Reporting season winds down, as did the market today…(PPT, RHC)

WHAT MATTERED TODAY

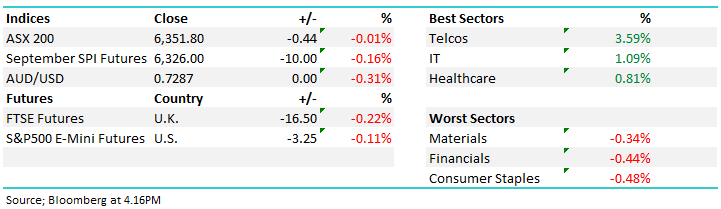

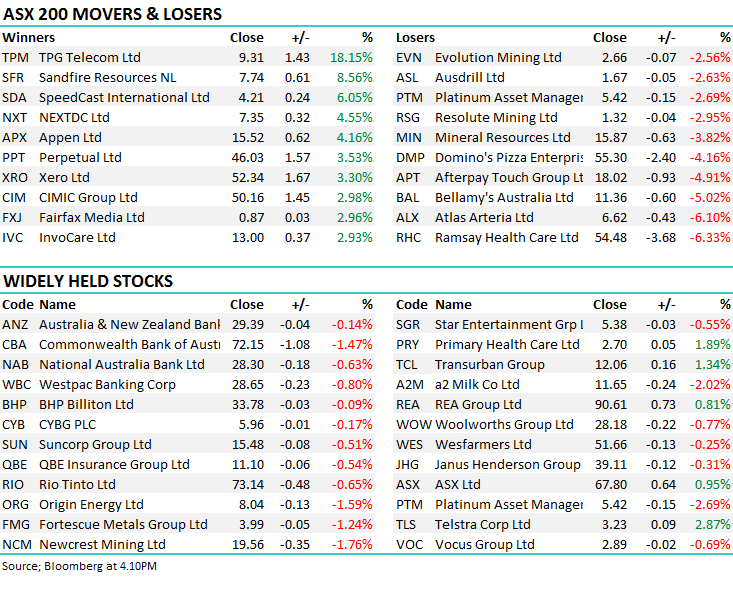

An extremely optimistic start faded throughout the day as the market edged back to parity in a sign the selling strength theme is in play. Options expiry and follow through buying of the banks caused a messy open, but this waned to see each of the big four close noticeably lower. Materials were also softer today with oil doing its best to offset some weaker commodity prices. The Telco sector remained the big mover as the $15b merger deal between TPG & Vodafone Australia moves ahead, now just subject to regulatory approval. TPG ripped another 18% higher to close at $9.31, Telstra (TLS) added +2.87% to close at $3.23 – and impressive result given that 11cps plus franking has come out of the stock this week, while Amaysim (AYS) is starting to look interesting here if further consolidation plays out in the sector. A higher risk option in the Telco space around $1.14 a pop.

Overall, the index closed flat today at 6351.

Two stocks were have across the portfolios reported today, Ramsay Healthcare dropped on its report today while Perpetual saw some buying on the back of their FY18 numbers – more on these two later. Others that reported today:

Reporting season just about wraps up tomorrow for those with a June half or full year end. For a full list of company reporting dates – click here

It’s been a busy period for the markets with some huge individual stock volatility- we’ll look at what has transpired in coming notes.

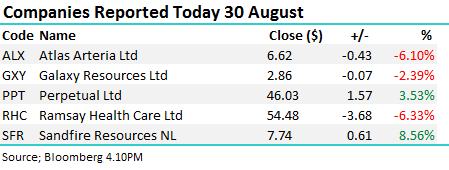

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Domino’s copped this most pain from the analysts today, with Goldman’s note enough to knock ~4% off the price as the stock gave back some it’s impressive post report performance

Elsewhere….

· Austin Engineering (ANG AU): Raised to Buy at Argonaut Securities

· Bega Cheese (BGA AU): Downgraded to Reduce at Morgans Financial; PT A$7

· Domino’s Pizza Enterprises (DMP AU): Cut to Neutral at Goldman; PT A$52.40

· Independence Group (IGO AU): Upgraded to Hold at Canaccord; PT A$4.40

· Money3 (MNY AU): Upgraded to Buy at Hartleys Ltd; PT A$2.38

· Santos (STO AU): Cut to Neutral at Credit Suisse; Price Target A$6.35

· Southern Cross Electrical Engineering (SXE AU): Raised to Buy at Argonaut Securities

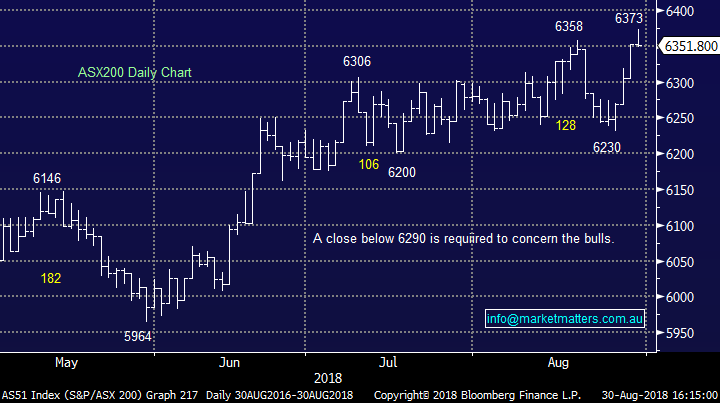

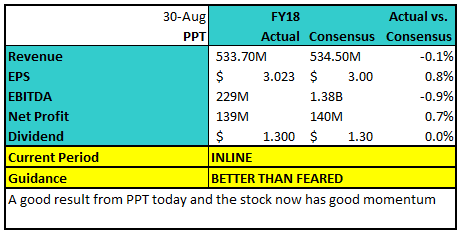

Perpetual (PPT) $46.03 / +3.53%; Reported full year earnings today and the results were broadly inline with market consensus, however this is a stock that has experienced a tough 6 months or so, was / is cheap and the market saw the commentary as more upbeat than current positioning suggested. The chart below looks at Perpetuals PE relative to its competitors over the past 5 years. Good managers (and Perpetual is a good manager) have periods of poor performance as we all do and that often leads to FUM outflows and a compression in PE’s. That is more often than not transient, and PE discounts then close. The periods of green is when the stock is cheap relative to others – the red is when it’s expensive.

At the end of 2017 and again in mid-2018, the stock was more than 1 standard deviation cheap relative to peers. Right now its fair value v the sector once again. We have PPT in the MM Income Portfolio and remain comfortable in the position, looking to sell when the stock becomes more expensive relative to comps.

Perpetual (PPT) – PE relative to sector

In terms of result, all metrics were mostly inline with our / market expectations while in terms of outlook,. they said…, we continued to invest in our data and analytics solutions this year, while a significant technology modernisation program has also been established to deliver stronger foundations for future growth

Perpetual (PPT) Chart

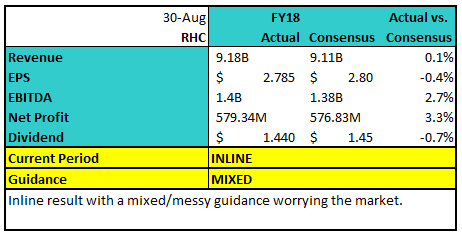

Ramsay health Care (RHC) $54.48 / -6.33%; Hospital owner/operator Ramsay has been sold off today despite what appears to be a solid result with reasonable, if not messy guidance. The result was broadly in line with expectations, although they beat on the EBITDA line which was largely driven by margin expansion in the Australian business – once again the best segment for Ramsay, growing revenues by 5% but EBITDA +12% over the year.

Guidance for FY19 flagging a higher than usual tax hit and increasing interest was mixed with core EPS guided to 2% growth while the market was looking for a mid-single digit uplift. However, stripping out the tax and interest components, EBITDA growth as guided to 4-6% with the market currently placed at the lower end of 4%.

Ramsay Health Care (RHC) Chart

OUR CALLS

No trades across the MM Portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here