RBA still banging the lower for longer call on rates

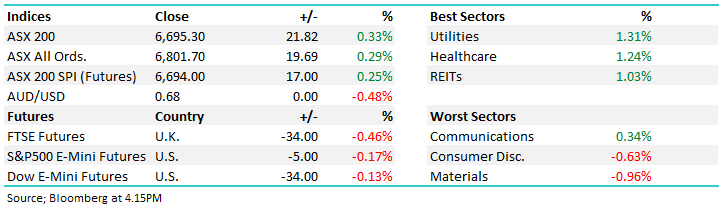

WHAT MATTERED TODAY

The RBA minutes moved the market today, or more specifically, put pressure on the AUD which made our market more appealing from an international perspective. Decent buying in the SPI Futures after the minutes were released at 11.30am saw the index trek up +45pts from the daily lows to close near the session highs. More on the minutes below.

Energy stocks were higher again today, although less so than yesterday while the more defensive ‘yield trade’ was back in favour, Utilities, Healthcare & Real-Estate the three best sectors on the ASX today. While one day is largely irrelevant, this does fit the theme we wrote about this morning when suggesting that for now we believe the rally in bonds yields is a move to fade rather than a dramatic change of trend.

Across the desk today we saw some meaningful buyers in the names like Transurban (TCL) who benefit from lower bond yields while decent sellers were around in areas like Suncorp (SUN) who have enjoyed the short term bounce in yields…buying TCL, selling SUN is an example of a trade fading the recent move in the bond market. (TCL and other infrastructure stocks like lower yields, SUN and other insurers / financials like higher yields)

Overall, the ASX 200 was up +21pts today or 0.33% to 6695, Dow Futures are now trading down -33pts/-0.12%.

ASX 200 Chart - ramp up on the close again – market put on +13pts in the match again

ASX 200 Chart

CATCHING OUR EYE;

RBA Minutes: Some key points from the minutes released at 11.30am today….

1. The RBA sees an extended period of low rates

2. Wage growth remains subdued and forward looking indicators appear weak

3. House prices could move meaningfully higher given a lack of new construction and a ‘meaningfully weak outlook’.

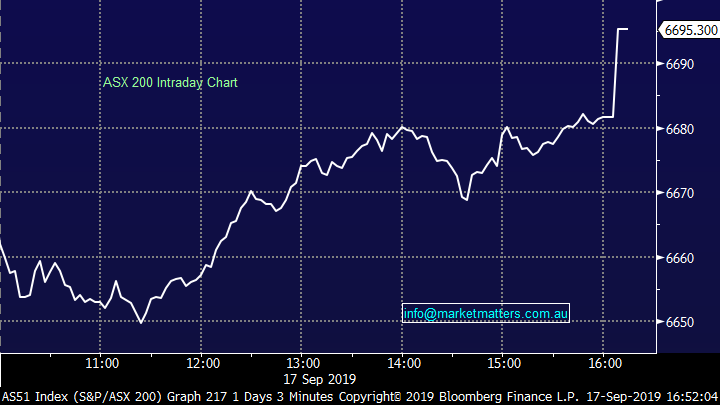

4. Since the two rate cuts and an easing of lending restrictions, property prices in Sydney and Melbourne have rallied – the below chart from Bloomberg shows that trend nicely

House Prices Chart

5. This however, has not flowed through to any meaningful strength in retail sales.

6. Household debt remains at record highs

The Aussie Dollar fell away after the minutes were released and that was enough to spur some reasonable buying in equities. Rates lower for longer the obvious takeaway.

AUD/ USD Chart

New Hope (NHC) –2.45%; the coal producer saw profits surge in FY19 thanks to a 21% increase in tonnes sold dropping down to an adjusted NPAT level of $211m, up 41% on FY18. Despite the big uplift, the result was below expectations with the bulk or the increase being attributed to New Hope taking an additional 40% stake in the Bengalla mine.

The outlook statements were not overly exciting either, with thermal coal continuing to see pressure and little progress seem in the approval process for their Acland mine. We remain wary of coal names, although we do hole Whitehaven in the income portfolio given its strong yield outlook and general market negativity surrounding the stock.

NewHope Coal (NHC) Chart

BROKER MOVES

- ADH AU: Adairs Upgraded to Buy at Baillieu Ltd; PT A$2.24

- DXS AU: Dexus Reinstated at Credit Suisse With Neutral; PT A$12.20

- MND AU: Monadelphous Raised to Buy at Baillieu Ltd; Price Target A$17.50

- NPH NZ: Napier Port Rated New Hold at Deutsche Bank; PT NZ$2.90;; Rated New Neutral at Goldman; PT NZ$3.03

- OGC AU: OceanaGold GDRs Raised to Outperform at Credit Suisse; PT A$4.25

- STO AU: Santos Downgraded to Hold at Morningstar

- SGM AU: Sims Metal Upgraded to Hold at Morningstar

- SDF AU: Steadfast Upgraded to Hold at Morningstar

- TLS AU: Telstra Downgraded to Hold at HSBC; PT A$3.90

OUR CALLS

No changes today

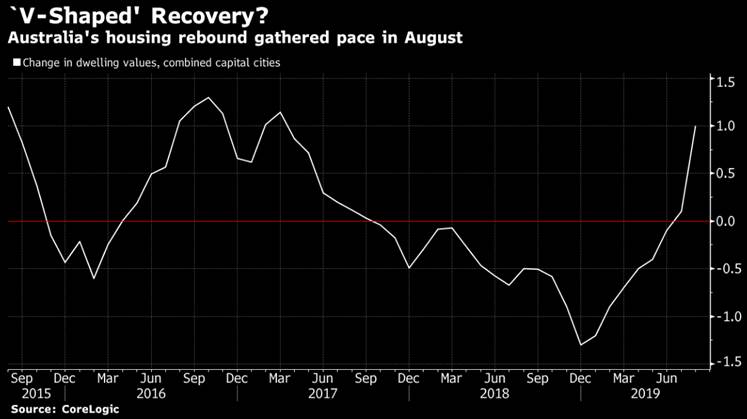

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.