Reporting Season Wrap: The Banking Sector

The banking sector has had Commonwealth (ASX:CBA) and Bendigo (ASX:BEN) report first half results while the other 3 major banks provided trading updates. Bank of QLD (ASX:BOQ) issued a profit downgrade.

Key points:

- Competition in the home loan sector is high in a weakening market – not surprising and probably set to continue

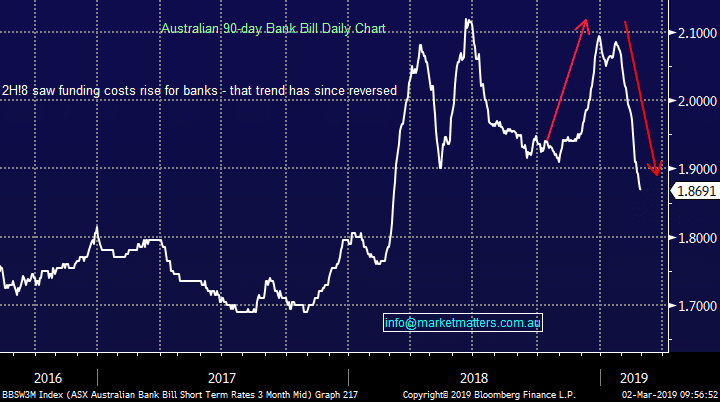

- Short term funding costs went up which put pressure on margins. This can be shown through the 90 day bank bill rate below. Banks generally borrow short term and lend long term, so higher short term borrowing costs hurt - the trend has now reversed. The regional banks are most impacted by this theme so theoretically, should have the most to gain on its reversion

- Regulatory costs were high, and will remain high for a while – not new news and the outcome from the RC was clearly more bank friendly than it could have been

90 Day Bank Bill Rate Chart

MM take:

- The banking sector to outperform from here, we remain overweight, holding CBA, NAB & WBC while we bought BOQ in the Income Portfolio into weakness this week. Regional's most oversold, WBC best value major, CBA the most likely to be sold into further strength.

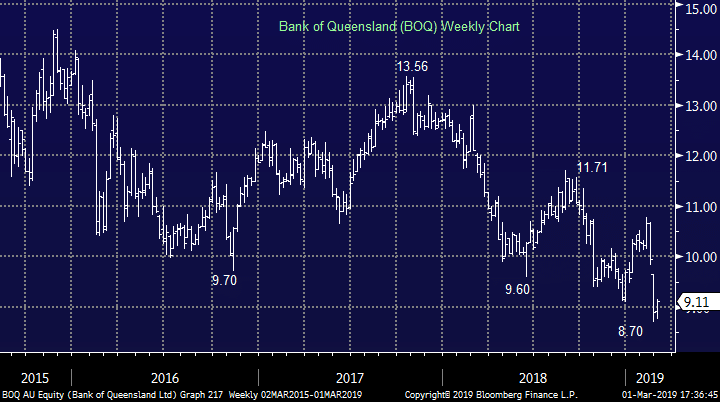

Bank of Queensland (ASX:BOQ)

MM take:

- The banking sector to outperform from here, we remain overweight, holding CBA, NAB & WBC while we bought BOQ in the Income Portfolio into weakness this week. Regional's most oversold, WBC best value major, CBA the most likely to be sold into further strength.

Bank of Queensland (ASX:BOQ)