Stock

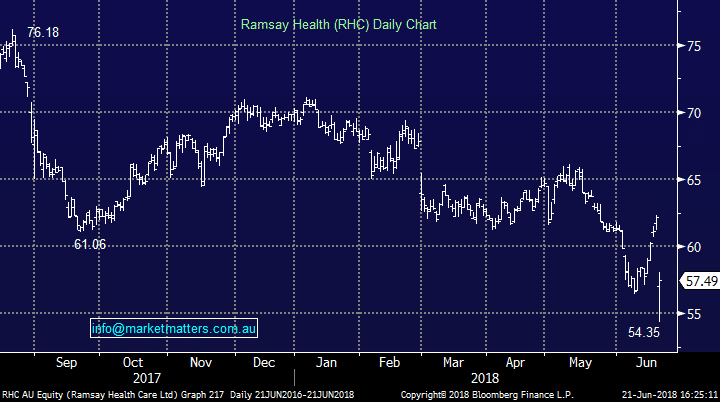

Ramsay Healthcare $57.49 as at 21/6/18

Event

Ramsay made a poor announcement this morning taking a non-cash write down on some UK assets, but more importantly, they amended their FY guidance down from earnings per share (eps) growth of 8-10% to now expecting growth of 7%. The prior guidance implied eps of $2.86 while market consensus was sitting just below that at $2.84. New guidance implies eps of $2.80 for FY 18, still reasonable growth, but clearly the 20+% levels of the past are now harder to come by.

Ramsay Healthcare Earnings versus share price – this is pre-downgraded EPS numbers, however new guidance implies $2.80 on our numbers. Here’s what we wrote back in the start of June….

RHC fell 2.2% yesterday to its lowest level since February 2016 not a great performance by the largest hospital operator in Australia. The company clearly has tailwinds due to the countries ageing population so we question why the much loved stock finds itself down over 28% over the last 2-years. The rising cost of private health insurance is probably the largest single factor with the greatest volume of people ever leaving the private health system last year – as we’ve discussed the average Australian is carrying a large pile of debt and this is one way they can cut back. Other negative factors are also coming through competition from not-for-profit hospitals and general trust in the industry – will the press turn here next after the banking royal commission ends?

RHC is a prime target for EOFY selling and due to the above reasons we have no interest in the stock unless it falls another 8-10%. Ideally we will get some negative news / downgrades moving forward that explains this recent poor performance which may be the catalyst for a low risk / value entry. (today we had the downgrade)

At MM we have been bearish RHC for well over a year targeting the $55 area which is now ~8% away – MM is a buyer of RHC around $55.

Ramsay Healthcare (RHC) Chart

Here’s what we wrote back in the start of June….

RHC fell 2.2% yesterday to its lowest level since February 2016 not a great performance by the largest hospital operator in Australia. The company clearly has tailwinds due to the countries ageing population so we question why the much loved stock finds itself down over 28% over the last 2-years. The rising cost of private health insurance is probably the largest single factor with the greatest volume of people ever leaving the private health system last year – as we’ve discussed the average Australian is carrying a large pile of debt and this is one way they can cut back. Other negative factors are also coming through competition from not-for-profit hospitals and general trust in the industry – will the press turn here next after the banking royal commission ends?

RHC is a prime target for EOFY selling and due to the above reasons we have no interest in the stock unless it falls another 8-10%. Ideally we will get some negative news / downgrades moving forward that explains this recent poor performance which may be the catalyst for a low risk / value entry. (today we had the downgrade)

At MM we have been bearish RHC for well over a year targeting the $55 area which is now ~8% away – MM is a buyer of RHC around $55.

Ramsay Healthcare (RHC) Chart