RBA cuts rates to historical lows – more to come

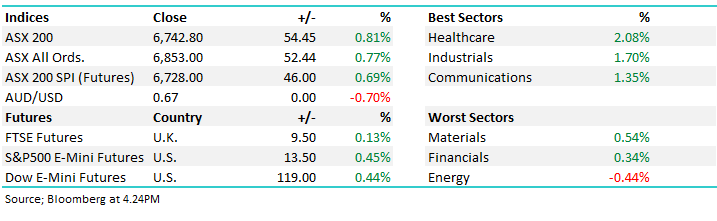

WHAT MATTERED TODAY

An interesting session locally with the RBA front and centre cutting rates as expected to 0.75% at 2.30pm this afternoon, the lowest level in history and enough to spur a sell-off in the currency and a rally in equities. Yesterday afternoon we saw a sell-off late in the day, end of month / end of quarter book squaring saw the index trade -50pts from the session highs while today we saw the opposite play out, the index rallied +50pts from the lows as the Aussie Dollar tested the 67c handle.

Australian Dollar Intra-Day

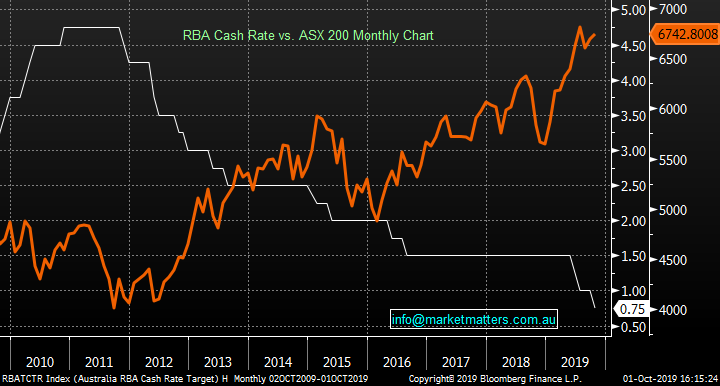

Rate cuts are clearly bullish for asset prices as this longer term chart implies, the white line showing benchmark interest rates while the orange line looks at the ASX 200.

RBA Cash Rate versus ASX 200

Also important today was the statement attached to the cut and this was as per programmed, with another 0.25% reduction likely, taking benchmark rates to just 0.50%. Hard to comprehend but here we are and from the tone of the statement, its seems the lower for longer call has merit.

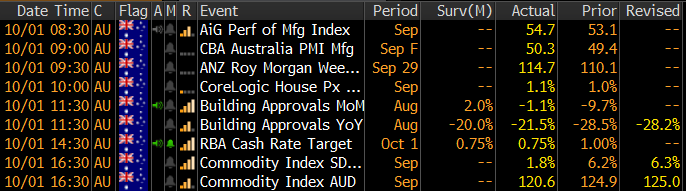

Somewhat justifying today’s cut we also saw weaker than expected building approvals down -1.1% MoM versus +2% expected while the annual pace of decline (-21.5%) is clearly a concern. So although property prices in Sydney and Melbourne have picked up, a theme the RBA covered, price increases are certainly not yet flowing through to improved construction activity.

Local Data Today

Source: Bloomberg

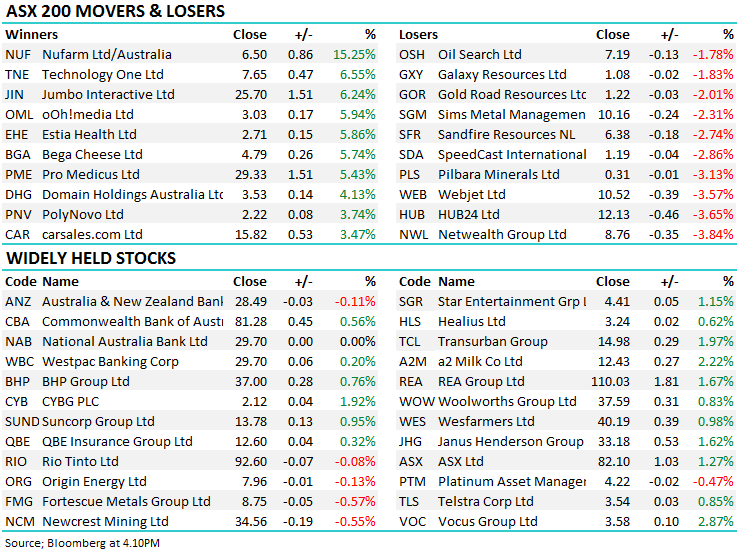

Overall, the ASX 200 added +54pts today or +0.81% to 6742, Dow Futures are trading up +113pts/+0.42%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

STOCKS MOVING: we saw some big moves on the stock front today and the theme we’ve touched on lately between high growth and cyclical value once again becoming obvious. While some growth names were strong, it’s the more traditional names like CAR, CSL, DHG, REA that have attracted buying over and above some of the newer growth stocks like Appen & Afterpay along with the platform providers like Netweath (NWL) and HUB. We’re also seeing some money flow back into beaten up value, Costa (CGC) an example yesterday while Pact Group (PGH) attracted buying today adding +9% from a low base.

Pact Group (PGH) Chart

CORPORATE ACTIVITY: A few stocks were on the bid & raise train today. The first, AMA group looking to take out Suncorp’s Smash Repairs business for $420m, with around half of the cost funded by tapping shareholders. There are a number of synergies between the two car repair businesses and further cements the relationship. New shares have been offered at a 5% discount to last close and the deal is expected to be EPS accretive in the first year.

Kathmandu (KMD) has also dipped into shareholder pockets in search of money to fund a takeover bid at privately owned surf wear company Rip Curl for $350m. the rational is to balance earnings for the company which currently receives the bulk of sales heading into winter. KMD will now hit up investors for around half of the cost of the acquisition while the regulatory approval process takes place…the acquisition should be very accretive from the get go.

BROKER MOVES;

· Nufarm Upgraded to Outperform at Macquarie; PT A$6.56

· Netwealth Cut to Market-weight at Wilsons; Price Target A$8.99

· Collins Foods Downgraded to Market-weight at Wilsons; PT A$8.49

OUR CALLS

No changes today

Major Movers Today

Have a great night

James the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.