What Matters Today: Three Companies that missed the mark, but has the market hit them too hard?

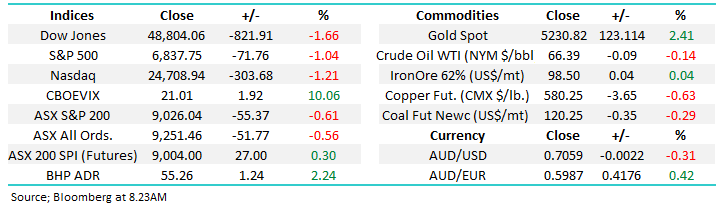

The ASX200 wobbled on Monday, as was largely expected, following Trump's tariff tantrum over the weekend, which created uncertainty around US trade policy. The local bourse slipped 0.6%, with over 70% of the main board retreating, but another strong session from the miners stemmed the losses, with heavyweight BHP again posting a fresh all-time high, closing up +19% year-to-date.