Resources drive the market higher (OPY, VCX, SGR)

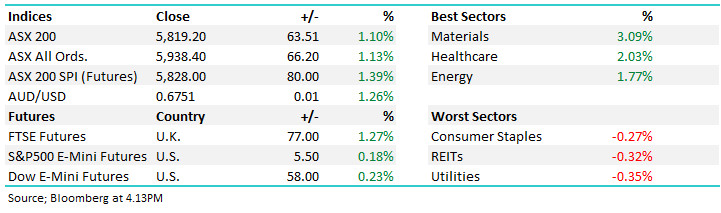

WHAT MATTERED TODAY

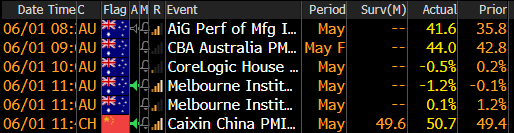

The market opened on the backfoot this morning down 70pts early as the vision from the escalating riots in the US prompted a sell-off to start the week, however as the day progressed, stocks were bought, better than expected manufacturing data from China helped although the market was already on the front foot before that. The currency has been strong during the session today, up another 1% to trade above 67c, a ~40% rally from the March lows.

Economic Data Today

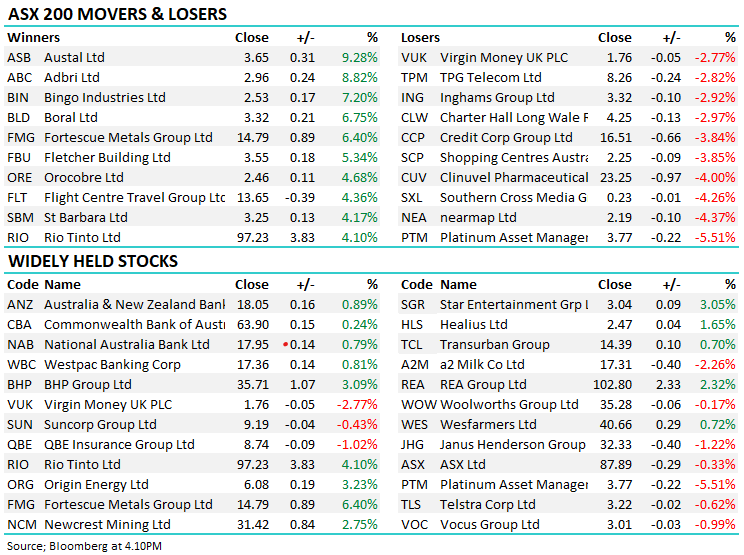

The resources the main game in town today and specifically the Iron Ore stocks as they benefit from weaker supply from Brazil thanks to the virus at a time when Chinese demand is increasing. Gold stocks also had a good day while the buying in the building companies continued, Bingo (BIN) +7% and Reece (REH), a new addition to the growth portfolio is finally edging higher, up +4.42% on the day. The ASX 200 put on an impressive +114pts from the morning low.

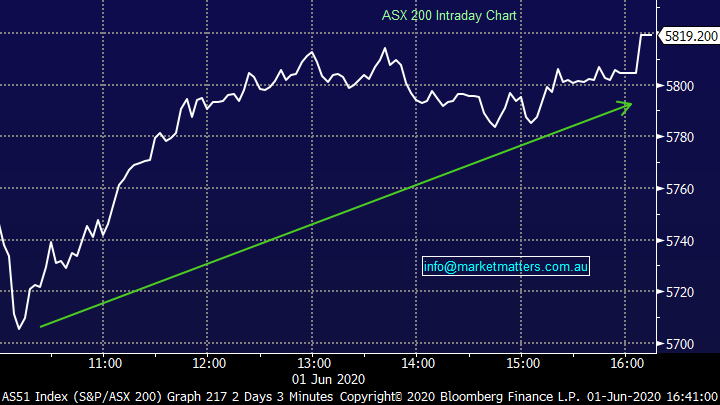

Overall, the ASX 200 added +63pts / +1.10% today to close at 5819 - Dow Futures are trading up 58pts/+0.23%.

ASX 200 Chart

ASX 200 Chart – oscillating around the 5800 midpoint.

CATCHING MY EYE:

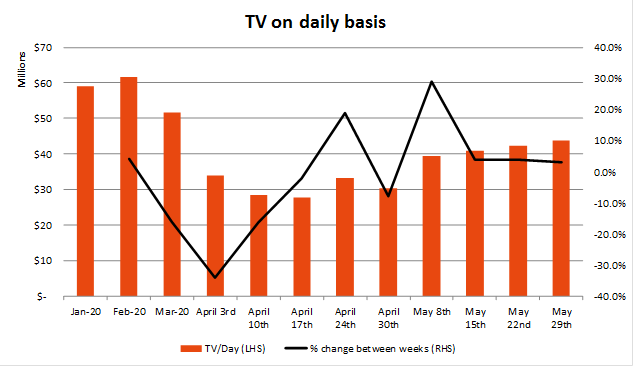

Tyro Payments (TYR) +7.92%: This morning TYR released its weekly trading update which it has been doing throughout COVID. We are providing just a high-level summary as TYR was/is the fastest growing terminal provider and likely to be a good indicator of broader offline transactions with a primary skew towards hospitality. As you’d expect, they are showing a steady increase in volumes as restrictions ease.

Key takeout’s

· Weekly transaction value (TV) to May 29th was ~$306m, or $43.7m a day. This is up 3% on the prior week, a similar delta to the prior week and continues weekly improvements.

· TV per day bottomed in Mid-April (week of 17th) at $27.8m and on a MoM basis TV is now comping ~43% higher. TV YoY for TYR is now down only 18% YoY versus -46% at the peak; and

· On current TV recovery run-rate Tyro volumes are on track to recover to pre-COVID levels in ~9-10 weeks or by August 2020.

Overall TYR is a strong bellwether for the domestic economic recovery, particularly in offline and retail/hospitality.

Source: Shaw & Partners

Openpay (OPY) +26.74%: This is a buy now pay later stock that listed last year at $1.60, had a tough run post listing and is now on the up. Today they announced two positive milestones: (1) UK funding facility secured; and (2) recent May 2020 month was the best ever in history, with significant and accelerating growth in the business around the two key metrics of customer and merchant growth. While AfterPay and Z1P get all the headlines, OPY has outpaced them both today (granted Z1P is in a trading halt!).

The securing of the UK facility removes a major overhang on the stock and the May month record highlights the resilience of the business through COVID-19. OPY is a young company doing everything right, and remains a good ‘punt’ at current levels despite the recent rally.

Openpay (OPY) Chart

Vicinity Centres (VCX) unch: spent the day in front of investors looking for $1.4b in additional cash with the shopping centre manager taking a hit to capital as COVID squeezes landlords. The raise is priced at $1.48 a share, around 8% below the last traded and at a value one third below reported pre-raise NTA. The raise is a line in the sand for Vicinity as it looks to sure up the balance sheet in the midst of uncertainty. The company has started re-valuing the portfolio as a result of the crisis with preliminary work showing a hit of 11 to 13% by the time the full year report rolls around at the end of the month.

The landlord said that foot traffic fell as low as 50% on last year in April, but has since recovered to around 25% down on the prior period. More than half of the retailers closed at the peak or the crisis however more than 80% are now trading. But while stores are opening, Vicinity are being pushed hard on lease variations. In the three months to May, just 49% of billings were received, leaving a hole in earnings. As a result, VCX are resigned to not paying a dividend for 6 months as they look to prop up the capital position alongside the raise. While things seem difficult for VCX at the minute, the raise will put them in a decent position, and as the economy opens up, people will return to malls and centres looking to spend. Shares trade at a discount to assets – and the raise at a deeper discount – so with the balance sheet secure, VCX now looks a better proposition.

Vicinity Centres (VCX) Chart

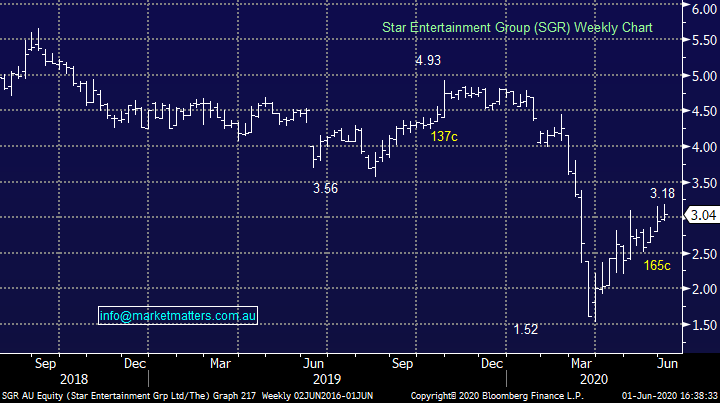

Star Entertainment Group (SGR) +3.05%: traded higher ahead of the market today as the company announced its Sydney casino would re-open to patrons today on a restricted basis. The casino will be allowed to host 500 punters on an invitation only basis from today, while customers can return to the retailers and winers and diners can eat at the restaurants.

The Sydney site also signed on with the NSW Government for a 20-year long tax agreement on its gaming revenues through to 2041. While rebate gaming will be taxed at the same 10% level, non-rebate table games will be taxed at 29%, in line with the deal Crown signed for their site in development. The non-rebate EGM tax rate will slowly increase over the next few years but top out at34% for FY28 through to the end of the period. In signing this, Star ensured that they would be the only casino with electronic gaming in Sydney for the next 20 years while also opening up compensation if NSW look to change many of the regulations in place for the casino. Regulatory certainty goes a long way for such a controversial business. We prefer Crown (CWN).

Star Entertainment Group (SGR) Chart

BROKER MOVES:

· Johns Lyng Rated New Buy at Canaccord; PT A$2.75

· Ampol Reinstated Neutral at Goldman; PT A$29.80

· Event Hospitality Cut to Neutral at Citi; PT A$9.75

· Lovisa Cut to Sell at Citi; PT A$5.85

· Bingo Industries Raised to Buy at Citi; PT A$3.10

· Westpac Cut to Underperform at Jefferies; PT A$13.34

· Afterpay Cut to Hold at Morgans Financial Limited; PT A$46

· Vicinity Centres Raised to Outperform at Credit Suisse

· Freedom Foods Cut to Hold at Morgans Financial Limited

· Costa Raised to Add at Morgans Financial Limited; PT A$3.60

· PolyNovo Cut to Hold at EL & C Baillieu; PT A$2.85

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.