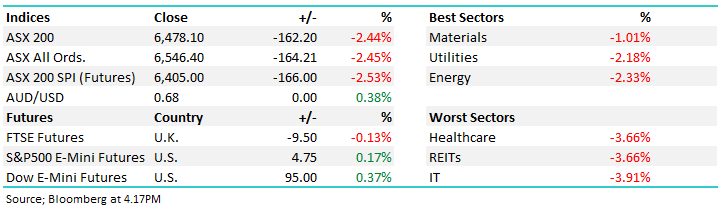

A big day for the local market with the index losing another 2.44% coming on the back of a 1.90% decline yesterday – the drop from recent highs to today’s low is now 431pts / 6.2% and in the very short term, the selling now looks overdone. This morning US futures opened on the back foot, down another ~1.5% post US close - that saw our market open down nearly ~200pts before some aggressive buying in some stocks played out. US Futures rallied +2% from the lows to be trading up around 0.30% at 4pm – volatility reigned supreme!

The early negativity came after the US officially labelled China a currency manipulator while the positive offset came when they actually manipulated their currency slightly higher on the day – traders liked the conciliatory move and bought US futures up from the lows. Seems China is only a manipulator when the manipulation hurts the US…

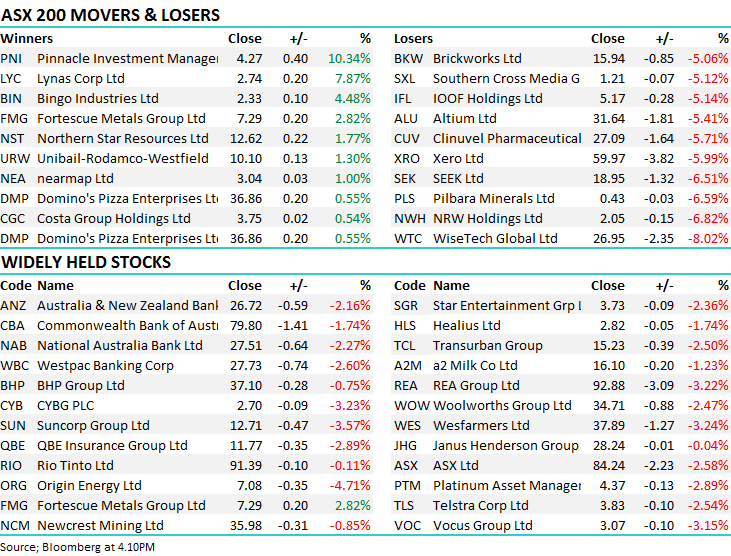

At a sector level, the material stocks bounced back (relatively speaking) in a weak market while the IT stocks were once again hit hard, off another ~4% after finishing down ~5% yesterday. ***The RBA kept rates unchanged today at record lows***

Overall, the ASX 200 lost -162pts today or -2.44% to 6478. Dow Futures are trading up 77pts /0.30%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

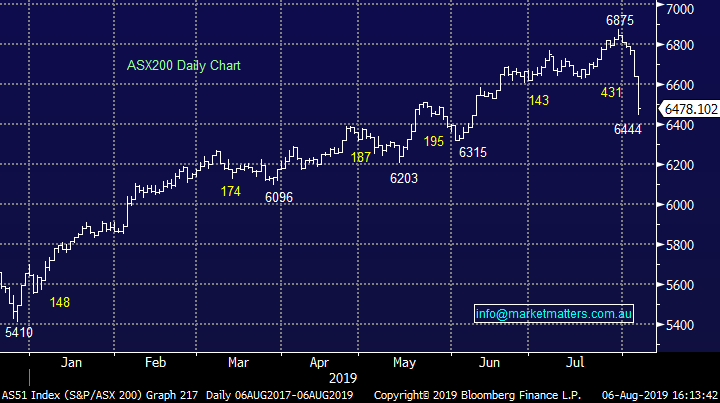

Big Moves: Some big moves today at the stock level and we used it to tweak the MM Growth Portfolio…Selling Newcrest (NCM) into early strength, Buying CBA and up weighting RIO, & FMG into early lows. A market like this lends itself to more activity. The Iron Ore miners turned out to be the standout in a weak market - Fortescue (FMG) the best of them closing at $7.29 after being down as low as $6.59, the stock actually finished up on the day by 2.82% after presenting at the Diggers & Dealer event . More on that below.

Days like today give a good insight into what’s on buyers wish list into weakness – much like MM presented a list this morning, many insto’s will have stocks and prices where the button gets pushed – the point of value. Bingo (BIN) a case today printing a weak $2.13 low before rallying hard to a $2.40 high – there was someone bidding the stocks hard today implying a decent buyer is out there into weakness. We talked BIN this morning, looking to buy sub $2.20 (but preferably after they report later in the month).

Bingo (BIN) Chart

Fortescue Metals (FMG) +2.82%: Presented at the Diggers and Dealers today and it was guidance / commentary around their dividend that got the buyers back out. There was some in the market thinking the 60cps that was framed as a special dividend in May looked more like a combination of special and full year dividend, packaged up as one payout ahead of the potential change of Govt / franking credit legislation, however today in a highlight slide the term dividends to date implies more to come when they report on Aug 26.

FMG have an ordinary dividend policy of 50-80% of underlying earnings with FY19 expectations hence there is the potential for A$1.10 vs paid to date of A$0.90 = a further 20c expected on August. We are now bullish on FMG.

Fortescue Metals (FMG) Chart

Pinnacle (PNI) +10.34%: A big day for PNI after reporting decent earnings – not one we follow closely + it comes off a low base however inflows were strong across its managers overall and that dropped down to a rise in net profit of 32% to $30.5m for the full year. Funds under management hit $54.3 billion as at June 30 which included the ~$7b they acquired during the year. They announced a full year fully franked dividend of 9.3cps. They’ve found it hard to attract buyers in a strong market however a seas of red seemed to do the trick – go figure!

Pinnacle (PNI) Chart

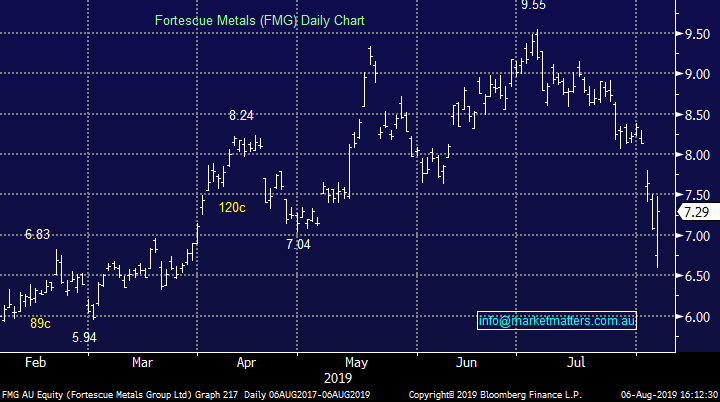

Property Stocks Reported Today: While reporting season has drifted into the background, 3 property stocks were out with results today and Harry provided a run down on the numbers…no great surprises across the board, a special dividend from BWP was nice on asset sales.

BWP -1.83%: The landlord to many Bunning’s sites, BWP fell today despite beating in terms of earnings and dividend. Both beats were driven by asset sales and the trust was keen to reward shareholders however it does present a medium term problem. With Bunnings growth starting to slow, BWP flagged it will struggle to increase rents at the same rate over the next few years, tying rental increases to inflation which has largely stagnated. Shares were down today, although BWP did outperform the index.

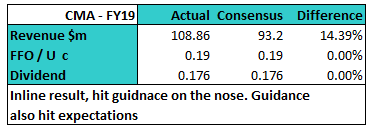

Centuria (CMA) -1.41%: Very few surprises with CMA, as is standard and what you would expect from a trust that consistently updates the market on a range of metrics. CMA is building itself out as a quality pure play office REIT that gives its shareholders consistency. It was sold off hard early in the broad market rout but recovered well – once again a tough day to report.

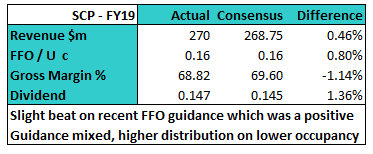

SCA Property (SCP) -0.78%: The shopping centre REIT hit the mark today, with a large area of space held on long term leases with the likes of Woolworths SCP should never really come up with any major downside news. The only fright to shareholders was a small uptick in occupancy – the headline grabbing 37% fall in profit was more a blip on the radar with the company flagging falling valuations. More important to shareholders was the 6.7% increase in Funds from Operations (FFO).

Broker moves;

- Iluka Upgraded to Buy at Morningstar

- Mineral Resources Upgraded to Buy at Morningstar

- Reliance Worldwide Cut to Equal-weight at Morgan Stanley

- Rio Tinto Upgraded to Buy at DZ Bank; PT 51 Pounds

OUR CALLS

In the Growth portfolio we sold Newcrest (NCM) into early strength, bought CBA and up weighted RIO, & FMG into early lows

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.