Questions from subscribers – alternative ways to find income

**This is an extract from the Market Matters Morning Report from 15 July. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

Question 3

“Hi Team, a quick one. I want to park some cash for a period, where can I go to evaluate the alternatives with respect to Hybrid’s ; i.e. is there an evaluation list someplace.” - Thanks Geoff S.

“Weekly subscriber question Hi guys, with moving to more cash, do you have a suggestion on somewhere to 'park' to money while in cash. Regards, Glenn H.

Morning Lads,

For a full list of hybrids, here is a rate sheet from Shaw and Partners which covers the universe of listed hybrids. Download rate sheet – CLICK HERE

Excuse the plug but our MM Income SMA : https://www.marketmatters.com.au/news/sma/, has a mix of stocks and income investments like hybrids that have lower volatility and higher yield than the underlying market. The portfolio returned +10.16% in FY19 versus its benchmark of RBA +4% . Obviously by definition we hold our preferred hybrids in this Portfolio. (BTW, I do intend to review our hybrids in this weeks income note on Wednesday )

We would be delighted to send through some more details on our SMA’s, just drop an me an email to : [email protected]

By way of reminder, we only provide general advice.

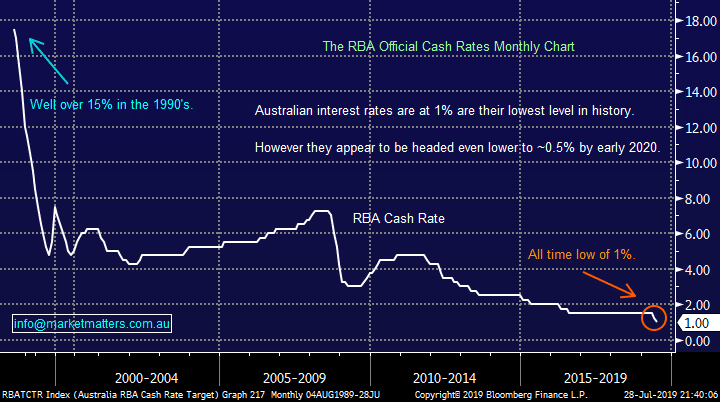

The RBA Cash Rate Chart

Question 4

“Hi, Team at Market Matters, How would you rank the safety of investing in MXT, NBI & GCI? Thanks Sidney Is this the right place for subscribers to ask questions?” – Sidney H.

Hi Sidney,

You’ve asked a question I believe a number of subscribers have been thinking, especially as we own both the MXT and NBI listed investment trusts (LIC’s) in our Income Portfolio. This first point I would make is safety can be a dangerous perception as we all know plenty of household names who have fallen by the wayside over the last few decade’s but a spread of risk across a portfolio of say 20 positions certainly softens any position specific risks.

The three securities are very different in terms of their underlying exposures however the return objective provides some insight into the perceived risk of each. MXT targets the cash rate + 3.25%, GCI targets cash rate plus 3.50% & NBI targets 5.25%.

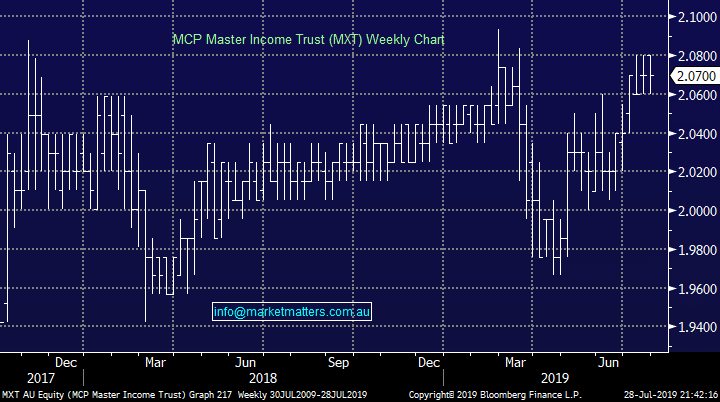

1 – MCP Master Income Trust (MXT) – MXT invests in domestic corporate loans, so sitting in alongside, or in place of banks, lending to Australian corporates.

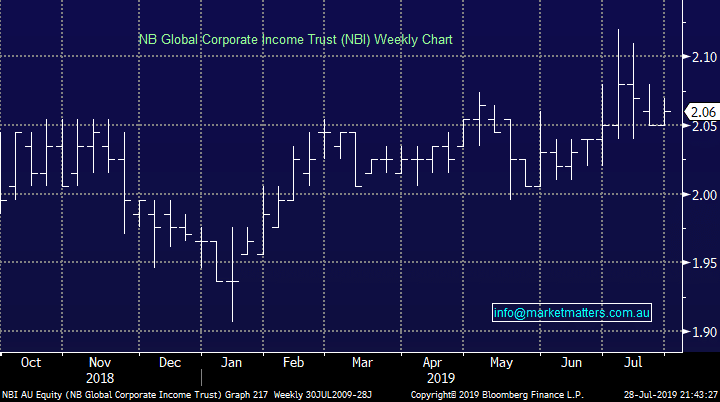

2 – NB Global Corporate Income Trust (NBI) - NBI invests in global bond markets, holding a very diverse portfolio of overseas bonds.

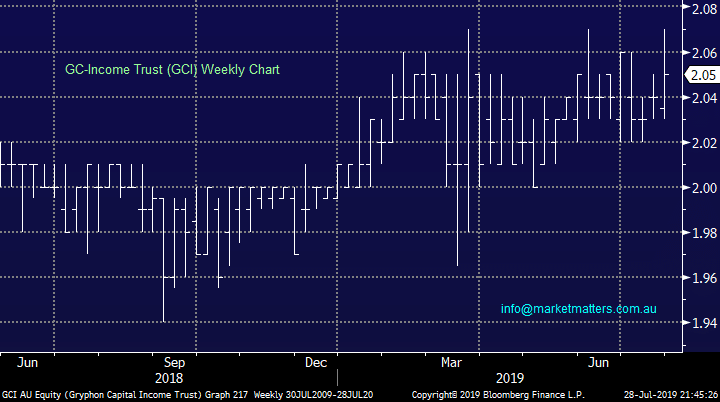

3 - Gryphon Capital Income Trust (GCI) - GCI invests is residential mortgage backed securities (RMBS), which in simple terms is a security that is underpinned by a bunch of residential mortgages

These are all well diversified funds within their respective areas, however from a risk perspective, diversification between funds, fund managers, their strategies and underlying asset classes is the best way in managing risk.

MCP Master Income Trust (MXT) Chart

Question 4

“Hi, Team at Market Matters, How would you rank the safety of investing in MXT, NBI & GCI? Thanks Sidney Is this the right place for subscribers to ask questions?” – Sidney H.

Hi Sidney,

You’ve asked a question I believe a number of subscribers have been thinking, especially as we own both the MXT and NBI listed investment trusts (LIC’s) in our Income Portfolio. This first point I would make is safety can be a dangerous perception as we all know plenty of household names who have fallen by the wayside over the last few decade’s but a spread of risk across a portfolio of say 20 positions certainly softens any position specific risks.

The three securities are very different in terms of their underlying exposures however the return objective provides some insight into the perceived risk of each. MXT targets the cash rate + 3.25%, GCI targets cash rate plus 3.50% & NBI targets 5.25%.

1 – MCP Master Income Trust (MXT) – MXT invests in domestic corporate loans, so sitting in alongside, or in place of banks, lending to Australian corporates.

2 – NB Global Corporate Income Trust (NBI) - NBI invests in global bond markets, holding a very diverse portfolio of overseas bonds.

3 - Gryphon Capital Income Trust (GCI) - GCI invests is residential mortgage backed securities (RMBS), which in simple terms is a security that is underpinned by a bunch of residential mortgages

These are all well diversified funds within their respective areas, however from a risk perspective, diversification between funds, fund managers, their strategies and underlying asset classes is the best way in managing risk.

MCP Master Income Trust (MXT) Chart

NB Global Corporate Income Trust (NBI) Chart

NB Global Corporate Income Trust (NBI) Chart

Gryphon Capital Income Trust (GCI) Chart

Gryphon Capital Income Trust (GCI) Chart