Rio softens costs guidance (RIO, NHF)

WHAT MATTERED TODAY

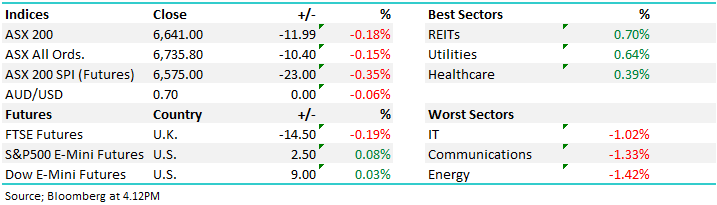

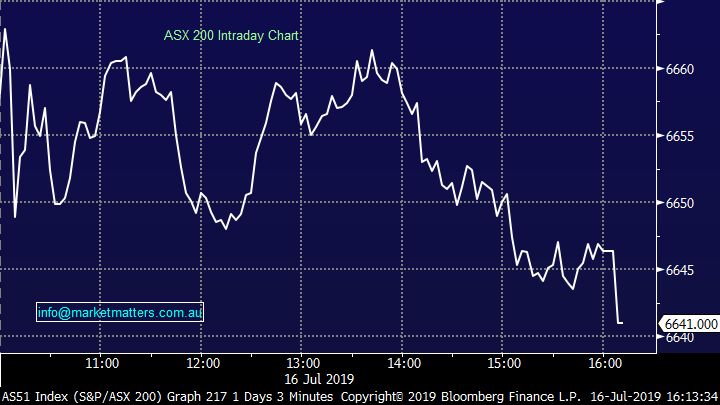

There was very little volatility in the market today with the index ticking within a tight range of around 10pts either side of yesterday’s close – the lead changed 8 times before the top 200 softened late in the session. Volumes remain light with school holidays in play contributing to the muted trading day. Under the surface there was a little more at play. Oil names were hit as WTI dipped back below the $US 60/bbl level. Communications were dragged by the sector heavy weight Telstra (TLS) which fell -1.84% - the second consecutive day of weakness as the stock comes of the boil. REITs and Utilities were supported with bonds rallying overnight.

Today Harrison Watt sat down with our Primary Contributor James Gerrish covering our current portfolio positioning, the backdrop for lower rates along with some stock ideas as we search for opportunity in an expensive market. CLICK HERE to view.

Overall, the ASX 200 lost -12pts today or -0.18% to 6641. Dow Futures are trading up +9pts / +0.03%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

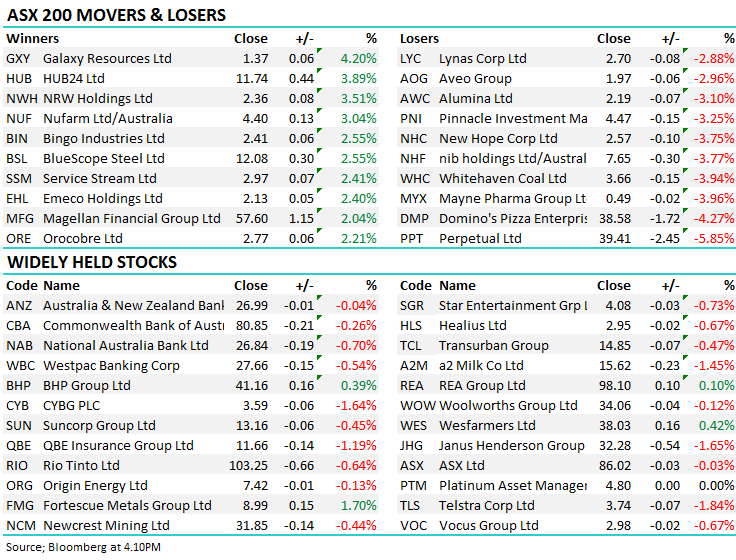

Rio Tinto (RIO) -0.64%; well underperformed the other iron ore stocks today on the back of soft cost guidance at their quarterly report. Production was hindered over the quarter on weather issues which forced Rio to downgrade production guidance twice, however the strength in the iron ore price has been more than enough to support the stock over the period.

In today’s announcement, Rio looks on track to meet the updated guidance targets from a production standpoint, however the company was forced to increase cost guidance at their main iron ore operations in the Pilbara by $1/t. Also unsettling investors was the commentary around the copper projects. Rio had a softer quarter on the copper front, with volumes reasonable but at a lower grade. The company also flagged some risks to capital needs at the Mongolia underground mine Oyu Tolgoi, which may need an additional $2bn above what has been provisioned. Production is set to achieved here between May 2022 and June 2023. We own Rio in the Income Portfolio.

Rio Tinto (RIO) Chart

Broker moves;

NIB Holdings (NHF) -3.77%; Hit today after two brokers downgraded the stock on valuations grounds. NHF saw an early low of $7.14, down 10% however buyers stepped up into the weakness. Goldmans put a very bearish $5.63 price target on the stock, however worth noting the analysts ranks low on Bloomberg given their bearish view over the past 12 months into what’s been a very bullish period for private health insurers. Citi is more credible in the stock, and they moved to a sell with a PT of $7.05, saying they expect lower rate increases over the next 2 years. We’ve had NHF on our sell radar for a while, after buying in February at $5.60. Today’s buying into weakness leaves us confident we’ll be able to realise a price above $8.00

NIB Holdings (NHF) Chart

- NIB Downgraded to Sell at Citi; PT A$7.05

- NIB Downgraded to Sell at Goldman; PT A$5.63

- Perpetual Upgraded to Hold at Morningstar

- Atomos Upgraded to Add at Morgans Financial; PT A$1.63

- Aspen Group Ltd/Australia Cut to Hold at Moelis & Company

- South32 Downgraded to Hold at HSBC

OUR CALLS

**No amendments today**

Major Movers Today – Obviously AMP the standout however Telstra (TLS) also weak. WSA caught my eye on Nickel’s strength outpacing IGO which has been rare in recent weeks / months.

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.