Resilience shown today by the market – particularly the resources

Yesterday we saw the market open firm and close weak while today we saw the opposite play out, weakness early gave way to strength in afternoon trade particularly in the resource sector as flagged in the AM report today.

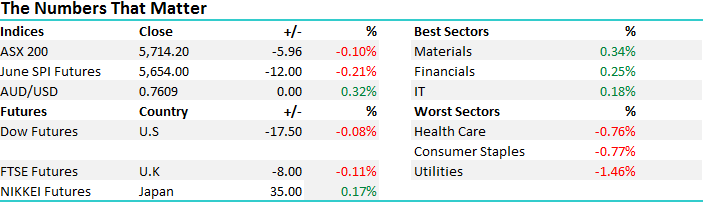

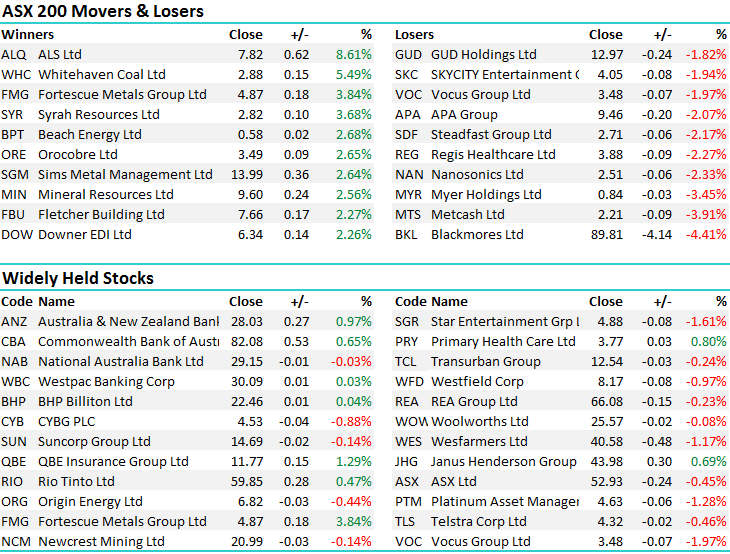

On the broader market today, the Material sector led the charge adding +0.34% while the interest rate sensitive Utilities saw most selling, and finished down -1.46% - an overall range of +/- 36 points, a high of 5721, a low of 5685 and a close of 5714, off -6pts or -0.10%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

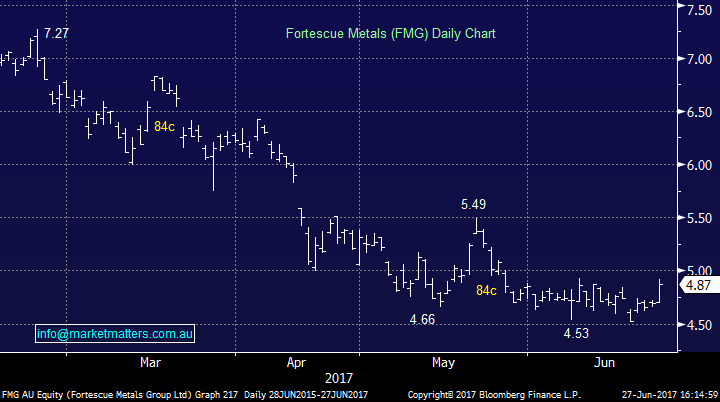

Fortescue was strong today adding +3.84% to close at $4.87 following another broker upgrade, this time from Bell Potter which upgraded their call from SELL to BUY with a price target of $5.55. They must have been reading the Shaw and Partners report out the prior day which made the same call with a double upgrade to BUY and $5.50 price target. Peter O’Connor, Shaw’s Resource Analyst is the best in the business in our view and has called FMG well in recent times. We were ahead of both but it’s encouraging to see the mkt start to come around from such a negative bias.

We own Fortescue from $4.66 and todays price action is encouraging.

Fortescue Metals Daily Chart

We pulled the trigger on QBE Insurance (QBE) this morning, adding another 3% to our existing 4% holding around $11.60 – we now have 7% in the stock which closed at $11.77, up 1.29%. The stock closed well today and for now looks reasonable. The recent downgrade was clearly disappointing and deserved a sell-off in share price, however we suspect that it’s now overdone with a portion of the selloff being emotionally driven – given their poor track record in recent years. The stock is now cheap (in our view) and the mkt is pricing more bearish assumptions in terms of margins than we think the company will deliver – however, it will now take time given management will get zero benefit of the doubt from the mkt. The upside kicker – the X factor, is if interest rates and currency markets move in their favour, as we think they will.

We’ll review our call on all general insurers in the AM report tomorrow.

QBE Insurance Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here