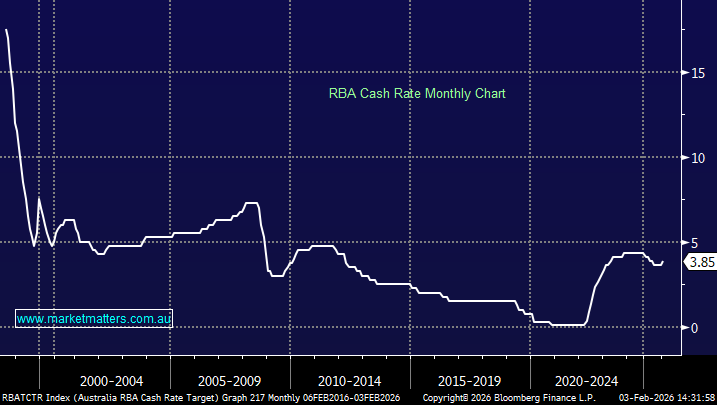

RBA has raised the cash rate to 3.85% – the first hike since 2023.

The RBA hiked interest rates 0.25% this afternoon, for the first time since 2023, a move that was largely expected with growth and inflation running ahead of the central banks expectations. The vote was unanimous with another priced into bond markets for later in the year.

The RBA bank now expects the headline inflation rate to peak above 4% in June 2027, up from its previous November forecast of 3.7 per cent in what it described as a “materially higher” revision of inflation. Not good news for mortgage holders:

- “The Board is focused on its mandate to deliver price stability and full employment and will do what it considers necessary to achieve that outcome.”

The initial hike took the shine off the ASX taking the days gain at 2.45pm back to +0.7%, while at the same time the $A jumped back above 70c and the bonds drifted lower (yields higher).