Reporting season creates some significant stock volatility (CGF, DMP, COH)

WHAT MATTERED TODAY

The local market bounced back strongly today thanks largely to some decent buying amongst the banking stocks after we saw both ANZ and NAB with updates that seemed to allay the market’s fears about the state of bank earnings – a couple more ‘less bad’ updates and the sector is seeing some buying, which makes sense. There was a lot of bank bashing over the last few months and the market is clearly underweight the sector. Strip out the banks and the overall market is very expensive yet on a relative basis to both the market and to their historical metrics, banks are on the cheaper side of fair value. This plays well into our thinking that banks will outperform the broader market, even into any weakness that is slowly, stubbornly threatening to emerge!

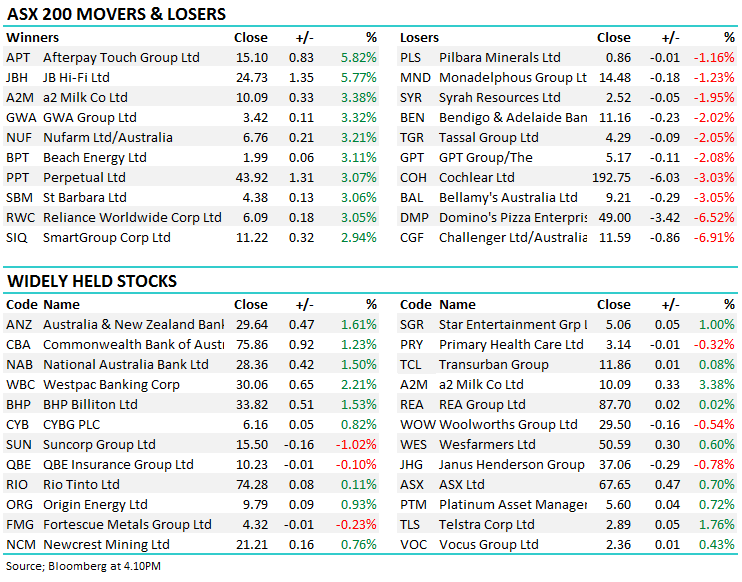

Reporting obviously dominated the news flow today with some huge volatility from companies that delivered results. Cochlear (COH) +/- 7.91%, Challenger Financial (CGF) ) +/-9.32% & Dominoes (DMP) +/- 13.16% with all three of them finishing well off their daily lows, although down overall. More on the results below.

We also saw A2 Milk (A2M) out with some reasonable news, reaffirming its strategic arrangements with China State Farm Holding Shanghai Co and extended the agreement for a further three-year period. The stock was up 3.38% as a result to close at $10.09

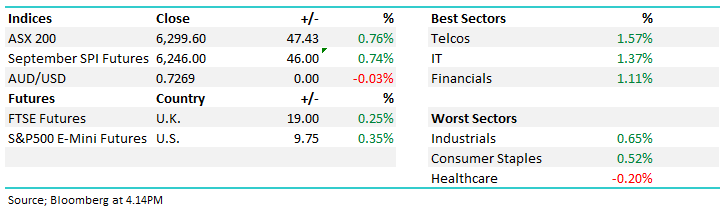

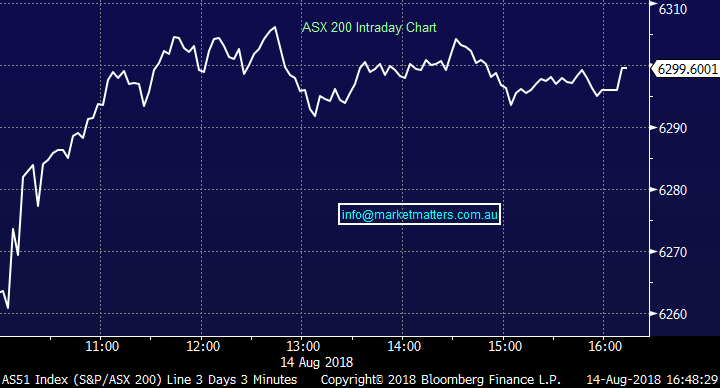

Overall, the ASX200 added +47 points today or +0.76% to close at 6299– Dow Futures are currently trading up 85pts.

Tomorrow is one of the bigger days on the local report front with CSL, CPU, DXS, FXJ, IAG, ILU, PGH, VCX, WES & WPL all out with results. For a full list of company reporting dates – click here

No companies we hold across the MM Portfolios reporting out tomorrow, however expectations for CSL are for FY net income estimate $1.71 billion on revenue of $7.72 billion. Profit guidance for FY19 should come in at $1.96b while the final dividend est. A$0.87/shr. It seems to me, the market is positioned for CSL to be at the top end of these numbers.

Wesfarmers (WES) also out with their FY18 numbers with the market expecting net profit of A$2.78 billion on revenue of A$70.13 billion. At the EBITDA line (before one offs) is expected to be A$5.49 billion with the final dividend expected to be A$1.23/share.

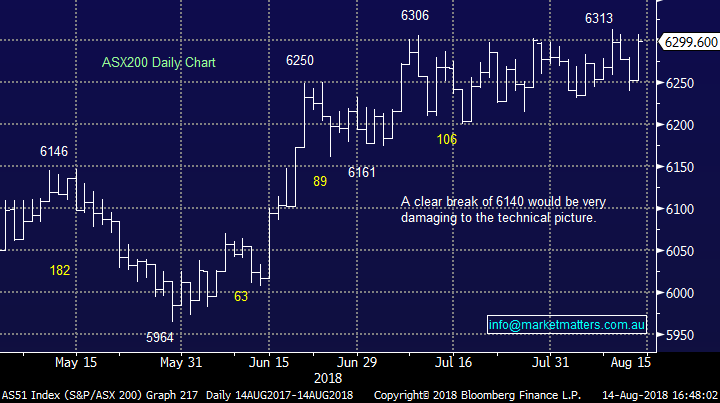

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· AGL Energy (AGL AU): Rated New Hold at Morgans Financial; PT A$19.78

· Avita Medical (AVH AU): Reinstated Speculative Buy at Bell Potter

· Bendigo & Adelaide (BEN AU): Downgraded to Neutral at Goldman; PT A$11.69

· Calpilano (CZZ AU): Downgraded to Hold at Canaccord; PT A$20.06

· New Hope (NHC AU): New Hope Downgraded to Hold at Morgans Financial; PT A$3.20

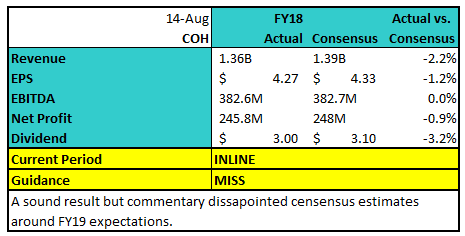

Cochlear (COH) $192.75 / -3.03%; Hearing implant developer Cochlear delivered a reasonable result pre-market, however guidance was well below analysts hopes for FY19 which sent the stock lower today. The company trades on a high forward PE of ~37x which requires a solid growth rate to justify. This morning COH guided to net profit growth of 8-12%, or around $270m for FY19 which is 5% below consensus estimates of 284.5M, enough to worry the market.

Working in Cochlear’s favour is commentary that may suggest the guidance may under-promise for the year ahead. The company indicates that guidance doesn’t include any currency tailwinds as it benefits from a falling Aussie dollar, while the board chose a more conservative estimate from emerging markets where they have seen a high level of growth in the second half of FY18. If these trends continue, the guidance will be under done.

COH traded as low as $183.05 today, 7.9% below yesterday’s close, however it rebounded reasonably well to close just 3.03% lower.

Cochlear (COH) Chart

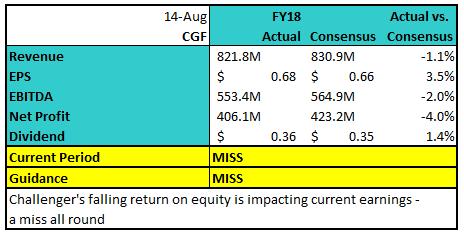

Challenger (CGF) $11.59 / -6.97%; This morning Challenger reported their full year results and they were a miss versus market expectations for FY18 and their guidance was also light on relative to the market. The stock is trading down 7.87% at time of writing on the session and we now have the share price down ~20% from the early January highs. NPAT for FY18 came in at $406m versus the $423m expected by the market, which is a about a 4% miss on the profit line. The dividend was in line with expectations, however that’s of little comfort given the guidance was below expectations.

The company guided for pre-tax profit growth of between 8-12%, at the midpoint (10%) it implies pre-tax profit for FY19 of $601m, however the market was forecasting $611m. The real issue it seems for CGF is the move to lower risk assets underpinning their future liabilities (annuities). While a mix of lower risk assets reduces the overall risk in the business, it has a negative impact on margins and the companies ROE will come under continued pressure.

Challenger Group Financial (CGF) Chart

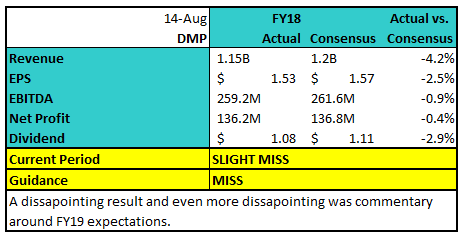

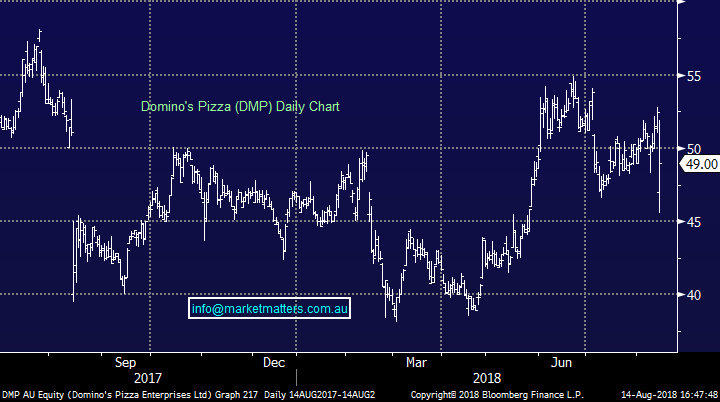

Domino’s Pizza (DMP) $49.00 / -6.52%; The result was undercooked at Dominoes this morning, and the stock is trading down 9% at the time of writing as the market sends back their orders. The big revenue miss into a smaller profit miss shows that an effort is being made to reduce some costs within the business, contrary to the markets expectations of growth for the company. NPAT growth of 15% for FY18 was well below the company’s previous guidance “in the region of 20%,” and the subdued progress looks set to continue with the company also missing on expectations into FY19. Same store sales growth was below expectations in the two biggest markets – ANZ & Europe – both guided to 6-8% for FY18 but Domino’s only managed 4.5% & 5.7% respectively.

Key to the commentary was FY19 EBIT guided to $227m – $247m, while consensus was looking for $251.7m next year = about a 6% miss to the middle of the range.

Domino’s Pizza (DMP) Chart

OUR CALLS

No trades across the MM Portfolios today, however we continue to monitor ORE and JHG s potential sells.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here