Resources lead market bounce…

What Mattered Today

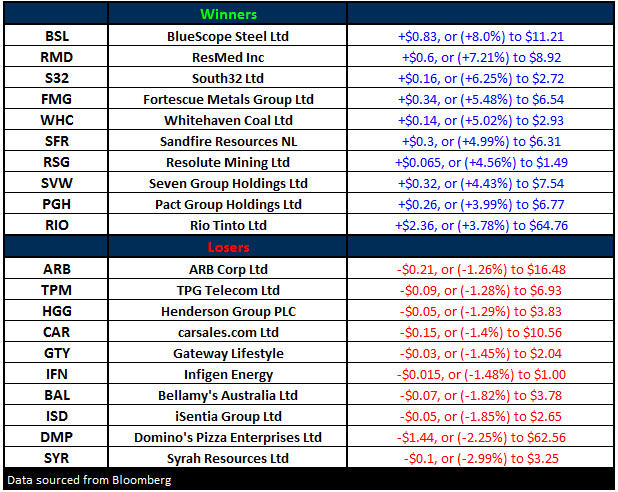

A good session for the market today with the index bouncing from key 5600 support, mainly dragged higher by the resource names while we also saw some good corporate news flow with a takeover in the Mining Services space - Cimic bidding for MacMahon (MAH), Bluescope (BSL) upgrading guidance highlighting the extremely strong momentum in that business (a good way to play infrastructure build in the States), Resmed (RMD) reported their December quarter numbers and rallied hard (+7.21%) while Brambles (BXB) wasn’t the disaster that it could have been today given overseas selling was pretty much inline with what we saw in Oz yesterday. We’re targeting ~$9.75 as our BUY level.

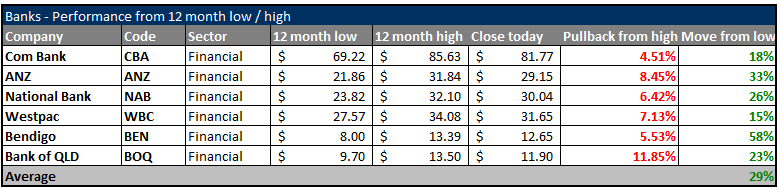

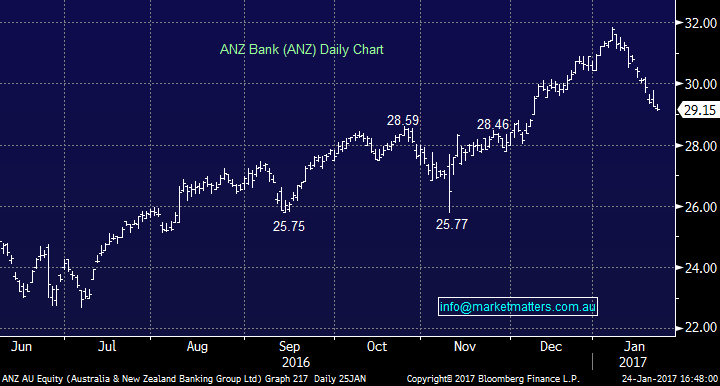

We bought two stocks today in the Market Matters portfolio, upweighting back into the banks with ANZ back in the portfolio - a 5% allocation while a more speculative play in Altium (ALU) was also added with a 4% weighting, Our cash levels were high and the ~4 % pullback too enticing.

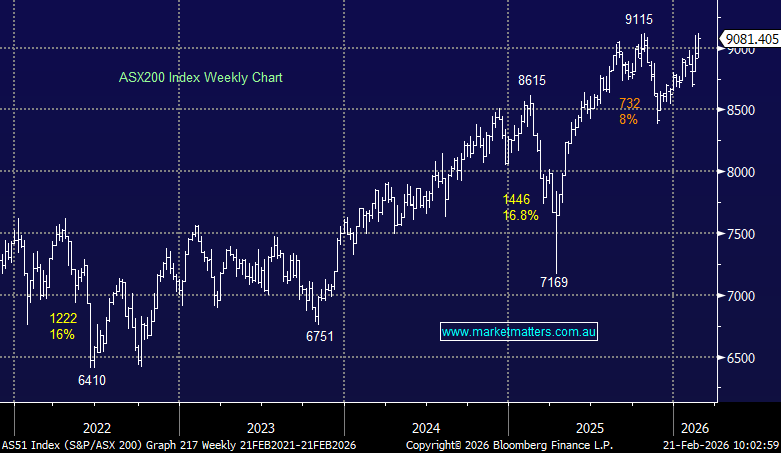

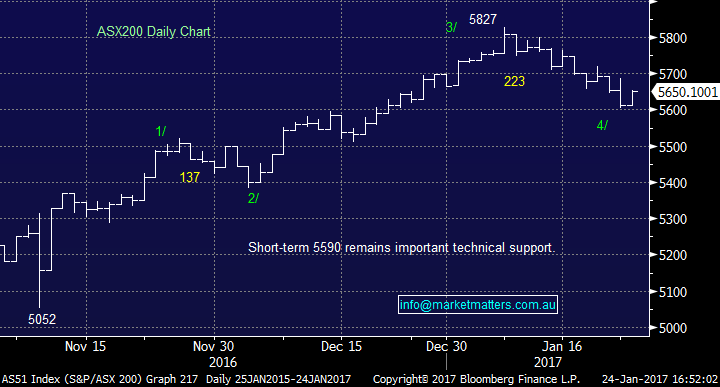

From its Jan 9 high of 5827 the ASX 200 traded to a low 5604 yesterday, and we saw a reasonable bounce today to be back up to 5650.

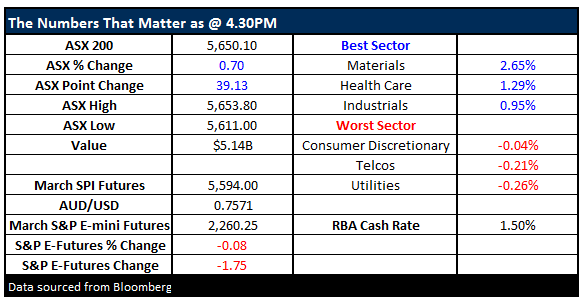

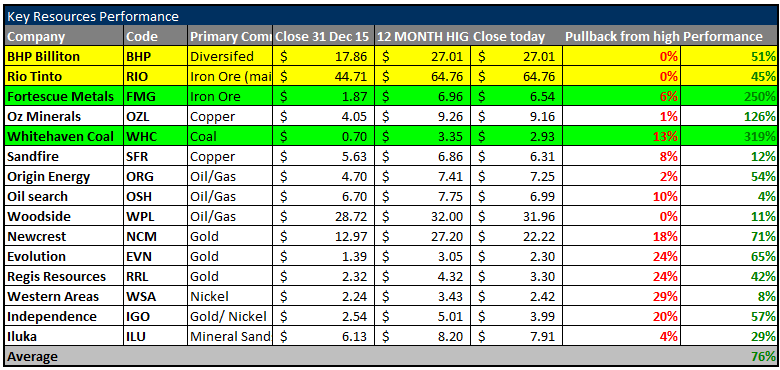

Resources saw most love with the basket of RIO, BHP, WHC, S32 & FMG accounting for +17pts of today’s rally while the Banks failed to contribute. BHP & RIO trading at their highest points in more than 12 months today and have experienced some HUGE rallies since the resource sector was pronounced dead by many about 18 months ago. Fortescue & Whitehaven the two that really stand out and these were the ones that had extremely stretched balance sheets / piles of debt and a single commodity exposure. They’ve just happened to be exposed to commodities that have rallied strongly in the last 12 months and it’s given them the opportunity to address debt – now they have big free cash flow if commodity prices stay high…

The banks are now a mixed bag since coming back from their highs – CBA has been supported most given upcoming dividend in Feb, ANZ the weakest out of the BIG 4 from the highs, but strongest from the lows. BOQ has been a weak performer relative to Bendigo.

Overall we had a range of +/- 40 points, a high of 5653, a low of 5613 and a close of 5650, up +39pts or +0.70%. Volume was good given it was stock options expiry today – which is rare on a Tuesday but a result of Australia Day this Thursday.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

ANZ; We trimmed our banking exposure into recent strength and now find ourselves with only a 5% allocations to CBA. ANZ dropped ~8% from its highs and we used the weakness to take a position today in the Market Matters portfolio at $29.10.

ANZ Daily Chart

Altium; A high growth tech business listed on the ASX with a market capitalisation of around $1bn, and not typically a stock that Market Matters would hold in the portfolio. That said, we like the growth plans for the business and see their targets for $100m revenue in FY 17 jumping to $200m in FY20 are achievable. . For those that don’t know, and in very simple terms, they are a printed circuit board software provider, or in other words, they provide the smarts for companies to design and make the circuit boards that are used in connected devices, and we all understand the growth in devices and their complexity over recent times. We bought today ~$8

Altium (ALU) Daily Chart

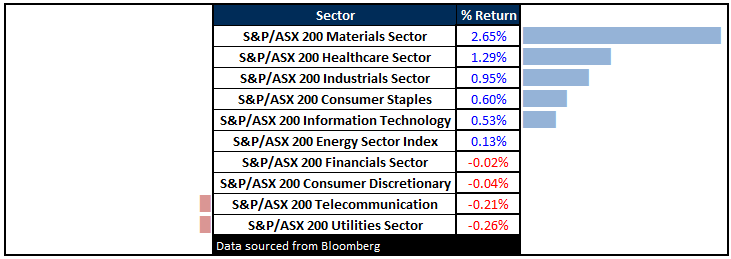

Sectors

ASX 200 Movers

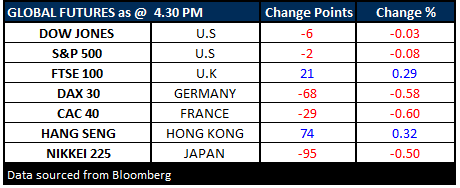

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here