RBA cuts growth expectations

WHAT MATTERED TODAY

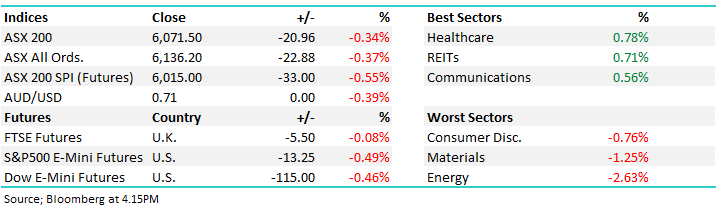

The market pulled back ~21 points today however continued to outperform overseas leads + we saw US Futures down during our time zone. The theme we discussed this morning around “Short SPI Futures / Long S&P spread trade” which seems to be unwinding was obvious again with weakness in US Futures not having the typical negative influence on our market. That could well be a transient thematic however the aggressive about turn by the RBA this week could clearly be a factor.

Today we saw the data that underpinned their change in stance with the RBA cutting official growth and inflation forecasts fairly significantly. In its quarterly update of forecasts, they cut expectations for growth in the year to June 2019 to 2.5% from 3.25% and in the following 12 months to 2.75% from 3.25%. They blame a fall in housing which will impact consumption. They also talk about lower Oil prices which are having a significant impact on inflation along with a range of other factors that have flowed into these forecasts - slowing momentum in China another contributing factor. In short, I think it’s pretty clear the RBA has done a significant about turn and is now more likely to cut rates than increase them - the market has now priced in easing. The AUD dropped to 70.81c today, however while its down, I would have thought that such a harsh re-aligned of forecasts would have led a bigger decline – shows some underlying fortitude in the currency!

While the numbers above are clearly a concern for the health of the Aussie economy, markets / asset prices like lower rates, and combined with bank buying following the RC + Iron Ore prices that have ripped higher due to Vale’s issues, we’re clearly seeing a confluence of 3 very influential factors for our market.

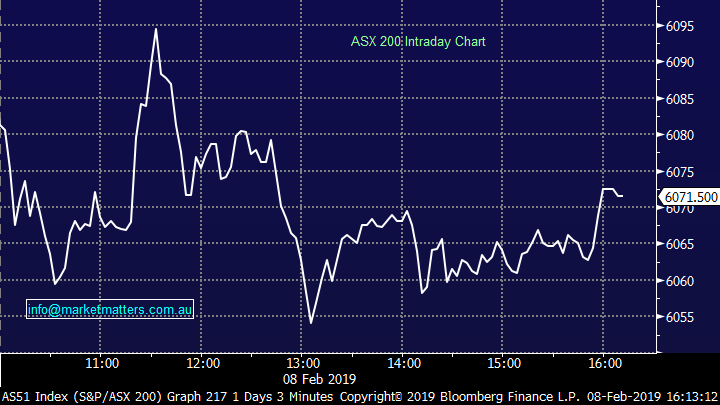

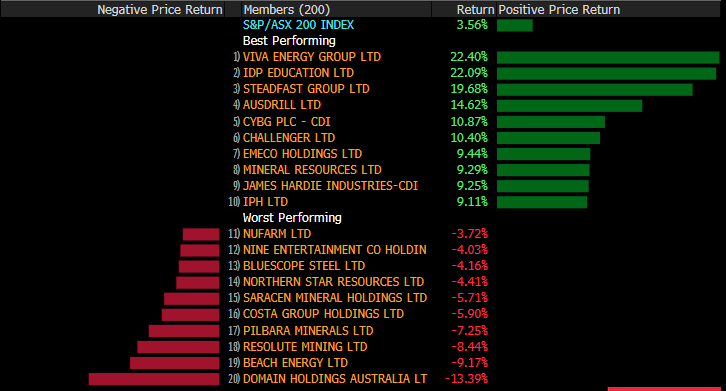

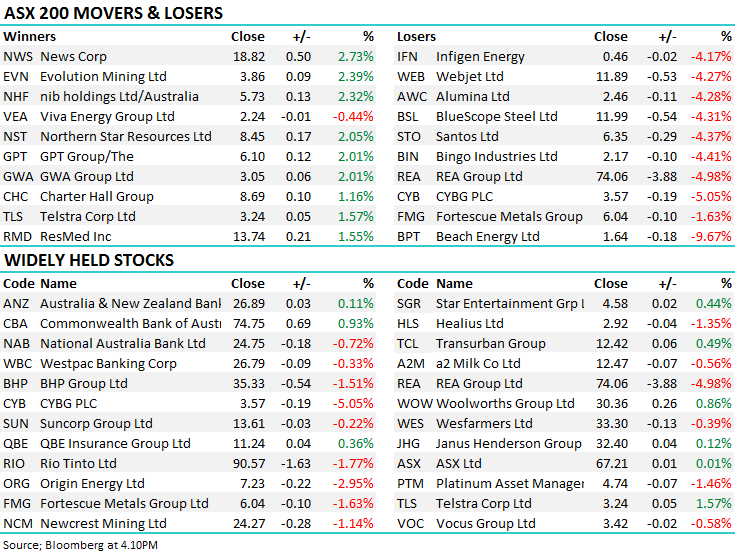

Overall today, the index closed off -21pts or -0.34% today to 6071 and was up an impressive 3.56% for the week. Dow Futures are trading down -110 points / -0.41%.

** Next week reporting really kicks into gear; Monday sees JBH, AMC, BEN, AZJ, COE, ECX, GPT amongst a few others**

ASX 200 Chart

ASX 200 Chart

ON THE BOX

This week I was on Your Money on Tuesday, Wednesday & Thursday mornings at 9am. I’ll do this through February reporting covering results as they fall. Foxtel Channel 601 or free to air 95

I was also involved in two video updates, a quick update with Harry covering the rise in the market, the banks, the easing bias from the RBA and a few other bits and pieces.

…and a recent BUY HOLD SELL for Livewire Markets released this morning and can be viewed below;

At the start of the year, the fundies with the top performing calls on Buy Hold Sell nominated their #1 stock picks for 2019. In today’s Buy Hold Sell, we ask our panellists for a second opinion on three of these stocks, which include a market darling tech stock, an overlooked gold junior that has just had an earnings upgrade and a fallen angel in the agricultural sector. We also ask our panellists for their own #1 pick for the year ahead. Joe Magyer from Lakehouse Capital explains why last year's ASX200 top performer could do it all over again, and James Gerrish from Shaw and Partners singles out another agri stock that could yield a bumper harvest this year. Tune in to hear five of the fundie’s favourites for 2019.

Sectors this week; Broad based gains…

Stocks this week;

Some of the specific events we covered during the week…

Boral downgrades again; the construction materials company suffered on Monday as downgrades continue to flow through. Click here

Commonwealth Bank; A look at Australia’s favourite income stock. Click here

James Hardie fares much better; Boral’s peer is faring much better with a reasonable quarterly update. Click here

The Royal Commission hits; take a look at some of the non-bank names impacted by the final report. Click here

Changes at the top for NAB; NAB lose their CEO & Chair and give a first quarter update. Click here

Viva Energy rebounds; the biggest IPO of 2018 rallied on a new deal signed with Coles (ASX: COL). Click here

IAG Reports; see how the first half went for IAG. Click here

OUR CALLS

No changes to the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/02/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.