Recession confirmed, stocks rally, IOOF tanks

WHAT MATTERED TODAY

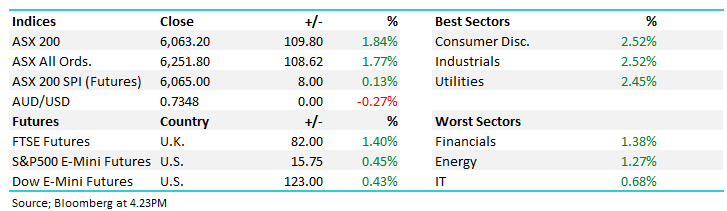

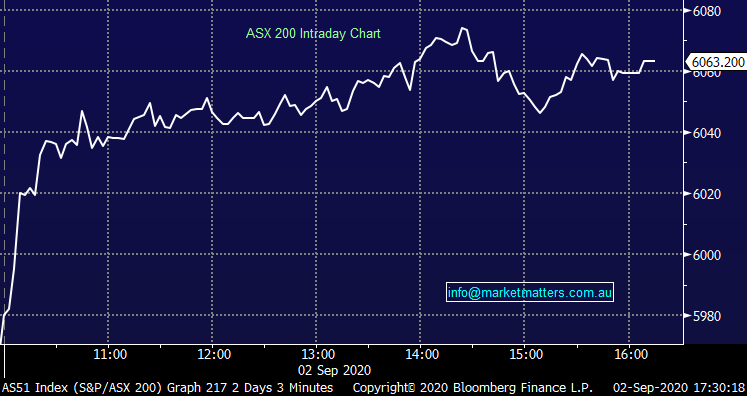

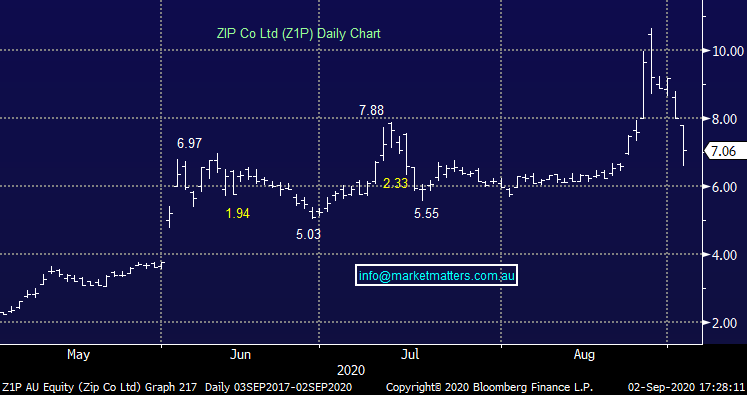

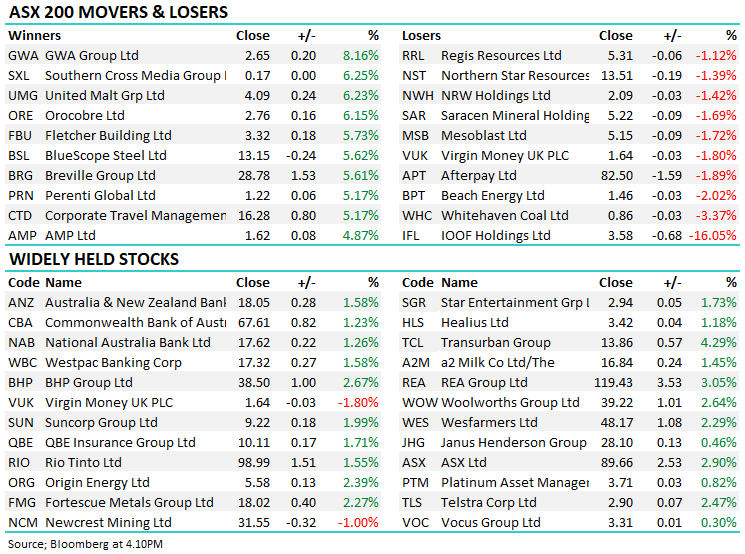

86% of the ASX200 closed in the green today with more than 10% of the index gaining more than 4%, while only 1 stock (IFL) lost more than that amount, clearly a very bullish day led out of the blocks by strength in the mining stocks, although the retailers and the broader industrials joined the party with some vigour. Futures were pointing to a 23pt gain early, they opened a bit better however really ripped higher in the first hour of trade coinciding with a drop in the Aussie Dollar back the 73.5c thanks to a weaker than expected GDP data at 11.30am. GDP for April-June plunged 7% from the first three months of the year, the largest fall in records dating back to 1959.

Asian markets were fairly subdued today (again), while US Futures supported out strength, edging higher throughout out time zone.

By the close, the ASX 200 was up 109pts / +1.84% to 6063. Dow Futures are trading down -73pts / -0.26%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

IOOF (IFL) -16.05%: First day back trading today after the announcement of the MLC acquisition and equity raise split between a placement & entitlement offer that netted IFL $734m. The raise was pretty well supported with 92% of eligible holders taking it up. The first day back after such a significant event is always going to be big but I’m a little surprised at how weak the shares were particularly given rumours that the deal was well supported. The raise price is $3.50 but doesn’t include the 11.5c fully franked dividend, today the stock closed at $3.58 on big volume. We flagged $3.80 as a level we like the stock, and that’s the case, however patience required here, the volume was huge today, nearly 25m shares and it was all one way traffic. We’re keen on IFL noting that the acquisition is a huge one with a lot of complexity. For now , we’ll wait and see how the selling unfolds.

IOOF (IFL) Chart

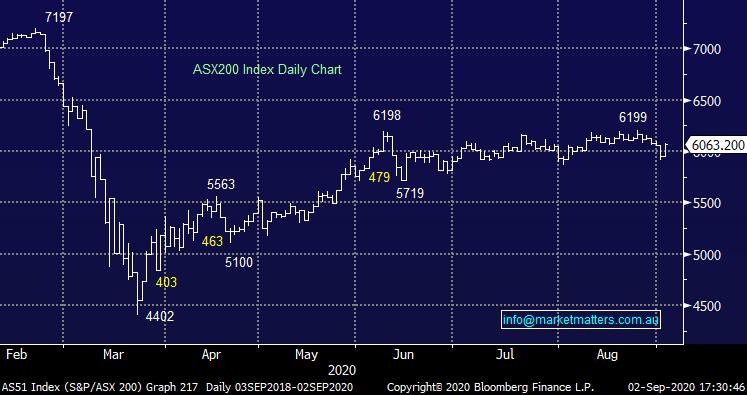

BNPL:A heap of discussion around this space with Z1P down -11%, OPY down -10%, while the rest were down less but they were extremely volatile during the session, Afterpay (APT) for example traded down to a low of $73.68 before finishing at $82.50. No doubt a lot of subscribers wondering what is going on, so here’s my take, and it’s a simple one stolen from a pretty savvy client who has done very well out of Zip Co (Z1P) & Kogan (KGN) for that matter.

He’s a farmer, doesn’t look at things intra-day – can go days without checking in but has a good insight into stocks that are growing. He only just caught up with the news that Z1P had done a deal with eBay, and the stock rallied 27% on the day, before being hit by the same magnitude following PayPals entry into the space. Firstly, no one has a crystal ball, we don’t nor does my good mate the farmer, and trying to value these stocks is incredibly hard – we all agree on that - however what I take away from his questions to me today, is that daily noise is irrelevant. He simply asked whether or not anything had changed financially in terms of funding, or bad debts and further to that whether we knew how many customers ebay would add and how many PayPal would take away? I couldn’t really answer it with any degree of certainty. His first reaction was that ebay has done a deal with them because they have a good product and competition is increasing because they’re onto a good thing, and he bought a few more. Simple approach, but sometimes the KISS principle is what’s required.

At MM, we have a small holding in Zip Co (Z1P), 3% of the growth portfolio, we’re up on the position, we were up more a few days ago however its one I think we should hold onto for now given the growth outlook remains strong, but don’t be fooled, we don’t know what tomorrow will bring and the moves over the past week have simply been huge on both sides of the tape.

Z1P Co (Z1P) Chart

Western Areas (WSA) +4.13%: A good update from WSA today with a major reserve addition to the Odysseus project …more resource = more project value hence the stock pop. The project is on track for first prodn/$$ in CY2022 while at the same time the nickel price is building nicely, tracking copper higher, although Australian nickel equities since early July have lagged. A topic I’ll talk

Western Areas (WSA) Chart

BROKER MOVES

- CSL Raised to Hold at Morningstar

- Blackmores Raised to Buy at Morningstar

- Sims Raised to Buy at Morningstar

OUR CALLS

No changes today

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.