Questions from Subscribers – Negative yields, Copper and Indian ETFs

**This is an extract from the Market Matters Morning Report from 16 September. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

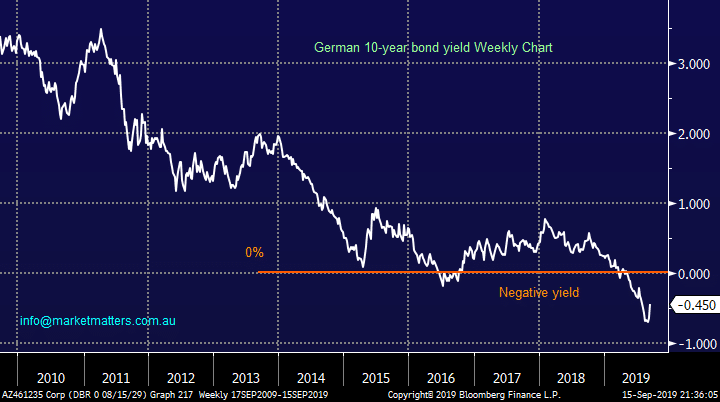

“Hi Guys, great report, I read it religiously every day. I just wondered when another subscriber asked why do fundies buys negative yielding bonds? Why not just hold cash? Do they expect bond yields to fall further and then gain and then sell before the stampede out of bonds? Besides inflation returning, what would cause bonds yields to start rising? A chance of viewpoint by market participants? Leading to rerating of bonds? Seems unlikely.” - Thanks Peter B.

Morning Peter,

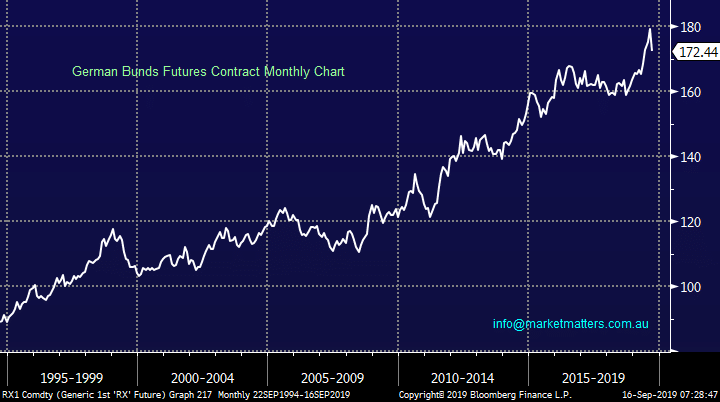

You have part answered your question but like yourself its extremely hard for me to understand somebody buying an asset that is guaranteed to lose money at its maturity. However investment funds simply have to follow their mandates, let’s say 40-50% equities, 30-40% bonds and 5-10% cash mandates are clearly defined so investors know how their hard earned dollars will be deployed thus allowing them to pick the product which best fits their needs, often around the perceived degree of risk.

A fund manager uses his knowledge and expertise to decide how to balance the mix both within say the 3 asset classes used in the example above and then within those assets themselves e.g. do they buy German bunds or US bonds, where’s their respective currencies going etc….the mosaic gets more complicated the deeper you delve.

However in nutshell bonds do offer a degree of safety and they have enjoyed an amazing bull market for decades, investors who thought that German Bunds would not go below say 1% have missed out on some excellent returns……who’s to say they’re not destined for -2%, the investment landscape has clearly been turned on its head post the GFC.

We had the CEO of EFG in a few weeks ago and they are ‘reluctantly’ about to start charging clients to deposit cash with them – never forget that investing is a relative game.

German 10-year Bunds Chart

German 10-year Bond Yield Chart

German 10-year Bond Yield Chart

Question 2

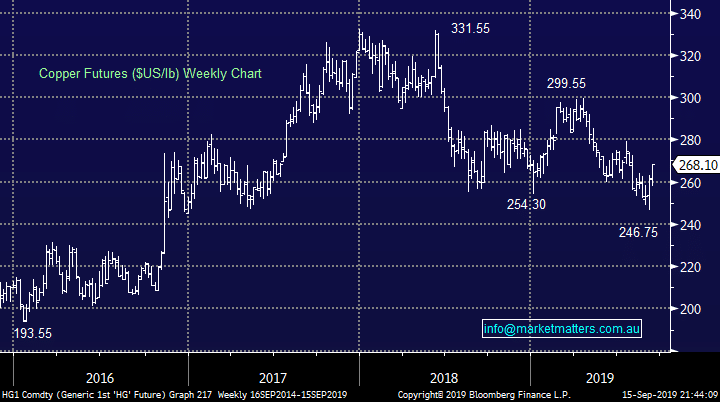

“Hi, just checking again your thoughts on long on copper” – Tim W.

Hi Tim,

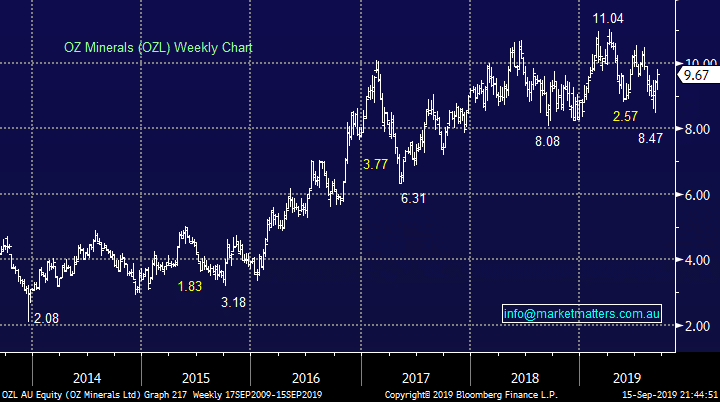

No major change, we continue to feel there’s a strong possibility of another leg lower in stocks which is likely to mean a short-term pullback for copper stocks, assuming we are correct of course. However technically copper looks good short-term as US-China trade talks loom in October making it tricky at present, thus leaving us happily sitting on our hands.

If / when we see the ASX200 correct back towards 6200, or when we decide this scenario has become unlikely and the market again looks net bullish copper stocks will be on our buy radar. Assuming no unusual news on the corporate front in the weeks ahead we particularly like OZ Minerals (OZL) for copper exposure, an excellent business which we believe the market is undervaluing medium-term.

MM’s favourite vehicle to buy for copper exposure is OZ Minerals (OZL).

Copper ($US/lb) Chart

Question 2

“Hi, just checking again your thoughts on long on copper” – Tim W.

Hi Tim,

No major change, we continue to feel there’s a strong possibility of another leg lower in stocks which is likely to mean a short-term pullback for copper stocks, assuming we are correct of course. However technically copper looks good short-term as US-China trade talks loom in October making it tricky at present, thus leaving us happily sitting on our hands.

If / when we see the ASX200 correct back towards 6200, or when we decide this scenario has become unlikely and the market again looks net bullish copper stocks will be on our buy radar. Assuming no unusual news on the corporate front in the weeks ahead we particularly like OZ Minerals (OZL) for copper exposure, an excellent business which we believe the market is undervaluing medium-term.

MM’s favourite vehicle to buy for copper exposure is OZ Minerals (OZL).

Copper ($US/lb) Chart

OZ Minerals (OZL) Chart

OZ Minerals (OZL) Chart

Question 3

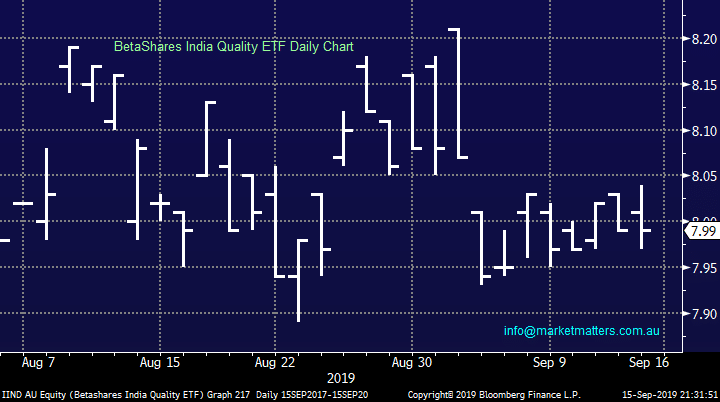

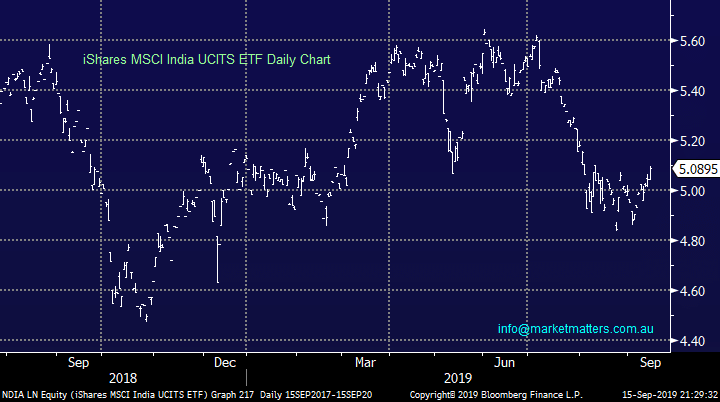

“Dear James, could you please advise on taking exposure in ETFs IIND and NDIA?” - Best regards, Sachin S

Morning Sachin,

Two relatively new ETF’s to allow investors to gain exposure to the exciting Indian market, and economy.

1 – iShares MSCI India UCITS ETF (NDIA LN) is incorporated in Ireland, the fund tracks the MSCI India Index net $US. The market cap is $US240m but will require investors to have access to an overseas trading platform / broker to invest / trade.

2 - BetaShares India Quality ETF (IIND AU), a relatively small ETF with a market cap below $8m however it should be relatively easy for local investors to use - the fund is priced / traded in $A.

I have not watched the 2 products closely so unfortunately I cannot comment on their spreads, or average net cost to buy / sell.

On face value both look to be good vehicles to gain exposure to India with investors needing to decide where they want exposure i.e. locally in $A, or overseas in $US.

iShares MSCI India UCITS ETF Chart

Question 3

“Dear James, could you please advise on taking exposure in ETFs IIND and NDIA?” - Best regards, Sachin S

Morning Sachin,

Two relatively new ETF’s to allow investors to gain exposure to the exciting Indian market, and economy.

1 – iShares MSCI India UCITS ETF (NDIA LN) is incorporated in Ireland, the fund tracks the MSCI India Index net $US. The market cap is $US240m but will require investors to have access to an overseas trading platform / broker to invest / trade.

2 - BetaShares India Quality ETF (IIND AU), a relatively small ETF with a market cap below $8m however it should be relatively easy for local investors to use - the fund is priced / traded in $A.

I have not watched the 2 products closely so unfortunately I cannot comment on their spreads, or average net cost to buy / sell.

On face value both look to be good vehicles to gain exposure to India with investors needing to decide where they want exposure i.e. locally in $A, or overseas in $US.

iShares MSCI India UCITS ETF Chart

BetaShares India Quality ETF Chart

BetaShares India Quality ETF Chart