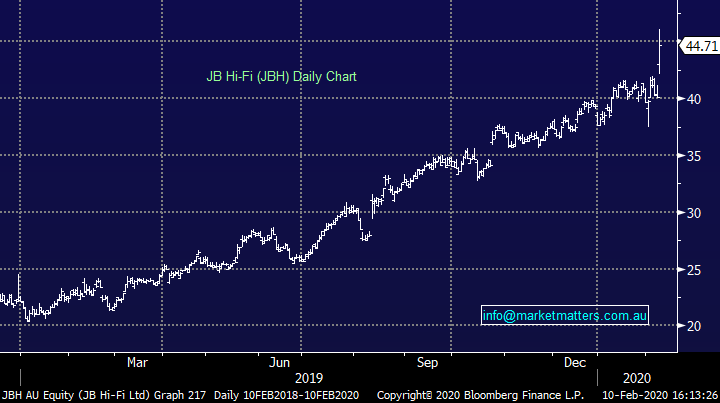

Reporting season kicks into gear (PPS, JBH, BLD)

WHAT MATTERED TODAY

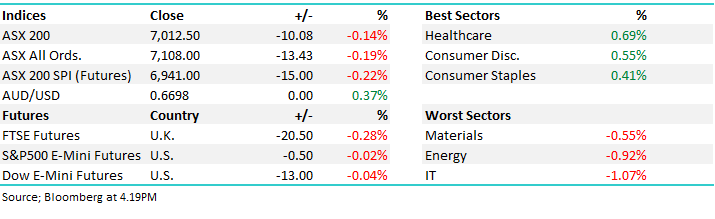

A weaker session locally today although the market did edge up from the session lows which were set around midday. Stocks were initially sold off with the index hitting a 6983 low early on before bouncing to close back up above ~7000. Asian markets were all down, but again, losses were curtailed to less than ~1% while US Futures were fairly muted during our time zone after some initial weakness. At the sector level, the hot healthcare stocks were best on ground while there was buying back into the Gold sector, while growth related areas were sold off, Materials, Energy & IT the biggest drags.

Reporting season kicking up locally with a reporting schedule available: CLICK HERE

In the recording below I cover results from JB Hi-Fi (JBH) and Boral (BLD)

Tomorrow we have reports from companies including: AMC, AVN, CGF, CLW, MQG, SUN, TCL

Overall, the ASX 200 fell by -10pts/ -0.14% today to close at 7012. Dow Futures are trading higher by +8pts/+0.02%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

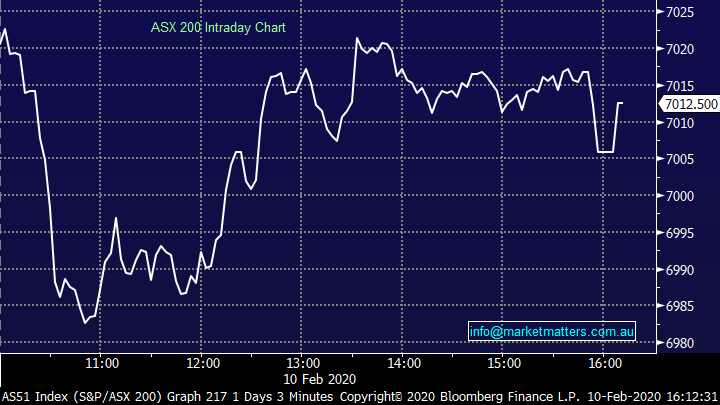

Boral (BLD) -10.68%: Updated the market today on the issues they flagged around their Window’s business back in December of 2019. In short, that division has overstated earnings and heads have now rolled, including the CEO Mike Kane who will retire early. The impact on before tax earnings is $US24.6m inline with their guidance when they first discovered the irregularities of $US20-30m at the EBITDA line. In short, while the headlines here are poor this is not new news. The new news in the update came from 1. The early retirement of Mike Kane (Positive) & 2. An earnings downgrade (Negative). BLD now expect full year net profit of $320-$340m while the market was at $348m, a 5% downgrade at the mid-point. We own BLD from $4.86 and are now reviewing the position here. The stock is off far more than the downgrade suggests.

Boral (BLD) Chart

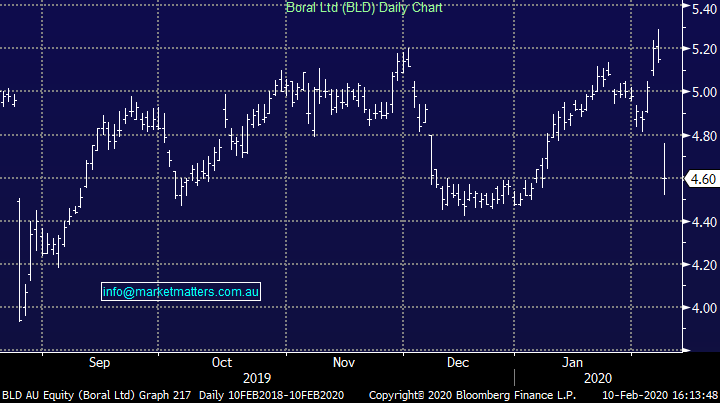

JB Hi-Fi (JBH) +11.5%: cracked all-time highs today in the face of a softer broader market thanks to another stand out report. In what was considered to be a difficult 6 month period for retail in Australia, JB have managed to grow earnings 6.55% to $170.6m for the first half largely a result of margin improvements with revenue adding 3.9%. The bulk of the good work was done by the JB Hi-Fi Australia unit which saw particular growth in hardware, while an improving online offering added 18.3% to sales. The Good Guys brand also contributed positively with 1.5% sales growth, ending the year with a wet sale with 2Q sales +2.7% pcp.

The company also trumpeted an impressive start to the new year. Comparable sales for January in JBH Australia are 6% higher than last year, while The Good Guys was tracking +1.4% on January 19. Guidance for the full year was provided, with NPAT at $265m to $270m around 7% higher than FY19, and around 2.5% better than consensus estimates. They have shown continual improvements in costs and efficiency, remained a market leader in range and price all while adding new stores effectively and improving the online offering all during an anaemic retail market. They managed to lift their half year dividend to 99c franked yield, up from 91c and on a reasonable 18.5x PE, JBH is one on the buy radar for us.

JB Hi-Fi (JBH) Chart – The chart doesn’t suggest a tough retail environment

Praemium (PPS) -2.02%: investment platform provider Praemium tracked marginally lower today despite what was a reasonable half year result published this morning. The report showed revenue growth of 6% on the first half of 19 with EBITDA at $7m just marginally below consensus estimates. Praemium continue to grow their already market leading margins, up to 28.8% at the EBITDA level, up from 24.3% pcp. One drag to the result was another half of losses from their international division of $1m. The division has been touted as cashflow breakeven for a number of years, and looks set to be delayed until at least FY21. PPS is sitting on a sizable cash balance, and now growing their franking credit balance, shareholders look set for a dividend next financial year.

Praemium (PPS) Chart

Broker moves;

- oOh!media Cut to Hold at Canaccord; PT A$3

- GTN Ltd Cut to Speculative Buy at Canaccord; PT A$1

- HT&E Cut to Hold at Canaccord; PT A$1.70

- Mirvac Group Rated New Hold at Jefferies; PT A$3.62

- Stride Property Cut to Sell at UBS; PT NZ$2.25

- REA Group Cut to Underperform at Macquarie; PT A$110

- Cimic Raised to Buy at Morningstar

- Reliance Worldwide Cut to Sell at Morningstar

- Boral Cut to Underperform at Credit Suisse; PT A$4.45

- BHP Group PLC Cut to Reduce at Oddo BHF

OUR CALLS

No amendments today

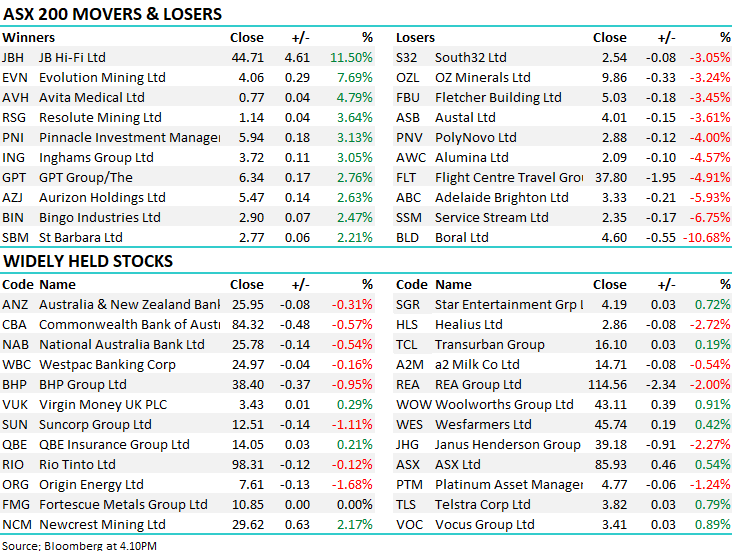

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.