Resources drag as market hits four month high

What Mattered Today

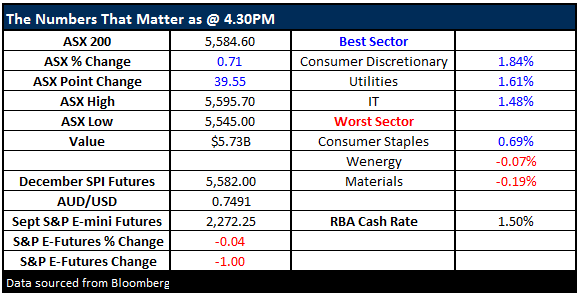

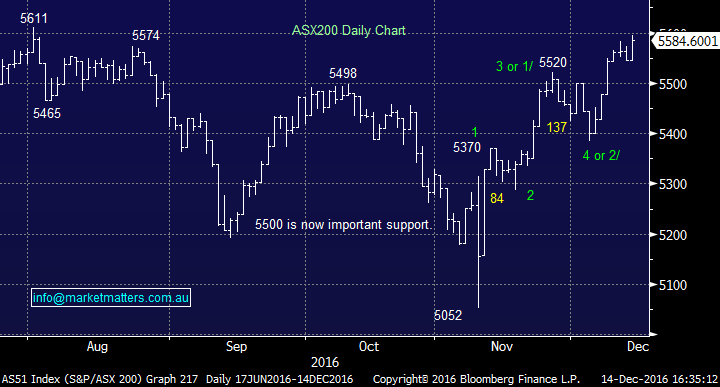

Another solid session for the ASX with the index closing at its highest level in the last 4 months - yesterday’s tepid pullback a distant memory…Banks were reasonable, some of the industrials copped a decent bid tone, Healthcare rallied +1.13% HOWEVER resources were the weakest link, losing -0.19% as a sector. BHP was off -1.23%, RIO fell -0.47% despite higher Iron Ore prices overnight and Fortescue Metals (FMG) dipped -1.56%. Some have now turned very positive commodities and if you look at broker upgrades to commodity price decks you can see why. The main guys, BHP, RIO, FMG etc are all cum upgrade in the coming months given the mkt was too bearish in terms of their underlying commodity price forecasts – the latest to upgrade their deck was Morgan Stanley yesterday, however the issue here is that we’re all expecting these upgrades. I spend 10 hours a day listening to a bunch of guys talk about the market, they in turn are talking to others and so on and so forth. ‘Resources are cum-upgrade’ has been the overwhelming rhetoric which is probably spot on, but markets / stocks rarely react to the known knowns. Resource upgrades are a known known.

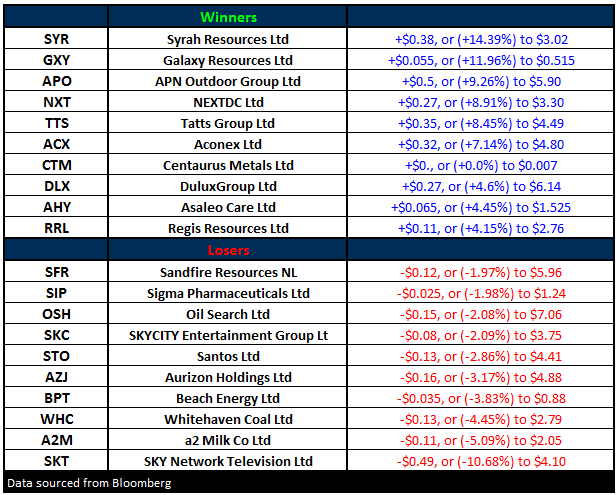

We once again use Whitehaven Coal (WHC) as our proxy for the broader space, and it was down -4.45% today to close at $2.79 – a very long way from the sub 40c mark at this year’s lows but extremely susceptible to further downside from current levels…here is a table of the other main commodity coys we look at and their price movements year to date + their move lower from their recent highs. No one now talking about GOLD and everyone talking IRON ORE & OIL...!!!

Source; Bloomberg

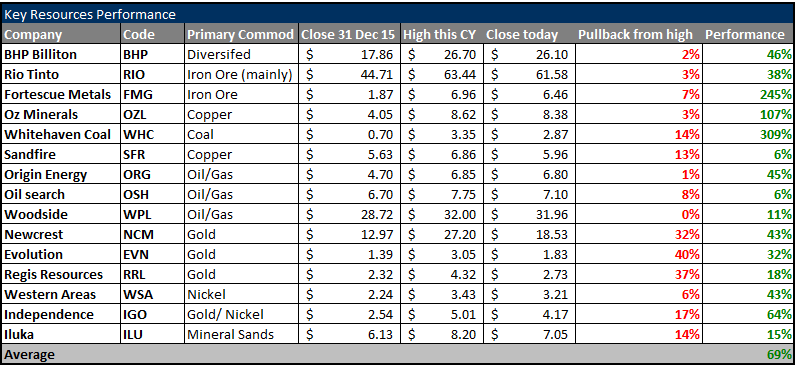

Elsewhere, Tatts (TTS) did well, closing up +8.45% after a Macquarie led consortium came to the party with a new deal that could scuttle it’s proposed merger with Tabcorp (TAH) – always good to have some competitive tension around the market! The MQG bid is worth something between $4.40 / $5.00 share while Tabcorp’s at $4.34 – Game on it would seem for the lottery business!

Tatts (TAH) Daily Chart

On the flip side, Bellamy’s (BAL) went from a trading halt into voluntary suspension – obviously having issues around disclosure to the market – essentially they need more time to get their story straight. A company can only ask for a voluntary suspension if it is unable to meet its continuous disclosure obligations to the ASX, or if it's not in a position to make an announcement after a trading halt. Not good news for BAL in all likelihood

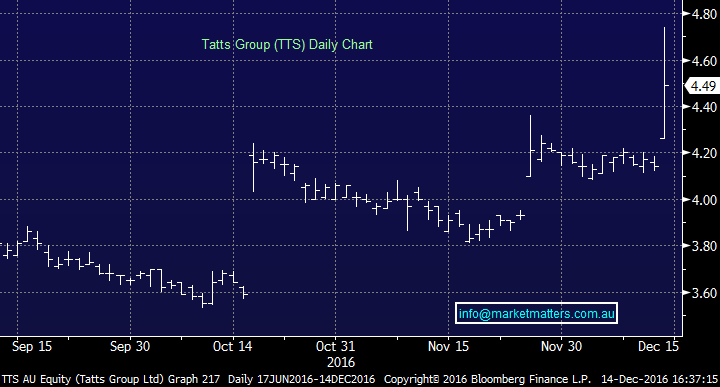

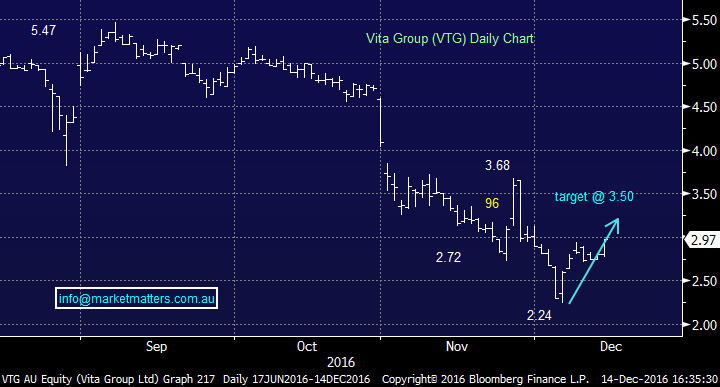

We’ve got a shorter term position in Vita Group (VTG) which is starting to look reasonable. We bought last week at $2.65 and it’s a good example of the stocks that we think should do well into the back end of the month, and early in 2017. Focus on the areas that have struggled or been hit for short term reasons – the stock closed today at $2.97, we’ve got a ~$3.50 target

Vita Group (VTG) Daily Chart

We had a range today of +/- 50 points, a high of 5595, a low of 5545 and a close of 5584, up +39pts or +0.71%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

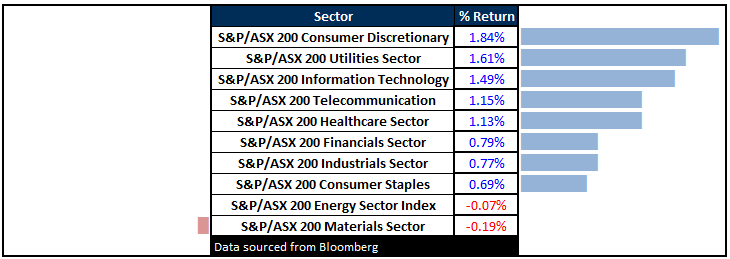

Sectors

ASX 200 Movers

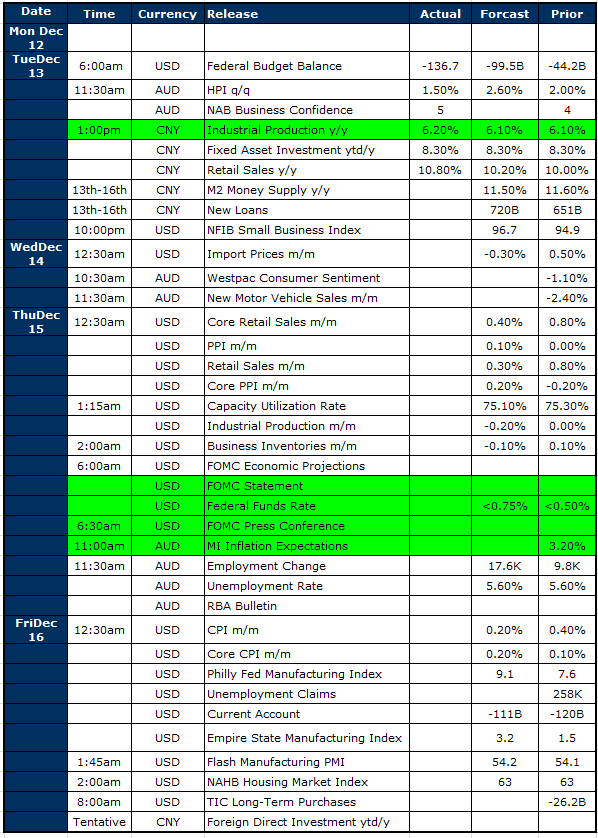

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

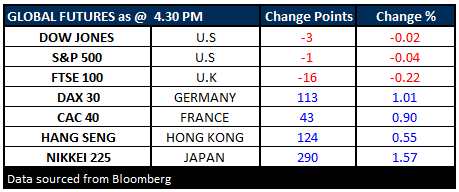

FUTURES mixed….

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here