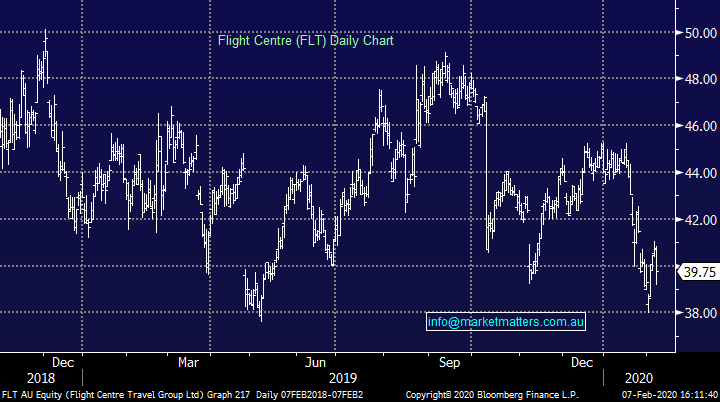

REA reports a 14% drop in local listings (REA, FLT)

WHAT MATTERED TODAY

A weaker session to end the week although it’s been a very interesting 5 days in the market. The week started on the backfoot coming off a major selloff in the states last Friday as the Coronavirus stepped up, however that proved to be a buy day and the market has rallied since then. US markets have been stronger than our own while Chinese stocks held up well considering the obvious negative influences, the PBOC certainly playing a roll there. As it stands, the death toll sits at an unfortunate 636 people with more than 31,000 cases recorded.

Asian markets were higher today again, all less than 1% however higher none-the-less, US Futures a shade lower during our time zone.

Reporting season kicking up locally with a reporting schedule available: CLICK HERE

Monday, we have reports from AMC, AZJ, GPT, JBH. Today we saw REA, which Harry covers below.

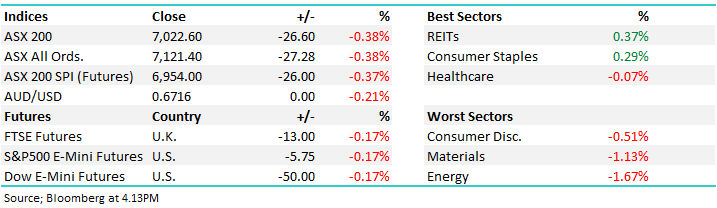

Overall, the ASX 200 closed down -26pts or -0.38% today to 7022, Dow Futures are trading down -50pts/-0.17%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

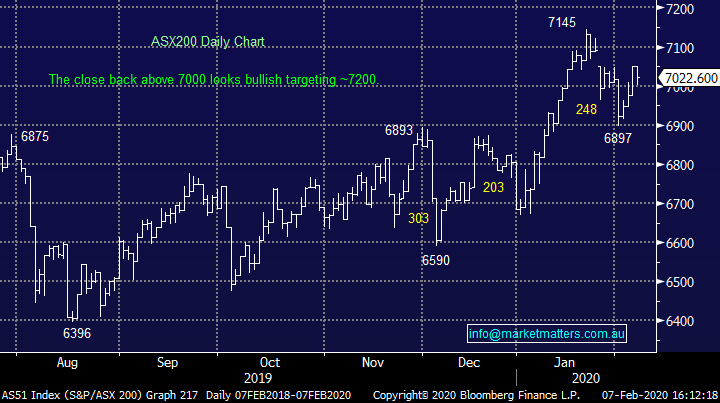

REA Group (REA) +3.1%; closed higher today despite what was on most accounts a difficult first half. Trading on a huge 40x earnings, REA saw profit fall 13% to $152.9m in the first half of the year, around 6% below consensus data, on a decline in listings weighing on earnings. The company noted residential listing were down 14% in Australia, while the company managed to generate earnings in the smaller geographies of Asia and North America. REA pointed to growth in their premium products in painting a rosy picture for the second half, with the market appearing to bank on a swift property market recovery and volumes to return with the share price trading higher by day’s end despite the weak result.

REA Group (REA) Chart

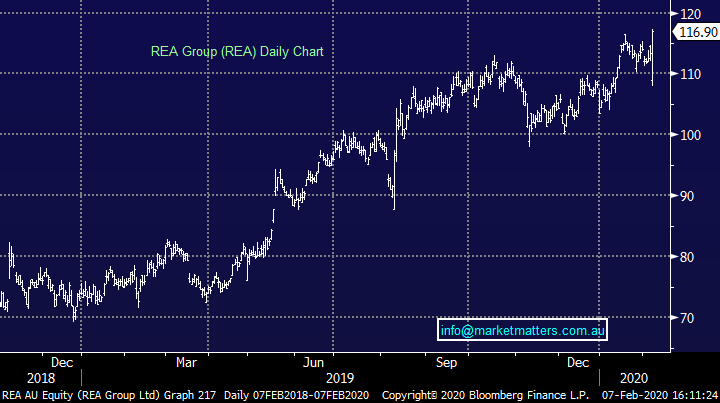

Flight Centre (FLT) -2.38%: briefly halted trading mid-afternoon today to update the market ahead of their 1st half result talking up the first 6 months of the year but pouring cold water on full year guidance as the coronavirus impacts travel. the company expects first half to come in slightly ahead of the midpoint of profit before tax (PBT) guidance of $90m-$110m in the first half. MD Graham Turner also talked down the full year guidance of $310m-$350m, although he stopped short of putting a figure on its impacting, saying it was too early to tell the full extent of the issue. Flight Centre have a small corporate travel segment in China, Singapore and Malaysia which makes up just 2.5% of total transaction volume, however the impact will likely spread to corporate and leisure bookings across the company’s wider geographies. FLT expect TTV to increase over 11% globally to reach a record $12.4B for the group in the first half.

Flight Centre (FLT) Chart

Sectors this week:

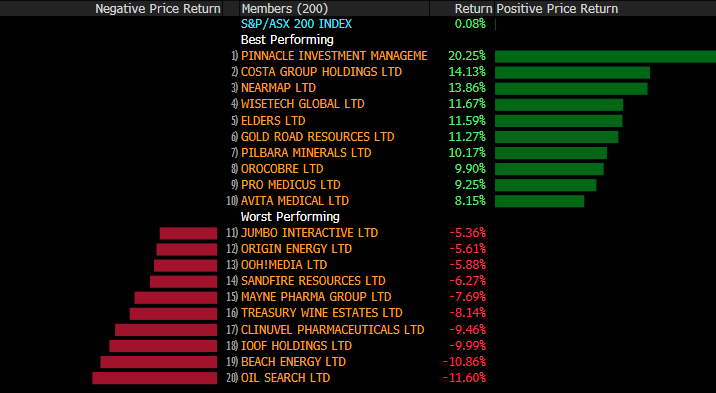

Stocks this week:

BROKER MOVES;

· IGO Cut to Sell at Morningstar

· Computershare Cut to Hold at Morningstar

· Pendal Group Cut to Sell at Morningstar

· Coles Group Raised to Neutral at Credit Suisse; PT A$16

· Coles Group Cut to Reduce at Morgans Financial Limited

· Perenti Global Raised to Buy at Argonaut Securities; PT A$1.95

· Mirvac Group Cut to Equal- Weight at Morgan Stanley

· SKC NZ Raised to Positive at Evans & Partners Pty Ltd

OUR CALLS

No changes to the portfolios today.

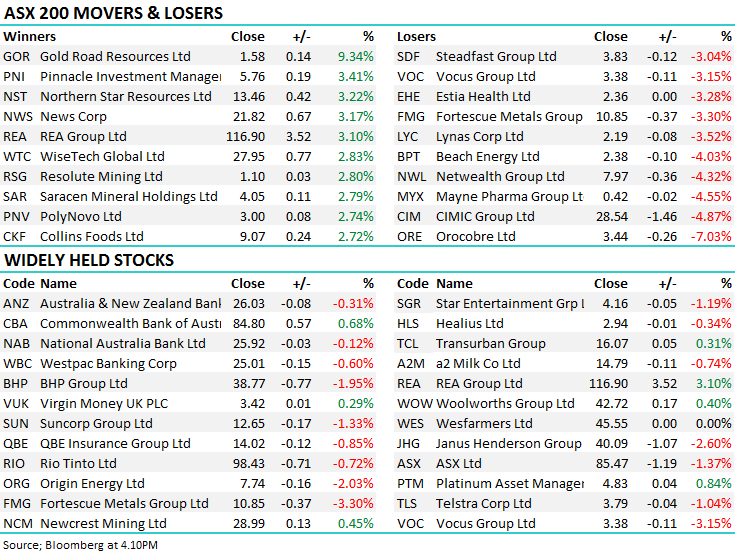

Major Movers Today

Have a great Weekend all

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.