The Match Out: ASX hits new all-time high amid a flurry of earnings reports

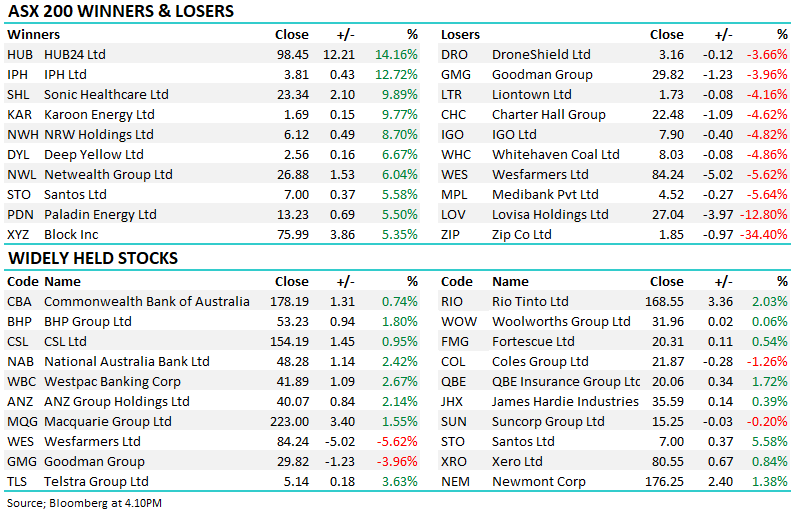

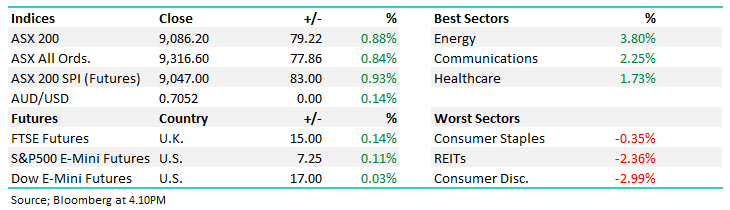

The ASX rallied today, hitting a new all-time high at 9118 (+3pts above the Oct high) before tapering off into the afternoon. Still, its longest winning streak in more than a month, corresponding with one of the busiest days on the reporting calendar. More beats than misses, and solid overall, but still a few landmines to navigate.