Qantas (QAN) raises capital to stave off infection

Qantas (QAN)

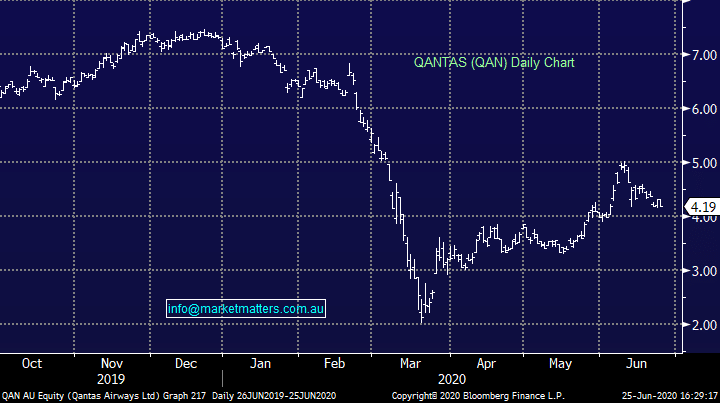

Launched a chunky $1.4b institutional placement yesterday along with a $500m share purchase plan today with the airline bringing in sweeping changes to keep the businesses in operation and hopefully come out of the crisis in better shape. Institutions were offered stock at $3.65 a share, a healthy but not excessive 12.9% to yesterday’s close. The raise will add 25% to shares on issue with the cash being put to work to support the recovery plan and sure up the balance sheet. Ahead of the full year result, the flying kangaroo managed expectations at the result guiding the market to a small underlying profit for the full year while also releasing $2.8b worth of significant items as outlined below.

Source; Qantas

Qantas will sack 6,000 staff, with another 15,000 furloughed as it continues to operate on drastically reduced flight numbers. Domestic travel is starting to see more demand with flights now back to 15% of pre-COVID levels, however the company does not expect international flights to see any significant rebound for another 12 months. Alan Joyce is aiming fir $15b worth of savings in the business to be stripped in the next three years with the CEO committing to the roll through to FY23. The raise draws a line in the sand for Qantas as it is forced to become a drastically different business. The price looks on the full side for ours with the 13% discount on the tight side considering the number of unknowns still out there.

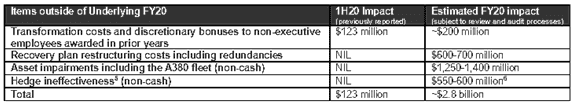

Qantas (QAN) Chart

Source; Qantas

Qantas will sack 6,000 staff, with another 15,000 furloughed as it continues to operate on drastically reduced flight numbers. Domestic travel is starting to see more demand with flights now back to 15% of pre-COVID levels, however the company does not expect international flights to see any significant rebound for another 12 months. Alan Joyce is aiming fir $15b worth of savings in the business to be stripped in the next three years with the CEO committing to the roll through to FY23. The raise draws a line in the sand for Qantas as it is forced to become a drastically different business. The price looks on the full side for ours with the 13% discount on the tight side considering the number of unknowns still out there.

Qantas (QAN) Chart