Positive start to the week, Macquarie downgrades, Citadel cops bid, Vocus added to Goldman’s conviction buy list (MQG, VOC, CGL)

WHAT MATTERED TODAY

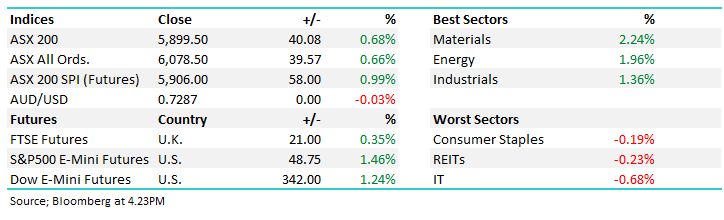

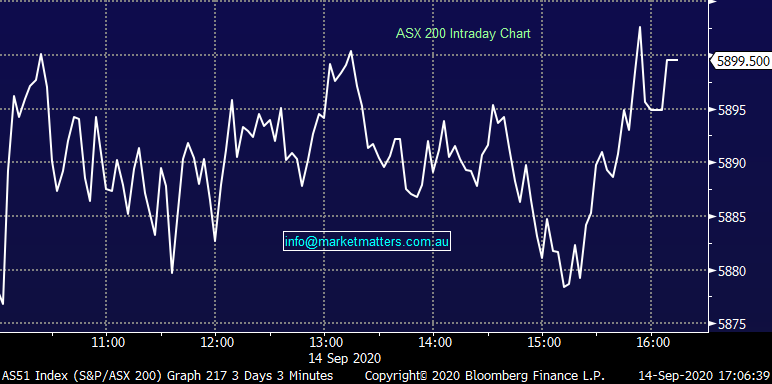

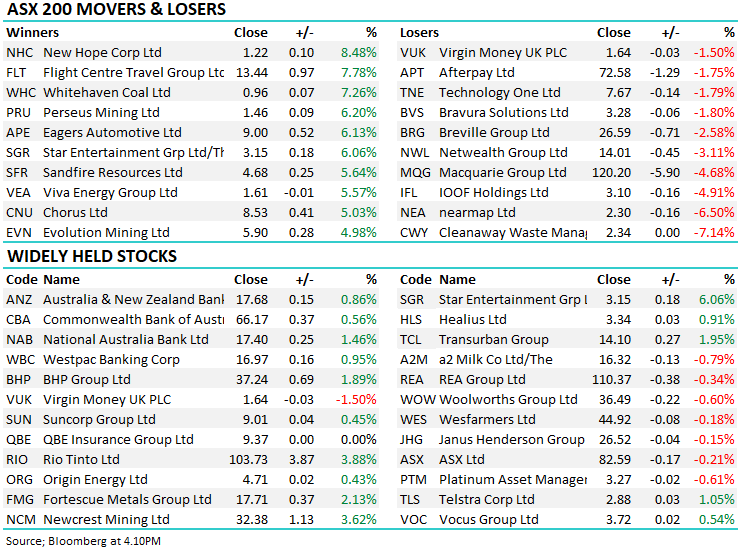

A decent way to kick off the week for the Aussie market with the material and energy stocks leading the charge thanks to strong moves in commodity markets on Friday. The ugly duckling of the resource trade did best today – Coal – with New Hope (NHC) +8.48% and Whitehaven Coal (WHC) +7.26% the standouts, while we also saw strong buying in the re-opening trade, Flight Centre - Star Entertainment & Co all up strongly on news that vaccine trials had recommenced. IT stocks still under-pressure with the BNPL names down again today, although there was some buying from the lows. Important to recognise this remains a momentum trade and while the momentum is down at the moment when it turns, the upside can play out quickly.

Asian markets were positive during our time zone today while US Futures are pricing a good start in US markets tonight.

By the close, the ASX 200 was up +40pts / +0.68% to 5899. Dow Futures are trading +342pts higher

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Macquarie (MQG) -4.68%: Hit today on a profit downgrade with the investment bank and infrastructure manager saying first-half profit will be down 35% amid the “uncertain” speed of recovery from the coronavirus pandemic. The market was already pricing in a 25% decline for the half however todays update is another leg down on that expectation, albeit, MQG have a history of under promising and over delivering. They say market conditions are likely to remain challenging, especially given the significant and unprecedented uncertainty caused by the worldwide impact of Covid-19 and the uncertain speed of the global economic recovery, plus they went onto say they’re unable to provide “meaningful” earnings guidance for the full year. The forecast implies net income in the six months ending Sept. 30 will fall to about $950 million, from $1.46 billion a year earlier and below the $1.1 billion expected. We’ve flagged MQG as a likely sell in the Weekend Note on Sunday however unfortunately we did not get the opportunity. We’re not keen to sell weakness so we’re holders until it recovers somewhat.

Macquarie (MQG) Chart

Vocus (VOC) +0.54%: Goldmans added the telco to its Conviction Buy List on Friday – for better or worse – saying that Vocus management is coming to end of three-year turnaround plan and bonuses are tied to share price performance + they expect dividends to resume from 2H FY22. Worth noting though that VOC replaces TLS as their Telco pick with Goldmans saying that TLS has a lack of positive near-term catalysts, although they still maintain a buy rating on the stock, sighting the same positive reason as MM in last week’s income note, that being sustainable free cash flow support. Don’t read too much into the GS conviction buy list, it sounds more positive than it actually is!

Vocus (VOC) Chart

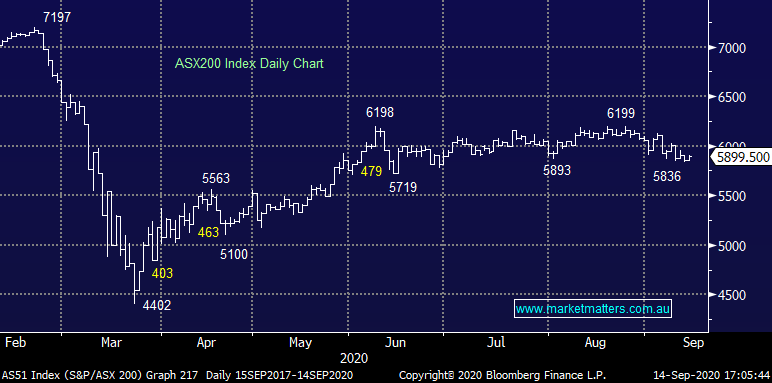

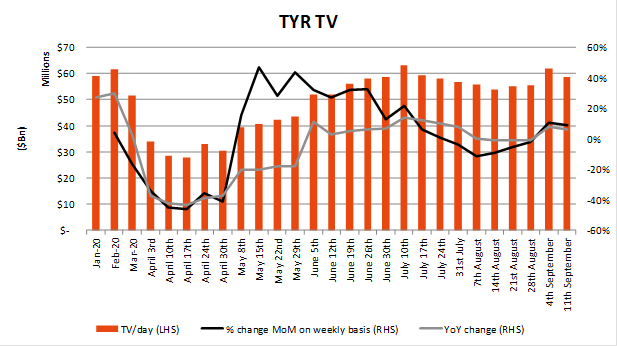

Tyro Payments (TYR) +1.54%: We haven’t covered this in a little while however circling back to Tyro’s weekly trading update they started during COVID which has been very useful in tracking card spend particularly in tourism and hospitality businesses. Overall the data looks to have peaked and offline looks really tough. Victoria lockdowns have contributed to negative sentiment and likely the next few months for offline providers will continue to be tough.

Key points of interest:

· Transaction Value (TV) to week of 11th September was $58m, this is now up 6% YoY;

· However, on a weekly basis this is down ~5%. TV on a weekly basis was ~$55m 2 weeks ago and volumes peaked at ~$63m in July. Although not broken down by geographic areas, likely confidence and decreased movements in Victoria is significantly contributing to the lower volumes. Hard to see how this and offline retail comps well over the next few months as a result;

· Continues to provide a strong proxy for online providers within the economy. Offline particularly those focussing on SME’s, travel and retail (offline) are finding it difficult. The economy in offline nationally is spluttering.

Expect online proxies to continue to rally. Comp sales for July/August continuing to strengthen for these players, should provide a strong 1Q21 update. October the time to own these players into the strongest online environment of the year to January. This chart from Shaw and Partners analyst Jono Higgins looks at total transaction value per day (left hand axis) and the growth rate MoM (Black line) and WoW grey line.

Source: Shaw and Partners

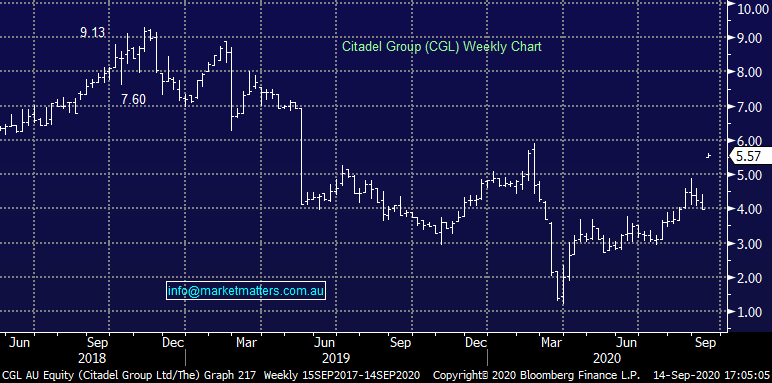

Citadel (CGL) 39.95%: shares in the software solution business popped higher on a takeover bid from private equity firm Pacific Equity Partners. The acquisition by scheme of arrangement comes at $5.70 per share, a 43.2% premium to last, though the price will likely fall by 15cps as the board flagged a 15cps special dividend to release some franking credits for holders. The board has unanimously recommended shareholders accept the offer which, provided the vote passes, the scheme is also subject to court and regulatory approval – unlikely to see much resistance given the PE firm is run locally.

Citadel (CGL) Chart

BROKER MOVES

· Domain Holdings Raised to Hold at Morningstar; PT A$3.20

· a2 Milk Co Ltd/The Raised to Hold at Bell Potter; PT A$17.15

· Incitec Raised to Buy at UBS; PT A$2.40

· Perseus Raised to Outperform at Credit Suisse; PT A$1.60

· Newcrest Raised to Outperform at Credit Suisse; PT A$37.70

· Regis Resources Raised to Outperform at Credit Suisse

· Evolution Raised to Outperform at Credit Suisse; PT A$6.55

· Galaxy Resources Cut to Underweight at JPMorgan

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.