Questions from subscribers – having a look at value in the US and Australian markets

**This is an extract from the Market Matters Morning Report from 15 July. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

“Hi to you all, I have been closely watching the S 'n P 500 as have you folk Was going to ask today if you thought time to open a position..and now you have. The previous time you opened this trade was using BBUS a geared entry. I had done the same during the December downturn I am curious as to your latest ETF choice I am not asking for advice....just want to know the point of difference and why you made the call many thanks and have a great day” – Malcolm S.

Morning Malcolm,

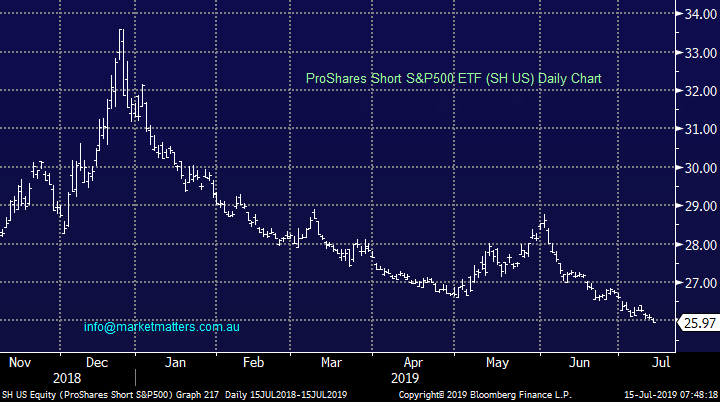

We chose the ProShares short ETF (US SH) over the previously used BBUS ETF for 2 simple reasons:

1 – The SH trades significantly more volume courtesy of it being domiciled in the US like the S&P500 e.g. on Friday night it traded ~2.6m units. This depth helps lower the spread costs between both buying & selling.

2 – The SH is not a leveraged product which suits our current stance of looking to “build” a position into strength as we await a clear sell signal on US stocks.

3 – The new Global ETF portfolio is not constrained by simply investing in ASX listed products however, for those only using ASX products, the BBUS will certainly do the job, however remember, it is leveraged.

MM sees decent risk / reward on the downside for US equities.

ProShares short S&P500 ETF (SH US) Chart

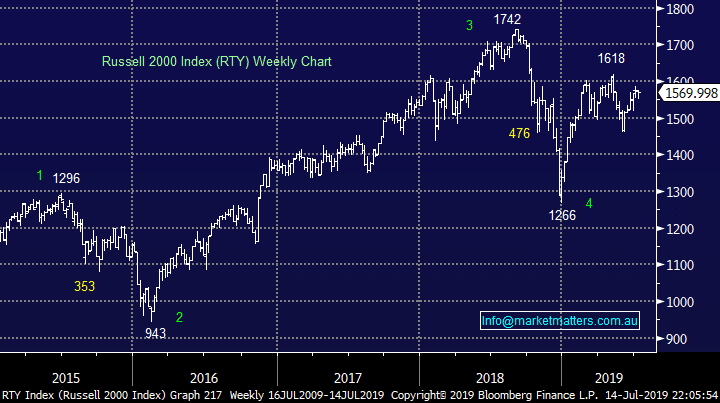

The S&P500 is in a classic sell position / area whereas the small cap Russell 2000 is more 50-50 i.e. did it top back in 2018 or is it poised to surprise many and make another push higher by ~10%. Hence our caution to go “all in” short US stocks at this stage.

Russell 2000 Index Chart

The S&P500 is in a classic sell position / area whereas the small cap Russell 2000 is more 50-50 i.e. did it top back in 2018 or is it poised to surprise many and make another push higher by ~10%. Hence our caution to go “all in” short US stocks at this stage.

Russell 2000 Index Chart

Question 2

“Hi Team, Question : If Marcus Padley and others are correct which 10 stocks would you put on a must buy if they drop list? I just read-- Several analysts have told PM a major stock market correction is imminent. "Something's clearly wrong," veteran market watcher Marcus Padley said. Plus, Australia is at risk of an imminent market correction that would leave thousands of older Australians approaching retirement out of pocket, analysts warn” – Regards Richard

Hi Richard,

While we are tweaking our Growth Portfolio to a far more conservative / defensive stance given the markets position, big calls like the ones above are often designed to attract readers / clicks rather than anything else. The obvious issue with calling an imminent market correction is picking the actual straw that breaks the camel’s back, a very difficult task and as we often say, picking market tops is trickier than picking bottoms.

However moving onto actually answering you question, the below 4 points should shine some light on our thoughts:

1 - A defensive portfolio construction is as much about what you avoid as what you buy – at MM we will be avoiding high beta and growth stocks with the best way to identify these potential “culprits” simply by revisiting stocks that were smacked the hardest in late 2018.

2 – Cash can be king for short periods of time but not in the long run, that prize belongs to equities hence while we are comfortable currently holding 25% cash today but we are always looking for opportunities to deploy this $$.

3 – If we become seriously concerned to the short-term health of stocks we may simply buy a defensive negative facing ETF e.g. BEAR as opposed to mass selling of stocks that still provide a steady yield i.e. hedging our portfolio.

4 – Stocks we like over the next 12-months are ones which produce a sustainable recession proof yield like Tabcorp (TAH) and Telstra (TLS) but the issue is many people have the same opinion so valuations are rich in many of these names. Also we like the resources, especially iron ore names into a correction, and we are looking to hold 1 or 2 gold names moving forward although we feel a US facing ETF like the GDX is likely to outperform if our call for a stronger $A proves correct.

In essence as opposed to saying buy these 10 names we prefer a mixture of stocks, cash for flexibility and negative facing ETF’s to insulate our portfolio against short term capital losses.

To view the current MM Growth Portfolio which reflects the shares we like at this point in time: CLICK HERE

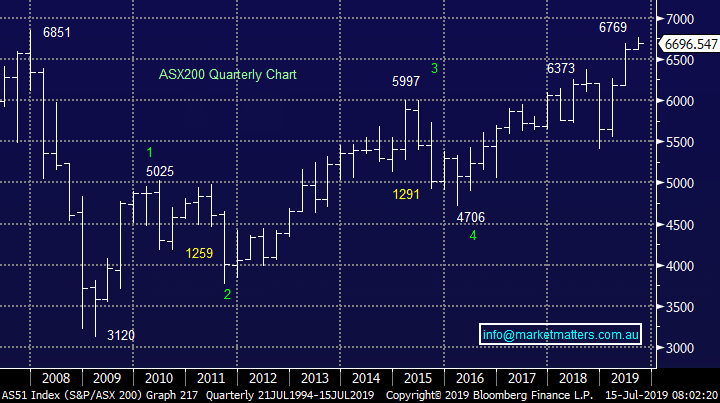

ASX200 Chart

Question 2

“Hi Team, Question : If Marcus Padley and others are correct which 10 stocks would you put on a must buy if they drop list? I just read-- Several analysts have told PM a major stock market correction is imminent. "Something's clearly wrong," veteran market watcher Marcus Padley said. Plus, Australia is at risk of an imminent market correction that would leave thousands of older Australians approaching retirement out of pocket, analysts warn” – Regards Richard

Hi Richard,

While we are tweaking our Growth Portfolio to a far more conservative / defensive stance given the markets position, big calls like the ones above are often designed to attract readers / clicks rather than anything else. The obvious issue with calling an imminent market correction is picking the actual straw that breaks the camel’s back, a very difficult task and as we often say, picking market tops is trickier than picking bottoms.

However moving onto actually answering you question, the below 4 points should shine some light on our thoughts:

1 - A defensive portfolio construction is as much about what you avoid as what you buy – at MM we will be avoiding high beta and growth stocks with the best way to identify these potential “culprits” simply by revisiting stocks that were smacked the hardest in late 2018.

2 – Cash can be king for short periods of time but not in the long run, that prize belongs to equities hence while we are comfortable currently holding 25% cash today but we are always looking for opportunities to deploy this $$.

3 – If we become seriously concerned to the short-term health of stocks we may simply buy a defensive negative facing ETF e.g. BEAR as opposed to mass selling of stocks that still provide a steady yield i.e. hedging our portfolio.

4 – Stocks we like over the next 12-months are ones which produce a sustainable recession proof yield like Tabcorp (TAH) and Telstra (TLS) but the issue is many people have the same opinion so valuations are rich in many of these names. Also we like the resources, especially iron ore names into a correction, and we are looking to hold 1 or 2 gold names moving forward although we feel a US facing ETF like the GDX is likely to outperform if our call for a stronger $A proves correct.

In essence as opposed to saying buy these 10 names we prefer a mixture of stocks, cash for flexibility and negative facing ETF’s to insulate our portfolio against short term capital losses.

To view the current MM Growth Portfolio which reflects the shares we like at this point in time: CLICK HERE

ASX200 Chart