Rates on hold as RBA sights an improvement in house prices (WSA, MPL, ORE)

WHAT MATTERED TODAY

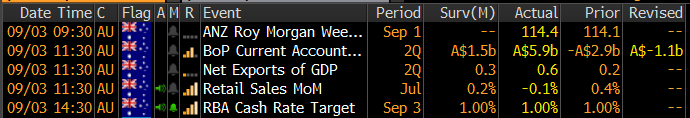

Stocks had a choppy day overall despite closing flat on the session, some large lines in the futures markets seemed the catalyst with the SPI Futures trading in a +/-40pt range before settling unchanged. The RBA rates decision headlined the economic docket today and as expected, they kept rates on hold at 1%, however the commentary key as always.

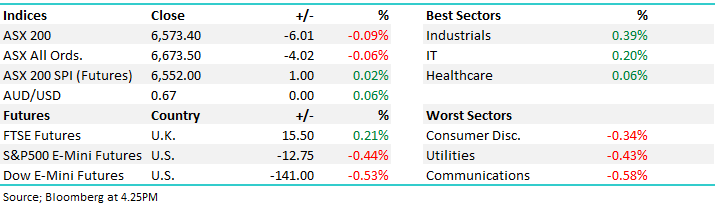

Economic Data Today

Source: Bloomberg

They talked about wanting to see how a combination of interest-rate cuts and tax relief impact the economy sighting the recent strength in Sydney property prices as a positive undertone, they used the phrase “gentle turn” as Governor Lowe predicted last month as showing signs of playing out.

On the other side of the ledger, they sighted the outlook for consumption as the main negative although a “pick-up in growth in household disposable income and a stabilization of the housing market are expected to support spending.”

“It is reasonable to expect that an extended period of low interest rates will be required in Australia,” Lowe said. “The board will continue to monitor developments, including in the labor market, and ease monetary policy further if needed.”

All in all it seems they’re ready to cut if needed however some more positive shoots directly related to housing have started to emerge. The news caused the AUD to trade marginally higher while the market sold off directly after the release.

Overall, the ASX 200 lost -6pts today or -0.09% to 6573, Dow Futures are now trading down -250pts /-0.90%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

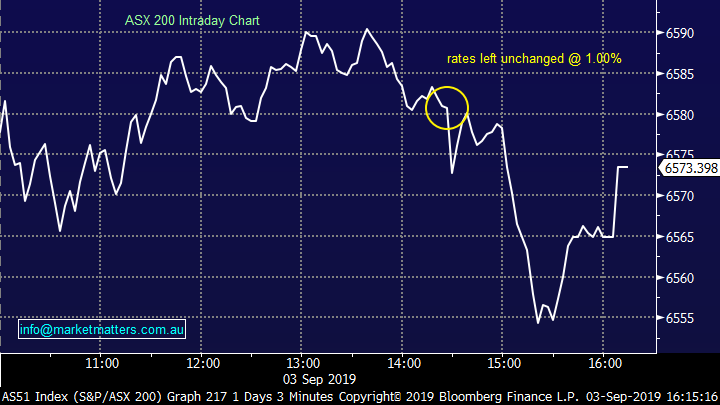

Nickel Again: Ripped for a second straight sessionwith the first bulge bracket broker flinching on higher prices. The Morgan Stanley commodity analyst upgraded the WSA target price more than 40% on the back of a higher underlying commodity deck, and moved the stock a buy equivalent. The upgrade was less significant to Independence Group (IGO) given the gold exposure...MS now joins Shaw and Partners as the most bullish on the stock, both with $3.30 price targets.

Western Areas (WSA) Chart

Medibank Private (MPL) -2.21%; shares were lower for the health insurer on the back of ACCC proceedings kicking off. The company self-reported issues from the ahm Health Insurance brand which saw members have legitimate claims rejected or policies upgraded where there was no additional benefit. The issues relate to less than 1,000 customers out of more than 130,000 ahm members and Medibank has already compensated the more significantly impacted clients. The ACCC proceedings will likely lead to fines or compliance programs but are unlikely to be a significant impost to business for MPL.

The main issue here is that both MPL and NiB Holdings (NHF) have been exceptionally strong post the election and now become susceptible to any setback. We sold NHF into strength above $8, the stock now at $7.06, we’d have interest back around ~$6.60

Medibank (MPL) Chart

Broker moves;

· Atrum Coal Rated New Speculative Hold at Bell Potter; PT A$0.35

· Pushpay Upgraded to Hold at Ord Minnett

· Incitec Upgraded to Buy at Citi; PT Set to A$3.45

· Steadfast Resumed at Macquarie With Outperform; PT A$4.10

· Reliance Worldwide Downgraded to Hold at Morningstar

· Collection House Cut to Reduce at Morgans Financial; PT A$1.09

· Western Areas Upgraded to Overweight at Morgan Stanley

· Huon Aquaculture Cut to Hold at Shaw and Partners; PT A$4.72

· Westpac Upgraded to Outperform at Credit Suisse; PT A$30.55

OUR CALLS

Today we took action to cull a number of underperformers in the MM Growth Portfolio. Adelaide Brighton (ABC) & Orocobre (ORE) were held with 3% weightings and they were sold for a loss, knocking around 1% off portfolio performance for each position. We’ve been looking to cut these positions plus also reduce our weighting to Costa (CGC) over the past week. ABC failed to rally from $3, and today broke through, suggesting lower levels are more likely in the short term.

Orocobre (ORE) has rallied from a $2.18 low to close today at $2.45, however selling into strength started to build throughout the session today, so we cut the holding. Costa (CGC) & Pact Group (PGH) for that matter, have garnered some support into recent weakness, PGH has now rallied from a $2.08 low to close today at $2.50, up +20% while CGC has added +17% from its low. That sort of buying implies that we should be more patient in terms of these stocks.

We also sold Bank of QLD (BOQ) for a small profit. We had originally bought BOQ on the potential for some consolidation amongst the regional banks, however this has now gone quiet. We see earnings risks here as interest rates decline putting pressure on margins at a time when regulatory spend as a proportion of earnings creates a bigger impost for the regionals. While the dividend is attractive, organic growth is sluggish at best.

Orocobre (ORE) Chart

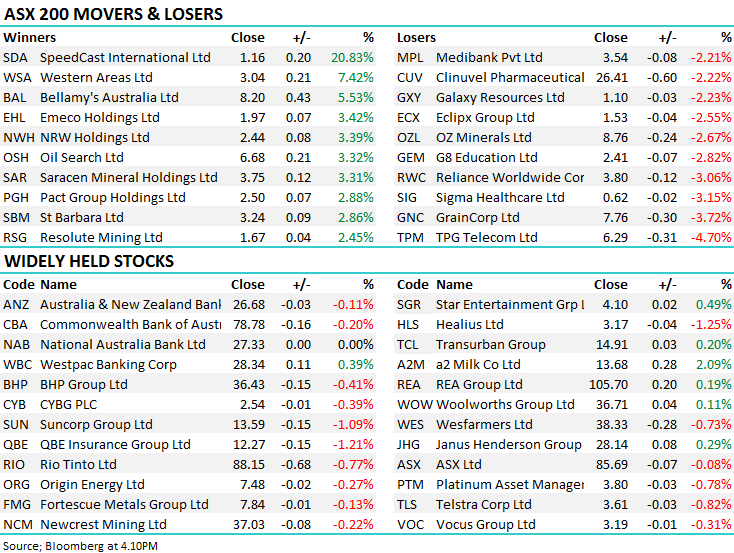

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.