Questions from subscribers – having a look at APT, SGM and more!

**This is an extract from the Market Matters Morning Report from 1 July. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 1

“Hi James & MM team, My first question is regarding Afterpay (APT). I was caught off guard by the 10% correction that played out on Friday afternoon after reaching all-time highs earlier in the day. Do you think the threat from Visa is significant and could destroy Afterpay? I also have concerns over the European branding strategy where they are using ClearPay due to issues with Afterpay trademark in that jurisdiction. What do you feel is the likely market reaction on Monday morning that people have had the weekend to consider the Visa announcement? Would you be selling now and potentially buying back later once the competitive threats have been fully understood? My second question is regarding Quickstep (QHL). Do you consider their business model viable? They seem to have a good technology, some good customers, Perpetual has taken a substantial holding, yet the share price has traded sideways for nearly two years.” - Cheers Craig L.

Morning Craig,

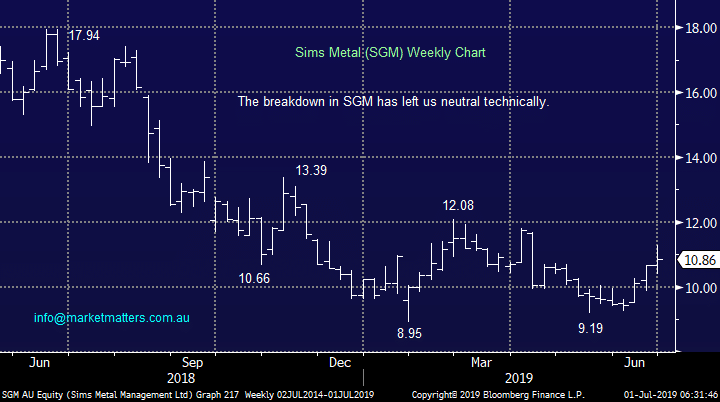

We discussed our view on Afterpay Touch (APT) last week following the Visa announcement:

“Visa is making it easier to provide shoppers the ability to choose how they pay before, during or after purchase with the introduction of a suite of Visa’s instalment solutions APIs. Through a pilot program, participating issuers and merchants will be able to offer their customers an instalment payment experience at checkout using a Visa card they already have in their wallet. With Visa’s instalment solutions, Visa cardholders will have the option to divide their total purchase amount into smaller, equal payments over a defined time period on qualifying purchases, at the store and online or while traveling abroad…and importantly as we said it sounds very much like APT to us!”

Visa are obviously a big player globally and two trains of thought could be taken here. 1. It validates what APT have created or 2. It signals growing competition from big players which is a significant negative for APT’s US ambitions.

There are differences in APT’s model v what Visa is planning to roll out, and importantly Visa essentially just greases the wheels for the banks to be the credit issuer and this will take time, plus Visa are saying that the pilot program will not be rolled out until 2020, however it’s clear that competition is likely to intensify in this growing market, much favoured by the millennials, and our concern for APT is its valuation into negative news, especially as increasing competition is likely to impact its already “rich” merchant fees. A reduction to these fees would have a painful material impact to APT’s revenue and profitability. Short-term stocks move with a large degree of randomness and we see no reason to be chasing APT at this juncture.

MM is bearish APT initially targeting another ~10% downside.

Afterpay Touch (APT) Chart

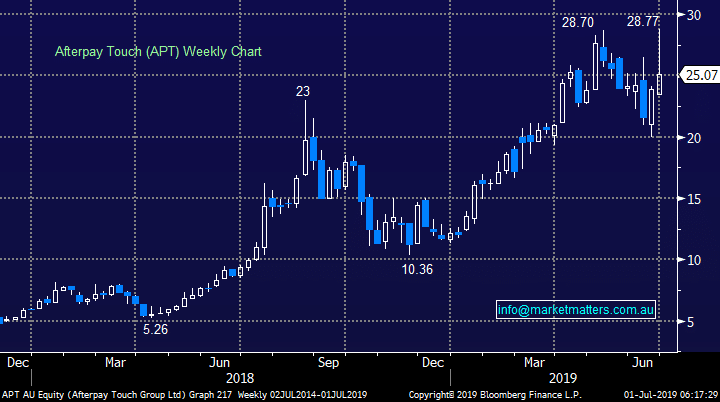

Quickstep (QHL) holdings manufactures a wide range of composite materials primarily used in the aviation industry but although the business has acquired some decent contracts the shares continue to struggle badly. This small cap stock only has a market cap of $61.8m taking it off the radar as a potential investment vehicle for MM hence our comments are only from a technical perspective.

Technically MM looks ok with stops below 7.5c but the trend is undoubtedly down.

Quickstep Holdings (QHL) Chart

Quickstep (QHL) holdings manufactures a wide range of composite materials primarily used in the aviation industry but although the business has acquired some decent contracts the shares continue to struggle badly. This small cap stock only has a market cap of $61.8m taking it off the radar as a potential investment vehicle for MM hence our comments are only from a technical perspective.

Technically MM looks ok with stops below 7.5c but the trend is undoubtedly down.

Quickstep Holdings (QHL) Chart

Question 2

“MM thoughts on ORA at $3.24 for a long-term hold?” - Chris G.

Hi Chris,

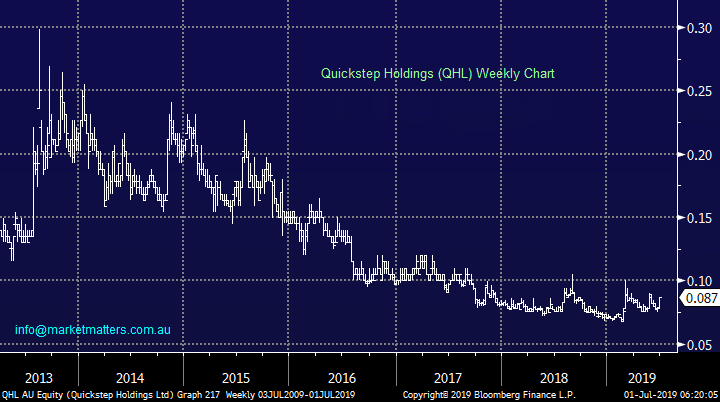

Packaging company Orora (ORA) operates in the same sector as Pact Holdings (PGH) which we averaged last week as it surged almost 20% in just a few days. There is little doubt that ORA currently is a better business than PGH and certainly has a better balance sheet, however in our view it’s not a 60% better business which is what the relative valuation between the two stocks implies. We would put ORA in the group of solid but not exciting stocks and we see more upside potential (and risk) with PGH during 2019. To specifically answer your question we see no reason to dislike ORA long-term but it’s not particularly exciting.

MM is currently neutral Orora (ORA).

Orora Ltd (ORA) Chart

Question 2

“MM thoughts on ORA at $3.24 for a long-term hold?” - Chris G.

Hi Chris,

Packaging company Orora (ORA) operates in the same sector as Pact Holdings (PGH) which we averaged last week as it surged almost 20% in just a few days. There is little doubt that ORA currently is a better business than PGH and certainly has a better balance sheet, however in our view it’s not a 60% better business which is what the relative valuation between the two stocks implies. We would put ORA in the group of solid but not exciting stocks and we see more upside potential (and risk) with PGH during 2019. To specifically answer your question we see no reason to dislike ORA long-term but it’s not particularly exciting.

MM is currently neutral Orora (ORA).

Orora Ltd (ORA) Chart

Question 3

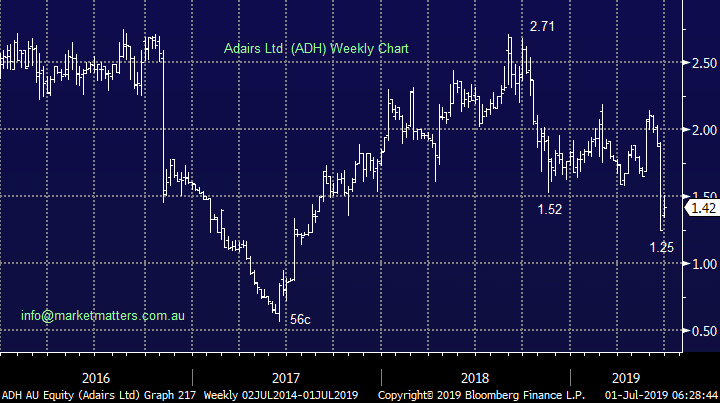

“Hi guys, recent subscriber with a question about ADH. Recently they announced a marginal downgrade to earnings. The stock dropped from $1.80 to $1.30. Director bought some at $1.38 from memory. I noted the downgrade did highlight very recent sales. This makes me worried about the guidance. I am not a holder, but it's on my radar. Technically I believe it looks great. Fundamentally, that's where I need your help! Do you have any thoughts?” - Thanks, Richard H.

Hi Richard,

Home furnishings retailer Adairs (ADH) followed many companies exposed to the indebted Australian consumer by downgrading earnings last month. The business is experiencing both volatile sales and margin contraction with the company now expecting total sales ~$340m with gross margin guidance lowered to around 60%. To compound the downgrade the surprise and sudden departure of their CFO is another concern. MM has remained out of the retail space believing there’s a strong possibility of an almost panic like washout in the sector over the next 6-12months, this view has not changed.

Technically, we are actually neutral ADH requiring a solid close above $1.55 to become bullish.

MM is neutral ADH at this point in time.

Adairs Ltd (ADH) Chart

Question 3

“Hi guys, recent subscriber with a question about ADH. Recently they announced a marginal downgrade to earnings. The stock dropped from $1.80 to $1.30. Director bought some at $1.38 from memory. I noted the downgrade did highlight very recent sales. This makes me worried about the guidance. I am not a holder, but it's on my radar. Technically I believe it looks great. Fundamentally, that's where I need your help! Do you have any thoughts?” - Thanks, Richard H.

Hi Richard,

Home furnishings retailer Adairs (ADH) followed many companies exposed to the indebted Australian consumer by downgrading earnings last month. The business is experiencing both volatile sales and margin contraction with the company now expecting total sales ~$340m with gross margin guidance lowered to around 60%. To compound the downgrade the surprise and sudden departure of their CFO is another concern. MM has remained out of the retail space believing there’s a strong possibility of an almost panic like washout in the sector over the next 6-12months, this view has not changed.

Technically, we are actually neutral ADH requiring a solid close above $1.55 to become bullish.

MM is neutral ADH at this point in time.

Adairs Ltd (ADH) Chart

Question 4

“Hi James & MM, could you please give me your analysis on Sims Metal SGM, it has been creeping up for a while now and looks like getting to its previously recommended M&M buy level of $11.50. Do you see this trend continuing and if so can you recommend to me a dollar exit level.” - Cheers Tony K.

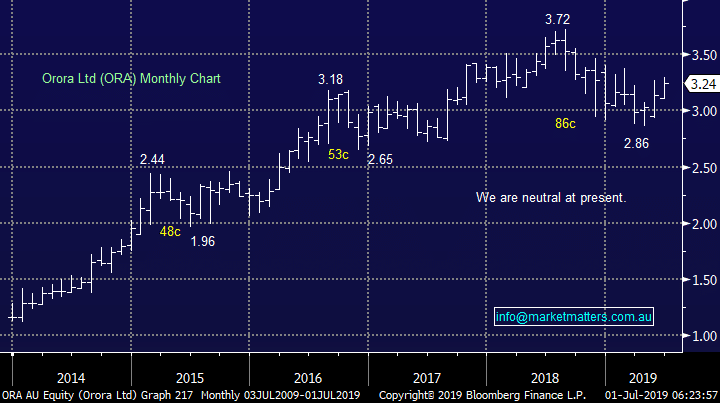

Hi Tony,

Sims Metal (SGM) continues to chop in an unpredictable manner between $9 and $12 with the stock currently in the middle of the range. If we were holding SGM our exit levels would be at $12 and $13 with a scale out approach feeling the likely strategy

MM is neutral SGM.

Sims Metal (SGM) Chart

Question 4

“Hi James & MM, could you please give me your analysis on Sims Metal SGM, it has been creeping up for a while now and looks like getting to its previously recommended M&M buy level of $11.50. Do you see this trend continuing and if so can you recommend to me a dollar exit level.” - Cheers Tony K.

Hi Tony,

Sims Metal (SGM) continues to chop in an unpredictable manner between $9 and $12 with the stock currently in the middle of the range. If we were holding SGM our exit levels would be at $12 and $13 with a scale out approach feeling the likely strategy

MM is neutral SGM.

Sims Metal (SGM) Chart