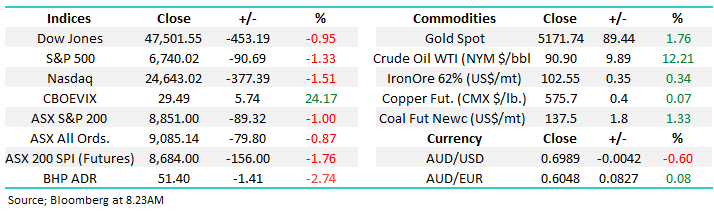

A brutal day across markets, the worst since 2020, with the ASX200 whacked 3.7%, Small Caps hit 4.5%, Japanese stocks down over 10%, with 99% of the main board in Australia closing lower (i.e. 2 stocks out of 200 finished up)! Our market started on the back foot but as Asian markets struggled and US Futures continued lower (Nasdaq Futures down 5.5% at our close), there was no reason to stand in front of the momentum – the index closing only ~15 points above its nadir. This is a headline-grabbing day, and taken in isolation, it’s a big move by the market, however, the magnitude is at least partially a product of just how strong the market has been, hitting a new record high at 8148 only 3-sessions ago.