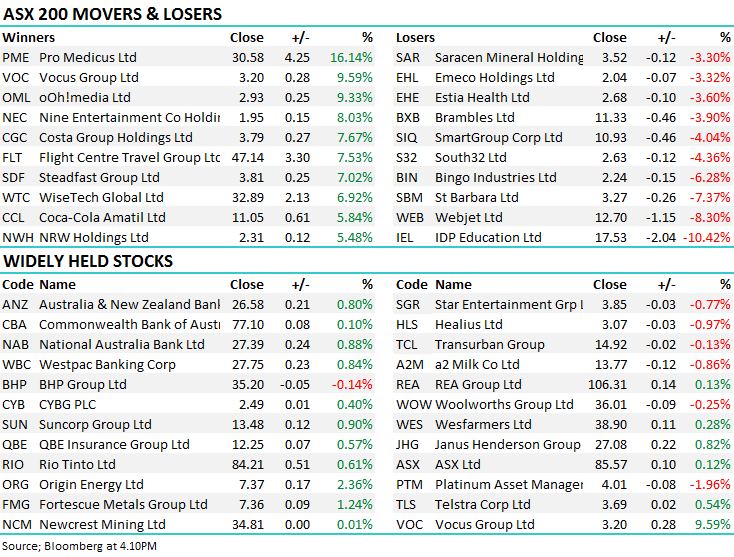

Reporting peaking today with over 30 companies out with results (BIN, Z1P, PPT, VOC, FLT, QAN, WEB, COL)

WHAT MATTERED TODAY

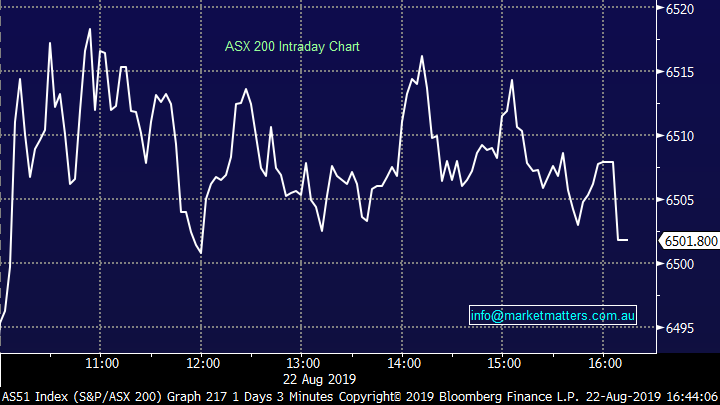

Less volatility at the index level today with the market opening higher before trading in a tight range throughout the session. A huge volume of company reports dominated my day / + a lot of others by the look of the overall market and I’ll run through the main ones that caught my eye below. It continues to be a fairly tough reporting environment in Australia with downgrades significantly outnumbering upgrades by the biggest margin since the GFC.

A quick look at today’s results that caught my eye: BIN, PPT, FLT, VOC, QAN…

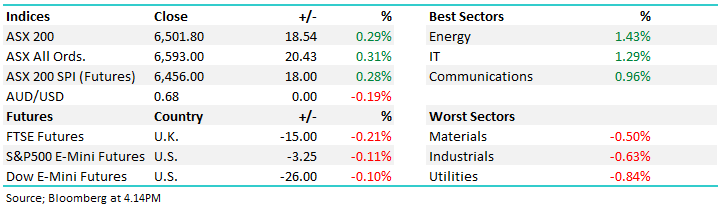

At a sector level today, the Energy stocks performed well thanks to a better than expected result from Santos (STO) while the more defensive utilities struggled. Asian markets were generally weaker today, but not materially so while US Futures were slightly in the red during our time zone. Iron Ore in Asia was better snapping the recent aggressive sell off we’ve seen… Iron Ore off futures +1.60% on the day.

Overall, the ASX 200 added +18pts today or +0.29% to 6501. Dow Futures are now trading down -19pts /-0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks today: The table below looks at the share price performance of those companies that reported today. Flight Centre (FLT) which we have in the income portfolio a standout, Bingo (BIN) a good read on first pass however underlying weakness obvious, Vocus (VOC) did better than mkt feared given potential acquirers had walked, and walked quickly while an off market buy-back supported the price of QAN…more insight below

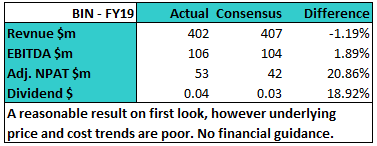

Bingo (BIN) –6.28%; Reported FY19 results this morning that looked above expectations on first read through however digging deeper, some of the trends were less pleasing. EBITDA was $106.1m v $104m expected while NPAT was $53.2m versus $42m expected however worth noting they got a one off $7.5m tax benefit.

The underlying BIN business produced underlying EBITDA which was flat on last year while DADI added $13.6m . EBITDA margins were a focus point and they took a hit with group margins down from 30.8% to 26.4%. No financial guidance was provided, this will be provided at their AGM on 13 November which I think is the reason to remain cautious the stock for now. The market has a very wide range of expectations on BIN earnings ranging from $142m to 183m for FY20 at the EBITDA line.

The issue, and this was a focus on the conference call, is whether or not the price rises they started to push through on the 1st July have had an impact on volumes. They say they are ‘comfortable’ with the outcomes on average, however worth noting that the lower hanging fruit would have been targeted first and they may not be as comfortable come November. The other headwind, and this is well known, is the slowdown in residential construction, particularly multi dwelling construction and BIN have talked often about this. They say a pickup in infrastructure development will more than offset the decline in resi however they also called out some delays in the infrastructure pipeline between approvals and activity.

While we like the longer term thematics behind BIN, there are a lot of moving parts and given its trading on 22x projected earnings, it’s still a buy the weakness type scenario nearer $2.

Bingo (BIN) Chart

Zip Co (Z1P) -4.17%; Reported FY19 results to the market this morning although there’s not a lot of new information here given Z1P release quarterlies. Growth rates always a focus in terms of transaction value & customer numbers - TV for FY19 was $1.128bn up 107% on FY18 while net customers increased by ~590k during FY19 bringing the total to 1.3m+, big numbers. Cash EBITDA has been pre-released at $9.2m with the company now generating positive free cash flow. The market liked the numbers early with the stock up +5% early, however talk on the conference call about further investment for growth etc prompted some selling.

Earlier in the week they also announced the acquisition of PartPay which is a NZ based credit and merchant platform which also holds stakes in a number of other businesses around the world including QuadPay in the USA, a UK business and a South African business. This now means that Z1P has a tech platform for multiple products globally via: zipPay (account/wallet based instalment and credit product), zipMoney (interest free product), PartPay platform (BNPL via 4 installments), PocketBook (personal financial management) and with further products likely.

While we like the story, this is a buy weakness sort of scenario.

ZiP Co (Z1P) Chart

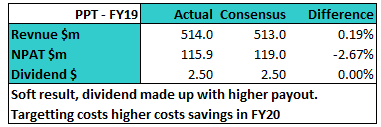

Perpetual (PPT) –1.18%: Reported full year results that were inline / slight miss this morning however there wasn’t a lot of optimism built into the market. They provided no guidance but said cost savings of $18-23m were being targeted in FY20. Current consensus was for earnings to be flat YoY as challenging conditions continue. Early weakness was bought and while the results were hardly inspiring, its inexpensive for a business that can do better in a consolidating wealth space.

Perpetual (PPT) Chart

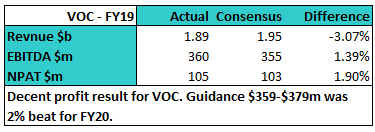

Vocus (VOC) +9.59%: A better result on all metrics with FY19 earnings meeting / beating expectations while guidance was also better than the street. While VOC remains fairly heavily geared, and a bevy of suitors have looked under the hood and left in a matter of days, the struggling Telco guided for better FY20 earnings saying EBITDA would be in the range $359-$379m versus current expectations of $363m…hard to like the stock but a beat none-the-less. Technically looks bullish…

Vocus (VOC) Chart

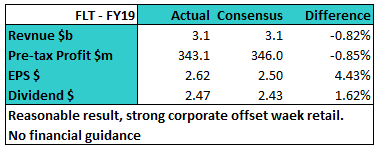

Flight Centre (FLT) +7.53%: Was one of the best performers in the ASX200 today, trading around 10% higher in the session thanks to a solid full year report. The key line for Flight Centre is the pre-tax profit number which was right in the middle of guidance and met expectations. The result was driven by an 8.8% lift in total transaction volume despite a low number of sales staff. The leisure market has been under pressure over recent years and TTV was flat again for FY19, however the company is continuing to shut, re-brand or re-locate stores in an effort to reduce costs. The Australian business saw PBT down 30% as a result of the subdued trading conditions, however growth in the Americas offset much of the fall. Corporate travel has also been a growth driver for Flight Centre with a number of recent acquisitions in the space, contributing to nearly 40% of profit at the result. We continue to like FLT and hold it in the income portfolio

Flight Centre (FLT) Chart

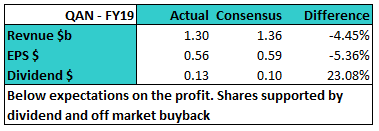

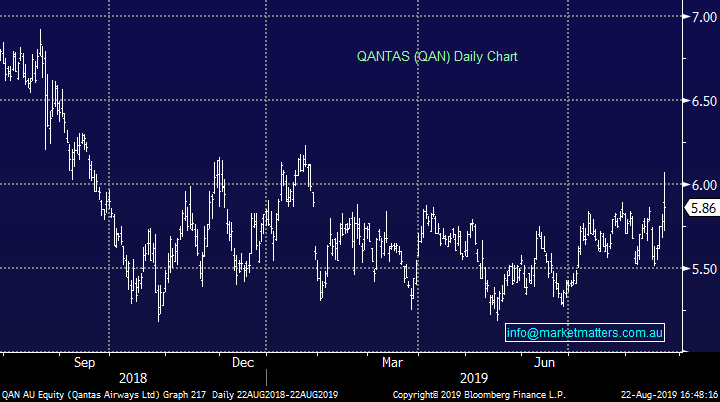

Qantas (QAN) +1.38%; The flying kangaroo missed on a profit line – however the market was ready for this given increasing fuel prices and a currency headwind impacting the result. Outlook was mixed with domestic travel facing pressure while international is stronger but offset by a weaker currency. The outlook did include a better fuel hedge for FY20 that will drop straight to the bottom line.

Buy backs have supported Qantas over the past few years but the company went with a different approach this time around by launching and off-market buy back allowing holders to reap a tax benefit through a big dividend component – I’ll touch on the metrics of this in a note soon. An ok result but earnings look to be back peddling.

Qantas (QAN) Chart

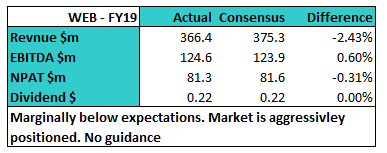

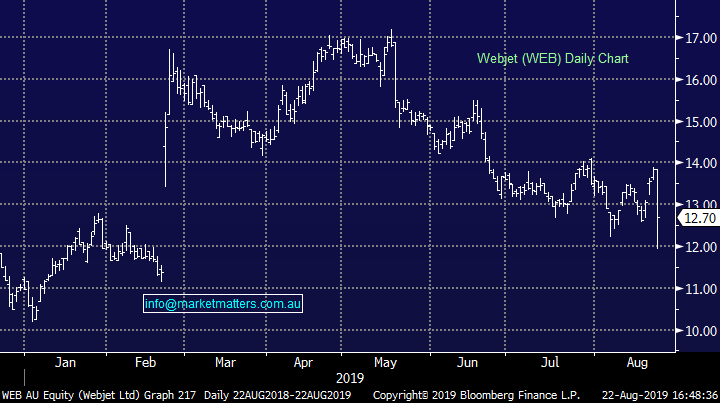

Webjet (WEB) –8.30%; Struggled post reporting today. EBITDA met guidance of over $120m with WebBeds the driver of growth. They downgraded Thomas Cook (again) with the outlook continuing to look bleak for the partnership while various other global events had impacted travel. FY20 appears to have started strong with the hotel bookings continuing its strong growth. We prefer Flight Centre (FLT)

Webjet (WEB) Chart

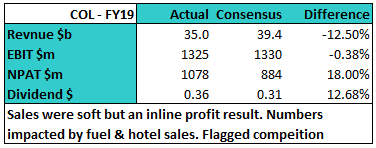

Coles (COL) +2.11%; the supermarket group reported its maiden set of accounts since going out on its own. Expectations varied widely for the result but the company managed to broadly beat. Investors were also rewarded with a special dividend which seems to be the all the rage this season. Revenue grew 3.1% after stripping out hotels (sold) & fuel (new agreement with Viva). In terms of outlook, Coles pointed to its Little Shop 2 campaign as driving strong engagement, however no particulars were given. The better dividend drove todays gain

Coles (COL) Chart

Broker moves;

- Spark NZ Upgraded to Outperform at Forsyth Barr; PT NZ$4.55

- NZ Refining Upgraded to Neutral at Forsyth Barr; PT NZ$2.15

- Select Harvests Upgraded to Buy at UBS; PT A$9.10

- Brambles Downgraded to Neutral at UBS; PT A$12.10

- Brambles Upgraded to Hold at Morningstar

- Brambles Downgraded to Underperform at Credit Suisse; PT A$11.20

- St Barbara Downgraded to Sell at Citi; PT A$3

- Stockland Downgraded to Neutral at Macquarie; PT A$4.34

- Stockland Downgraded to Sell at Morningstar

- Carsales.com Downgraded to Neutral at Macquarie; PT A$15.80

- GWA Group Upgraded to Hold at Morningstar

- Orora Upgraded to Hold at Morningstar

- Blackmores Downgraded to Hold at Morningstar

- A2 Milk Co Downgraded to Underweight at JPMorgan; PT NZ$13.50

- Steadfast Upgraded to Overweight at JPMorgan; PT A$3.90

- Nearmap Upgraded to Outperform at RBC; PT A$4

- WiseTech Upgraded to Positive at Evans & Partners; PT A$35.59

- Charter Hall Retail Raised to Hold at Moelis & Company

- Johns Lyng Reinstated at Bell Potter With Buy; PT A$1.70

- Domino’s Pizza Enterprises Raised to Neutral at Credit Suisse

- Iluka Downgraded to Hold at Shaw and Partners; PT A$10

- Bapcor Downgraded to Hold at Morgans Financial; PT A$6.98

- CYBG Upgraded to Outperform at Exane; PT 1.95 Pounds

- Emeco Downgraded to Accumulate at Hartleys Ltd; PT A$2.38

- Virtus Health Downgraded to Equal-weight at Morgan Stanley

- BHP Group PLC Raised to Hold at SBG Securities; PT 19.10 Pounds

- APN Industria REIT Raised to Positive at Evans & Partners

OUR CALLS

No trades today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.