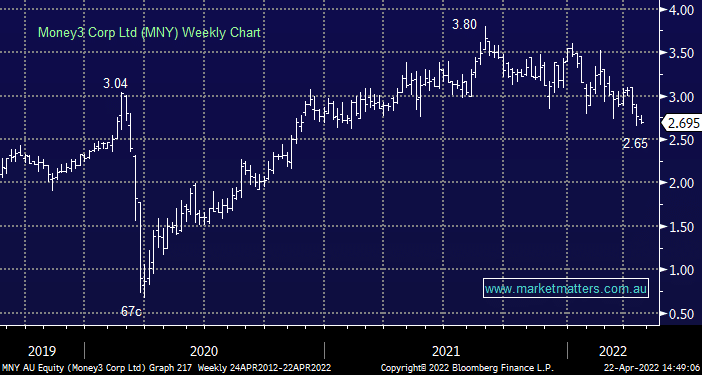

What’s MM’s current thoughts on Money3 (MNY)?

Hi James, Thanks for your excellent commentary and advice. Last year you were positive on MNY. They have since reported strong results and a positive outlook for FY22, and yet experienced a sharp fall in share price. Can you please update your opinion?