Reporting season kicks off with Credit Corp (CCP, CYP, SUN)

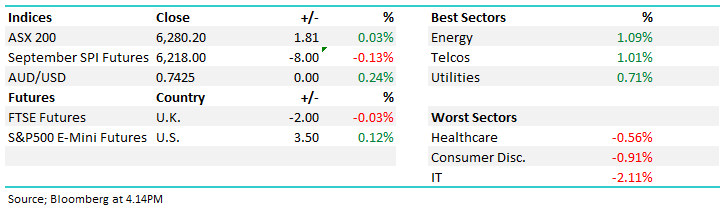

WHAT MATTERED TODAY

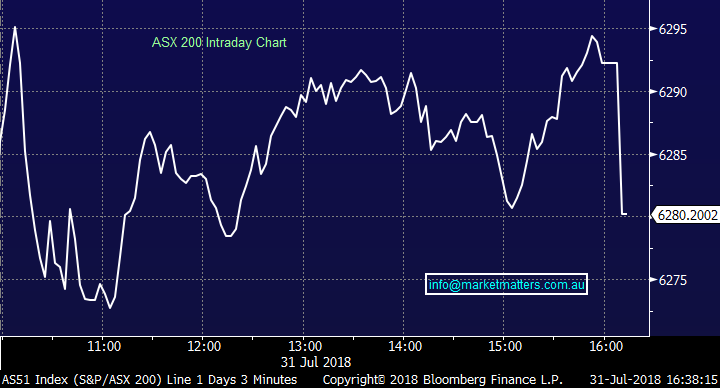

A lot across the ticker today with the start (sort of) for reporting season while we continued to see a barrage of quarterly activity reports particularly in the mining space, with some big moves playing out as a consequence. The market was hit early with the banks and resources trading down from early highs, however the market booked an 11am low and rallied for most of the afternoon…only to see a massive line go through on the match (end of month square up) which took a quick 13pts from the ASX 200.

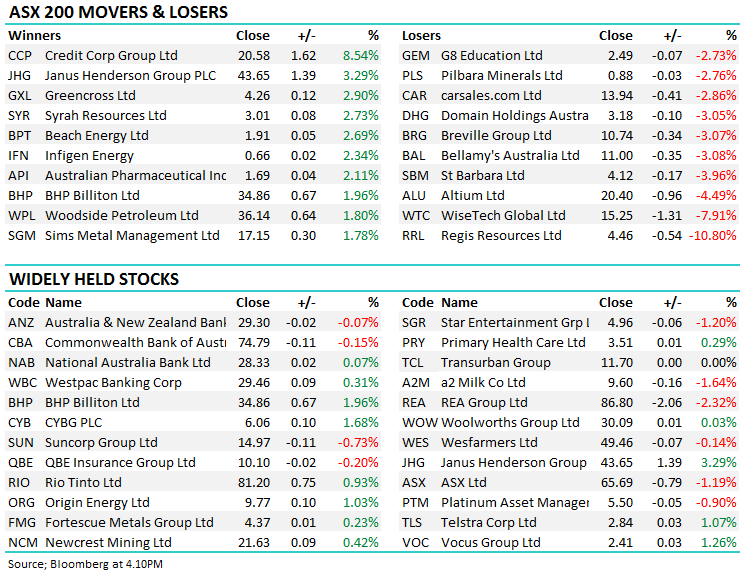

At a company level today, Senex (SXY) delivered strong quarterly production numbers and rallied +9.76%, Credit Corp (CCP) released full year results that were around 2% ahead of expectations, however their guidance was weak – the stock rallied 8.54% - more on that below, Carnarvon (CVN) gave a strong drilling update at their Dorado project which pushed the stock up 2.80% while we also had a good update from Infigen (IFN) – the stock adding 2.34%. Iluka (ILU) and Western Areas (WSA) announced a JV in South Australia, the market liked ILU’s deal better than WSA’s with the former up 1.33% while the later lost 0.61%.

On the flipside the market continued to punish those companies that have been well supported leading into an update where they fail to live up to expectations – Regis Resources (RRL) a clear example here with the company missing in terms of quarterly production and getting knocked by 10.8% on the session closing at $4.46.

The small tech sector in Australia has also felt the brunt of recent weakness in their larger US rivals…Wisetech (WTC) down 7.91% today and Altium (ALU) off by 4.49% the weakest of the bunch while the Lithium stocks were also hit hard, Kidman (KDR) and Pilbara (PLS) down 8.2% & 2.76% respectively. Orocobre (ORE) was down hard early however a strong production report released mid-morning had the sellers on the back foot and the stock recovered strongly – closing at $4.62 versus a $4.46 intra-day low. Companies that report strong numbers have tended to do well over the following few days and ORE should start outperforming the sector from here.

As we reiterated in the AM report today, we prefer GARP rather than GAAP…Growth at a reasonable price rather than growth at any price and some of the more highly valued ‘go to’ stocks now seem to be in the sights of sellers – profit taking ahead of reporting perhaps after seeing Facebook & Netflix hammered in the US!

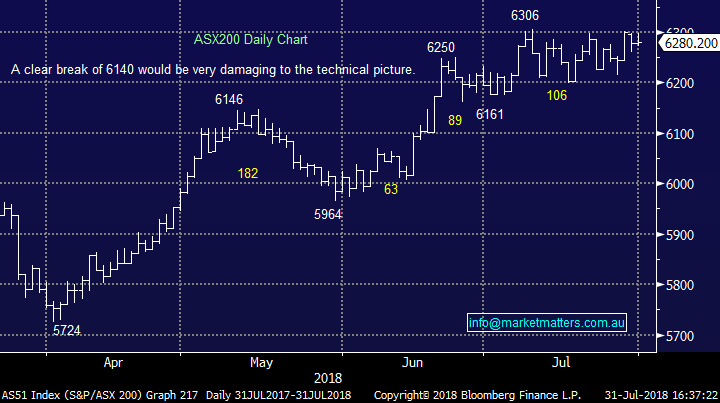

Overall, the ASX200 added +1point today or +0.03% to close at 6280 – Dow Futures are currently trading up 17pts. We remain mildly short-term bullish the ASX200 while the index holds above 6250, neutral between 6250 & 6140 and bearish on a break of 6140.

ASX 200 Chart – BANG on the close for end of month!

ASX 200 Chart

CATCHING OUR EYE

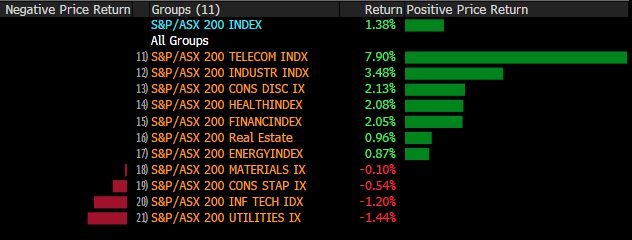

Volatility or NOT; July has seen the lowest monthly trading range since before the GFC i.e. well over 10-years. Hence while the market may have made fresh new decade highs this month the momentum has been far from convincing as stock / sector rotation remains the main game in town.

On a sector level the Telcos did best by a fair margin while the utilities were the weakest link.

Sectors for the month of July

Broker Moves; Suncorp saw 2x downgrades this morning from JP Morgan & Bells, both moving to a HOLD and $15 PT, which saw the stock sold early as their respective followings re-weight- still, early weakness was bought into and the stock did well to close only marginally lower on the session which implies underlying strength.

Suncorp (SUN) Chart

Elsewhere…

· Rio Tinto Downgraded to Hold at Morgans Financial; PT A$84.42

· Netwealth Group Rated New Hold at Wilsons; PT A$8.59

· GrainCorp Reinstated at Wilsons With Hold; PT A$7.79

· Suncorp Downgraded to Hold at Bell Potter; PT A$15

· Suncorp Downgraded to Neutral at JPMorgan; PT A$15

· Flight Centre Resumed at Bell Potter With Hold; PT A$64.20

· Orora Downgraded to Neutral at JPMorgan; Price Target A$3.60

· Breville Downgraded to Neutral at Credit Suisse; PT A$11.60

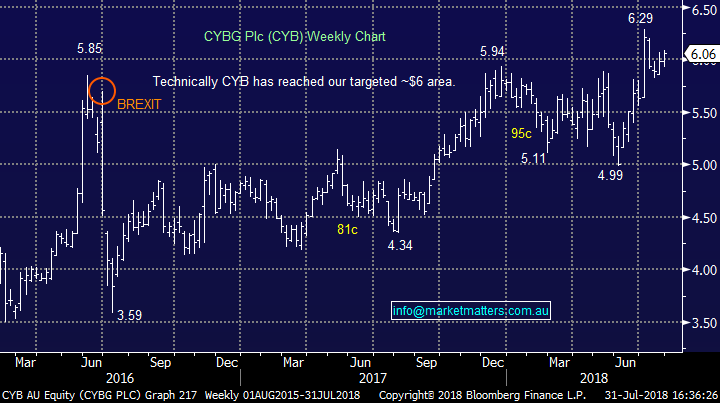

Clydesdale Bank (CYB) $6.06 / +1.68%; The UK bank provided investors with a 3rd quarter update late yesterday which came with no surprises, although was somewhat light on detail regarding the progress of the Virgin money acquisition. Mortgage growth was at an annualised rate of 3.8%, which is expected to drag the full year growth to the lower end of the 4-6% guidance. This was offset somewhat by SME lending which showed healthy growth of 5% annualised with resilience expected into the fourth quarter. Guidance was maintained across the board – we do see some risk to NIM however as CYB target 220bps, they have been running at ~218bps for the year.

CYB did say their ongoing PPI complaints remain elevated, although this is in line with expectations and are comfortable with current provisions for claims – some risk to their forecasts here as they expect a slowdown in claims before the deadline. Human mentality would suggest the potential for a spike in complaints before the August 2019 deadline.

Clydesdale (CYB) Chart

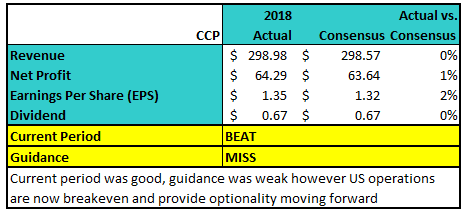

Creditcorp (CCP) $20.58 / +8.54%; Ah…the scent of local reporting season is wafting around the office with Credit Corp (CCP) out with full year results this morning ahead what’s likely to be fairly lively month ahead for Australian equities. Looking at CCP’s share price move today could well be precursor to what’s in store, with the stock down ~3% early before rallying strongly as the CEO does the rounds and talks up their US growth opportunity – a range +/-10%. As shown below, the FY18 result was about a 2% beat on the EPS line with revenue as per programmed while the dividend met expectations. A good result considering that the debt collector purchased less debt in the period which essentially means they ran on lower inventory, perhaps that’s why their FY19 guidance was lower than expected.

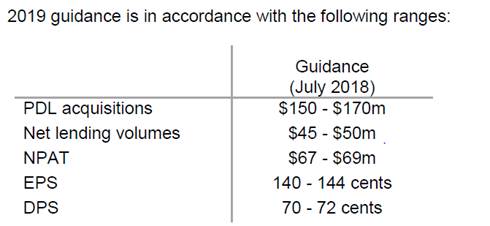

In terms of guidance, they outlined the following…

Consensus was already at $71m in terms of NPAT, 148cents at the EPS line and 74cps for the dividend, so a slight miss in terms of forward guidance, nevertheless, this is a business trading 13x so not a huge amount of upside built in. Assuming they meet company guidance, a business growing at 5% pa with a decent dividend while trading on a cheaper multiple than the market looks relatively attractive.

Credit Corp (CCP) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here