Quiet above the surface but a few ducks paddling hard below (WSA, EHL)

WHAT MATTERED TODAY

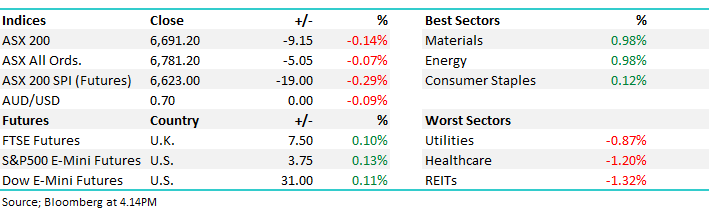

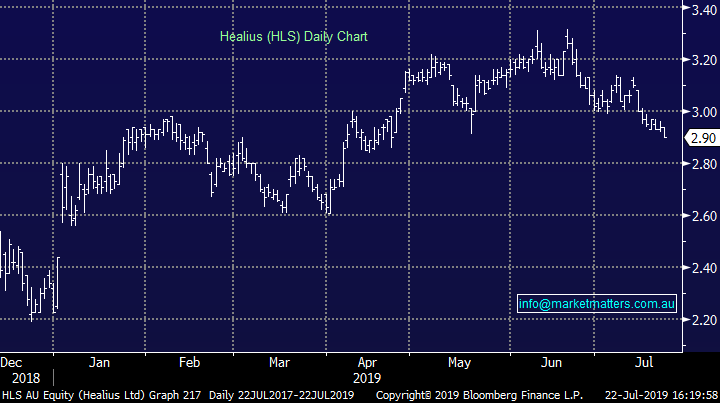

A fairly quiet day at the index level overall (-9pts) with the market peaking +10pts up around lunchtime before the sellers took hold. It looked like a decent portfolio trading out today as some stocks moved a long way in the direction of the intra-day trend, ASX & IVC two obvious examples. At a sector level, materials outperformed thanks to reasonable buying in the Iron Ore miners while Energy stocks enjoyed a higher Oil price on Friday – Whitehaven (WHC) copped a bid adding +2.74% closing at $3.75 after a tough few months.

Around the region, Asian markets were mostly lower while US Futures held marginally higher during our time zone.

Overall, the ASX 200 lost -9pts today or -0.14% to 6691. Dow Futures are trading up +31pts / +0.11%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks moving: while the market closed marginally lower there were some interesting stock moves that played out , particularly across some of the recent market darlings. ASX was hit -4.79% in a sustained sell-off that looked like a large holder simply offering the stock all day, funeral provider Invocare (IVC) was also weak closing down -6.48% - again, it looked a lot like a concerted seller simply hitting the stock for most of the session.

On the flipside, Elders (ELD) was strong again adding another +2.75% to close at $7.46 with retail shareholders sent details today about taking up the 1 for 6.7 non-renounceable entitlement offer which will likely be priced at $5.55 – a big discount to the last traded price making it very attractive for existing retail holders.

Across the MM portfolios today, the move by Emeco (EHL) caught my eye, the stock rallying +3.62% to close at $2.29, with $2.50 the next logical target while Pact Group (PGH) also had an interesting session after a week or two consolidation. Technically that stock looks destined for higher levels.

Emeco (EHL) Chart

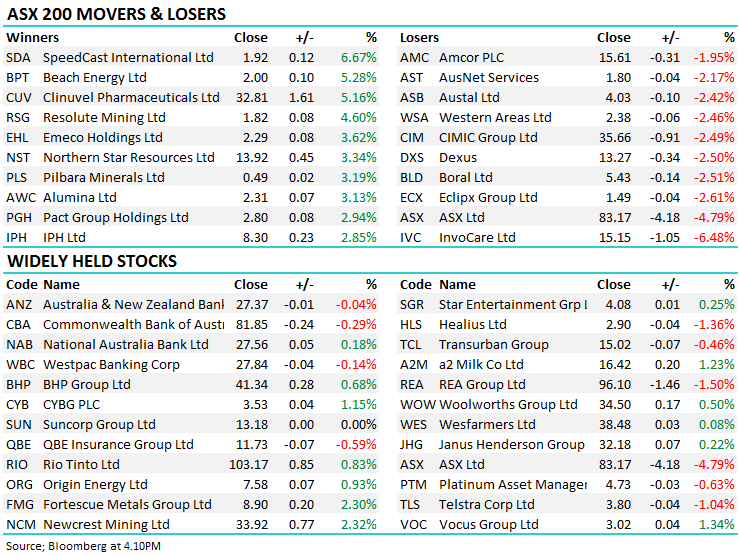

Nickel; Early in the month, nickel looked like it was teetering on the edge again after it slumped sub $US 5.50/lb, however it has since bounced back swiftly to crash through $US 6.50/lb and set a new 12 month high. The move has helped local nickel names Independence Group (IGO) and Western Areas (WSA) trade higher to their own multi-month highs. Indonesia is playing a big part in the rally. One of the world’s biggest nickel ore exporters is currently experiencing severe flooding which has constrained the supply in the market. Stock piles fell to four-weeks on hand as a result of the disruptions, and has also shed light on the potential impact that an Indonesia export ban could have on the market.

The Indonesian Government currently plans to ban unprocessed nickel exports from 2022, forcing miners to export the value-added refined product. Currently only a small portion of miners are prepared for the ban, with much of the supply unlikely to have smelters in pace in time for the cut off. Although the end date remains years away, it has helped the commodity higher in the short term and will potentially have a significant impact on earnings for IGO and WSA in the outer years. Nickel will continue to see increasing demand with steel mills currently running full pelt, and the rise of electronic vehicles set to surge over the next few years. If the average price holds around $US 6.50/lb, WSA could see a 10% uplift in its earnings for the year. We like WSA marginally lower for a small allocation leaving some powder try.

Western Areas (WSA) Chart

Broker moves;

- South32 Upgraded to Add at Morgans Financial; PT A$3.45

- A2 Milk Co Downgraded to Sell at Morningstar

- Fortescue Upgraded to Hold at Morningstar

- Synlait Milk Rated New Hold at Morgans Financial

- Sydney Airport Rated New Neutral at JPMorgan; PT A$7.90

- Western Areas Downgraded to Neutral at Credit Suisse; PT A$2.45

- PWR Holdings Upgraded to Buy at Bell Potter; Price Target A$4.85

OUR CALLS

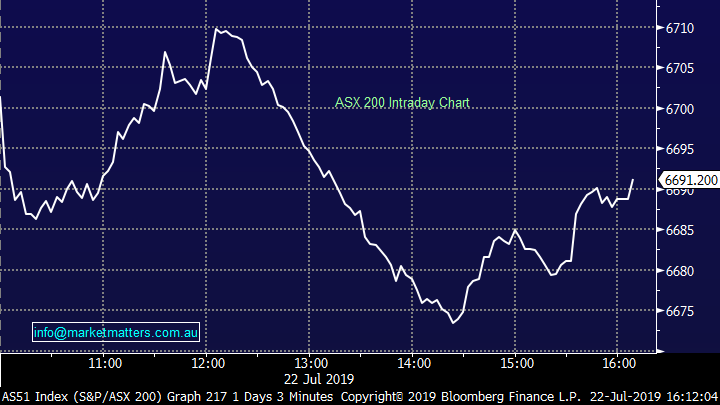

We sold out of Healius (HLS) somewhat reluctantly given the high chance that a bid is still forthcoming, the issue is from what level. Earnings risk in the business ahead of results we think is high, while the share price has remained firm pricing in a takeover. The closer we get to reporting, the less chance there is for a bid to emerge.

Healius (HLS) Chart

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence