Portfolio Change: Active Income Portfolio

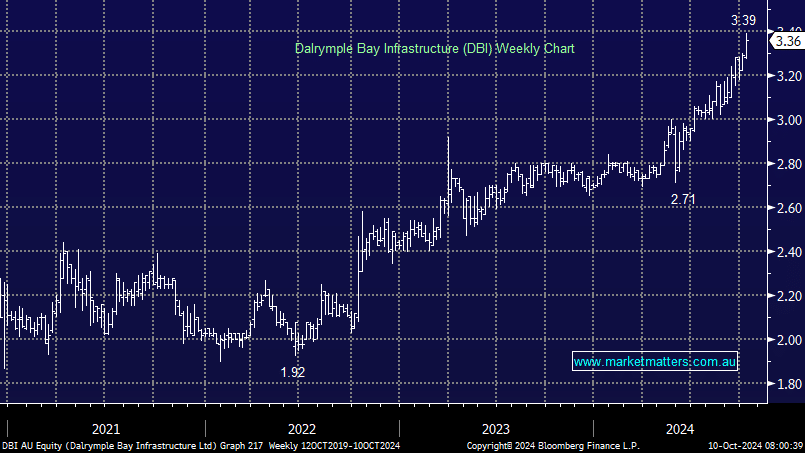

We are stepping up and buying defensive infrastructure company DBI. We were hoping to pick the stock up nearer $3.20, however we missed that level. We have elected to ‘pay up’ given the strong trend playing out in the stock. DBI yields ~7%, 60% franked.

Dalrymple Bay Infrastructure (DBI) provides infrastructure construction services. The Company offers port infrastructure and services for producers and consumers of coal exports. Dalrymple Bay Infrastructure serves clients in Australia.