Results dominate in a positive session overall (TWE, BHP, COH, MND, WBC)

WHAT MATTERED TODAY

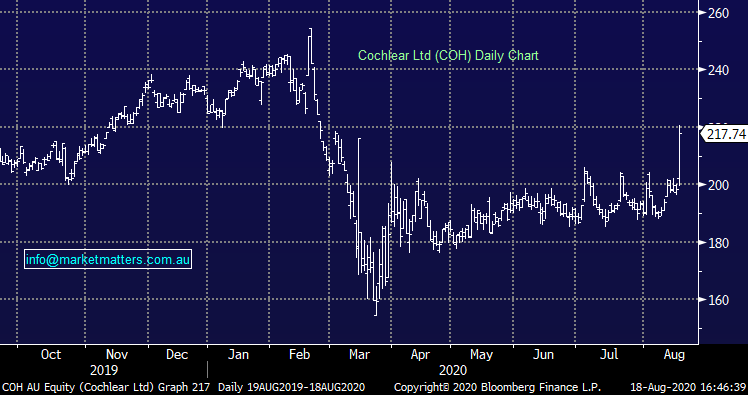

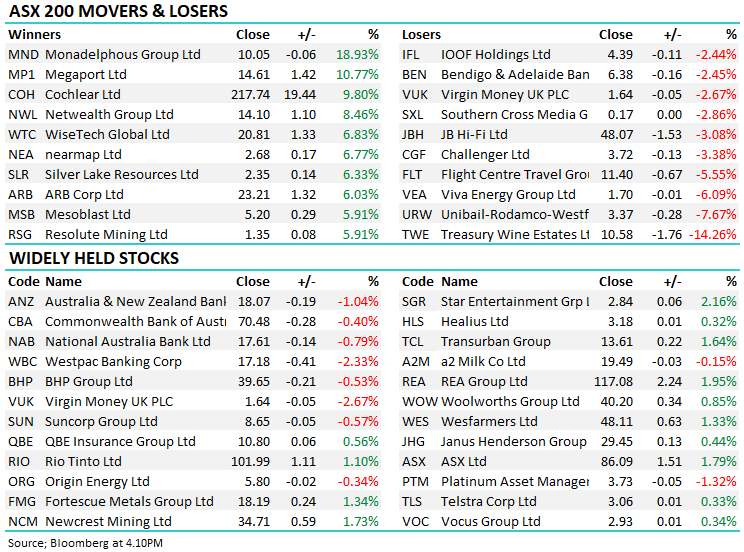

A busy day on the desk with a heap of reports to get through plus a few things bubbling away on the corporate side. Healthcare the standout thanks to a big beat by Cochlear (COH) and decent uptick in CSL which put on +4.37% adding a significant +17pts to the index. Reporting obviously dominated and we had some big moves at the stock level, 14 stocks in the ASX 200 up by more than 5% while on the flipside, only 4 fell by the same margin.

While we’ll get onto results below, including from BHP, as usual they provided commentary on the commodity outlook with its FY result today. BHP’s overall views haven’t changed, and you would characterise them as being bullish copper, oil, met coal, nickel and potash (long term), but bearish iron ore and thermal coal.

Asian stocks were mostly higher today, but not materially so while US Futures have ticked lower.

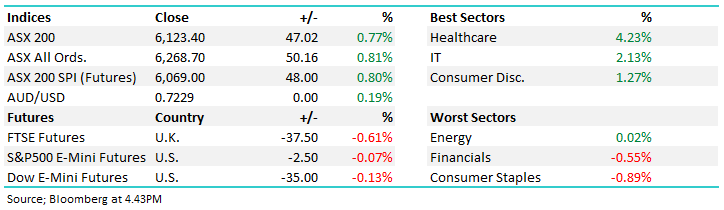

Overall, the ASX 200 added +47pts / +0.77% to close at 6123. Dow Futures are trading down -35pts / -0.13%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

I ran through some results this morning at 8.40am on Ausbiz – click here or the image below – no logins required. Stocks discussed, BHP, WBC, COH, MND, EHE.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Treasury Wines (TWE) -14.26%: BANG! Hit hard today on news that China started an anti-dumping investigation into Australian wine, with the investigation looking at wine sold in containers holding two litres or less. I’m not sure what this all means for TWE, obviously a negative but hard to quantify and I haven’t had a real chance to ponder it today – my inclination was to buy the weakness ~$10 but need to sleep on it!

Treasury Wines (TWE) Chart

Abacus (ABP) unch: as the lack of change by the stock suggests, today’s result was in line from the property group. Funds from Operations (FFO) per share of 19.38c and flat year on year while the dividend of 18.5cps was what the market was asking for. Within the portfolio, Abacus collected 90% of office rents, 98% in the self-storage book but only 49% of retail – fortunately retail takes up just 6% of total assets - a net decrease in valuations across the book of $41.2m weighed on profit. We own Abacus, and think they deserve more credit from the market for their work in reducing retail exposure and bumping up self-storage. We have the MD Steven Sewell in the office tomorrow at 8.45am – I’ll cover in more detail in tomorrow’s income note.

ARP Corp (ARB)+6.03%: A good FY20 result from the 4WD accessory business. Revenue $467m v $453m expected, NPAT $57m v $48m exp (flat yoy) while sales were up +4.8% during FY20 overall, although it was volatile with a weak April / May giving way to record highs for June / July. ARB, like many of the retailers used the weakness induced by lockdowns to meet job keeper hurdles before the business reaccelerated – smart move!! while they’ll provide more in a trading update at their AGM on the 16th October. The stock a few pennies off all time highs today.

BHP Billiton (BHP) -0.53%: FY20 Result ... it's a (slight) miss ... 0.6% at EBITDA, 3.9% NPAT and 2.4% dividend, however standing back and given credit where it’s due, BHP posted the second best FY earnings scorecard in 6 years. Divisions that missed include petroleum (and coal (met and thermal) on lower prices and weather. In terms of the dividend, it was a smallish miss but a miss, nonetheless. FY20 dividend landed at US120c vs 123c expected. More importantly though the FY20 dividend was a full US13c or 10% lower than the new high-water mark set in FY20 (US133c) despite EPS been a couple of shekels ahead (189c vs 186c). payout ratio was a “low” 67% compared to 76% in FY20, 70.3% in FY18 etc. All in all, a decent result from the big Australia, although they haven’t knocked it clean out of the park.

In terms of their outlook they said…. “With the exception of China, the world’s major economies will contract during the 2020 calendar year as a result of the COVID-19 pandemic. While the outlook for 2021 remains uncertain, within the scenarios that we consider, our base case has the world economy rebounding solidly during the year. There will, however, be considerable variation at the country level. Even with this rebound, our base case is for the world economy to be six per cent smaller than it would otherwise have been in the 2021 calendar year. We expect that China and the OECD will return to their pre COVID-19 trend growth rates from around 2023. Developing economies outside East Asia may take longer.”

BHP Billiton (BHP) Chart

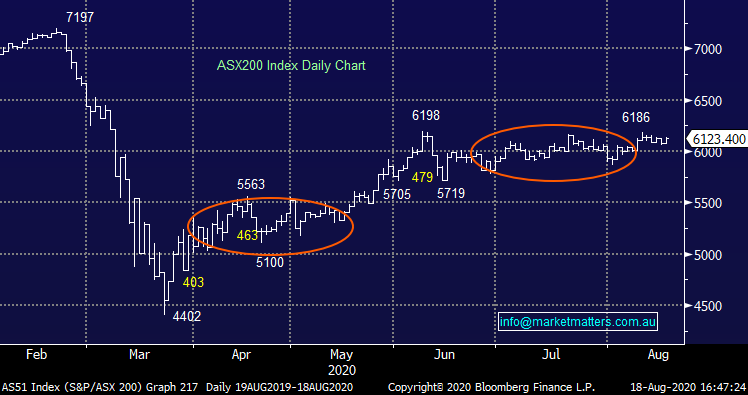

Cochlear (COH) +9.8%: The market wasn’t expecting a hell of a lot from COH this morning with a 46% reduction in earnings relative to FY19 pencilled in, and while the result wasn’t particularly strong it was a good beat relative to market expectations. Revenue was expected to be $1.26bn, they came in at $1.35bn with NPAT of $153m v $142.8m expected – about 7% ahead. While they didn’t provide full year guidance given a range of uncertainties, they said implant activity in June & July was back to 85% of the same time last year, which is good post a very weak April / May. For FY21, the market was expecting profit to increase +26% to $181m, however expect upgrades post today’s news. A good result after a tough period.

Cochlear (COH) Chart

Coles (COL) -1.16%: a pretty hard result from the supermarket giant, EPS came in at 70.1c, only marginally shy of expectations. The key grocery businesses in Australia have clearly seen a tailwind on the back of COVID-19, with the “pantry-demic” in the 3rd quarter of the year boosting sales significantly, while further restrictions on eating out saw sales growth sustain a higher than normal level into the last quarter of the year. Online grew over 18.1% despite some interruptions around March + the momentum has continued into FY21, with the company noting LFL sales has remained around 10% above the same period last year driven by lockdowns in Victoria. The market was expecting a lot from Coles, and largely got what was expected although worth remembering that both Coles and Woolworth’s are trading around their most expensive levels (ever!) and barring a multi-year lockdown situation, are largely ex-growth.

Estia Health (EHE) +4.21%: a very closely watched result out of the aged care space today, Estia reporting a loss of $116.9m driven by a non-cash impairment of $144.6m. EBITDA was a substantial beat though but this was driven by RADBond revenue with EBITDA on existing homes falling 18% to $79m v $80m expected. Occupancy dipped to 93.2%, though this was a better performance than thought given the media attention on two of Estia’s homes. The company is still working through the aged care Royal Commission impacts, while the COVID-19 hit making any forward-looking statements worth very little. The market liked the result though given the beat in headline EBITDA.

Monadelphous (MND) +18.93%: This is a stock that has been completely on the nose for the past 12 months + hasn’t even looked like enjoying any of the recent market joy – until today when their results were ‘less bad’ than expected. Revenue came in at $1.65bn v $1.57bn expected while EBITDA and NPAT were both ahead of forecasts + wait for it….they also announced a dividend when the market thought none was likely, declaring 13cps for the full year. All in all, every dog has its day and MND have just had a good one. Importantly, the read throughs here are positive for other mining services / infrastructure relative stocks that we discussed in today’s AM note – click here

Monadelphous (MND) Chart

Money 3 (MNY) -6.8%: This was one of the stocks I covered with Jono Higgins in a webinar a few months ago – click here….with Jono’s take today on the stock as follows… Cash NPAT for the group came in at $32.3m, 30% on FY19 continuing operations. Cash NPAT was 6.5%% above prior guidance and is above Shaw expectations prior to when COVID hit (and guidance withdrawn). We expected cash NPAT to be $27.8m, so represents an 16% beat. Whilst risks abound in credit and state by state volatility this is more than accounted for by a PER multiple which is only ~10x FY21. ROE, margins, increased financial flexibility, continued double digit organic growth and opportunistic M&A all in the mix and as such longer term MNY could trade at 15-20x so there’s plenty of upside.

Netwealth (NWL) +8.46%: FY20 results this morning that were inline / slight beat with revenue of $123.9m v $121m exp, however the number was up nearly 20% on FY19 while they grew profits by 21.7% yoy to $43.8m, a tad above street expectations. IT is a big cost for NWL and they continued to expense all development costs. Funds Under Administration (FUA) sat at $31.5b at June 30, an increase of $7.3b on the year. A good result in a business that has great momentum.

Westpac (WBC) -2.33%: third quarter update today was okay but not great from Westpac. They officially pulled the interim div after deferring the decision at the half year result which comes despite CET1 holding firm at 10.8%. Net interest income fell with NIM declining 8bps to 2.05%, but non-interest income offset the bulk of the fall – similar to NAB’s quarterly. Bad debts were increased 26% and an additional $500m was added to provisions. For the most part as expected, but at the same time it was not an overly optimistic report from the bank.

Westpac (WBC) Chart

BROKER MOVES

· Countplus Reinstated Market-Weight at Wilsons

· JB Hi-Fi Cut to Sell at Bell Potter; PT A$44

· Imdex Cut to Neutral at UBS; PT A$1.45

· Bluescope Raised to Equal-Weight at Morgan Stanley; PT A$11.50

· Viva Energy Cut to Hold at Jefferies; PT A$1.90

· Bendigo & Adelaide Cut to Neutral at JPMorgan; PT A$6.70

· Viva Energy Cut to Hold at Morgans Financial Limited; PT A$1.95

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.