Resource stocks dig deep today…(AWC, HSO, TLS, BHP)

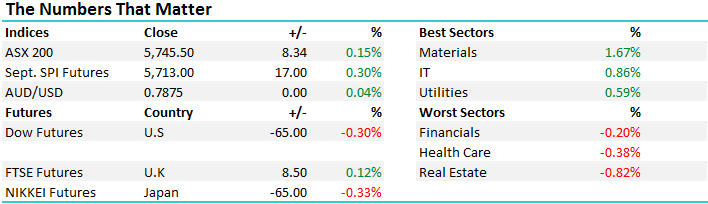

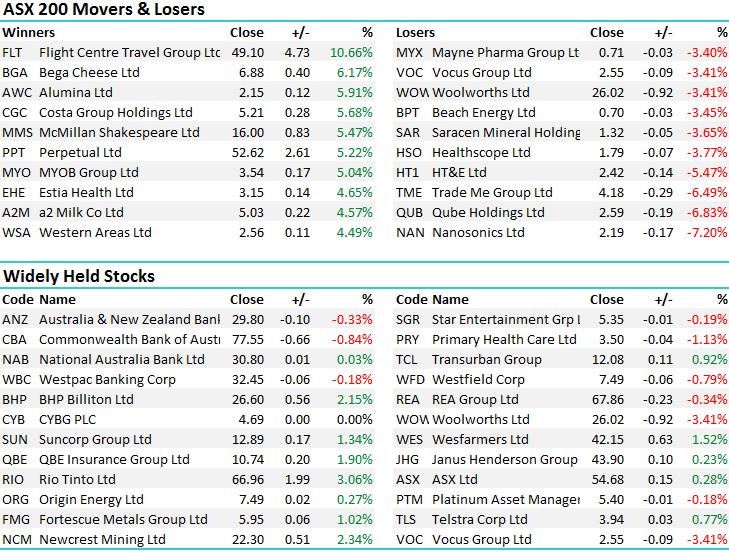

Another fairly subdued day on the index side however some decent moves in terms of stocks, particularly those that have reported. On the broader market today, the Materials sector led the way while most weakness was felt in the property stocks which lost 0.82% - an overall range of +/- 37 points, a high of 5753, a low of 5716 and a close of 5745, up +8pts or +0.14%.

ASX 200 Intra-Day Chart

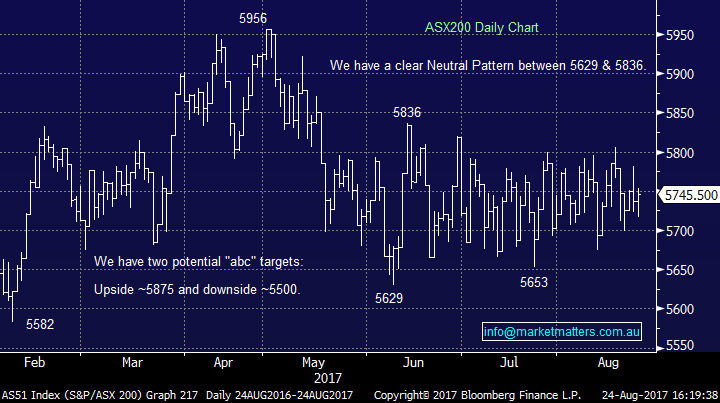

ASX 200 Daily Chart

It’s actually been an extremely busy / volatile reporting season on an individual stock level – more than we’ve seen in a number of years with the market showing very little tolerance for highly valued stocks that miss, or those that give lacklustre outlooks. One of those stocks yesterday was Healthscope (HSO) and today we bought it around $1.77. The volume was big today, bigger than yesterday with sellers on top early however by the close the buyers were finding some ascendancy. The stock closed at $1.785 down 3.77%. We like the longer term story and buying into what seems to be ‘panic selling’ we think should prove fruitful.

Healthscope Daily Chart

Telstra (TLS) was interesting today, and had a very strong close at $3.94 – the selling pressure has clearly been overdone and a close back up above $4 would be bullish for the stock. We bought at $3.85 this week as the majority dumped it on a bigger than expected cut to the dividend. We won’t fall in love here, however a run up to $4.20 would not surprise.

Telstra Daily Chart

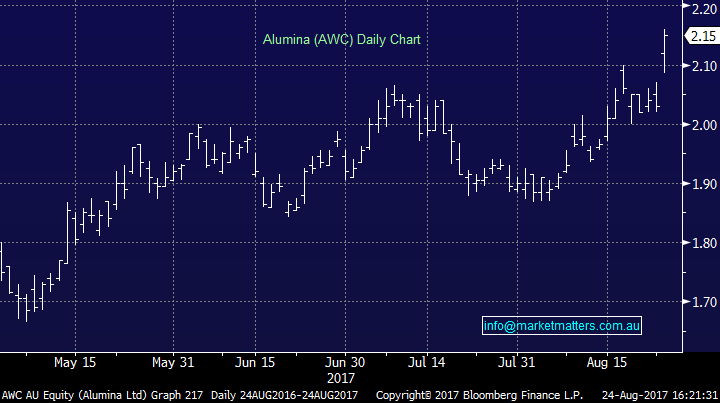

Alumina (AWC) reported strong numbers this morning with an earnings beat ($148m versus $134m consensus) and a cracker of a dividend underpinning our decision to have the stock in both the MM Platinum and MM Income portfolio. The backdrop of a strong Alumina price and the pass through of cash from AWAC creates a very good story and one we should continue to hold. Alumina added +5.91% to close at $2.15

Alumina Daily Chart

Elsewhere in the commodity complex, BHP had a good session adding 2.15% to $26.60 and we remain happily long here, looking for $28, while out switch from RIO into BOQ is yet to pay dividends – RIO up 3.06% today to close at $66.96 – clearly we sold too early! More on that in tomorrow’s am report.

BHP Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here