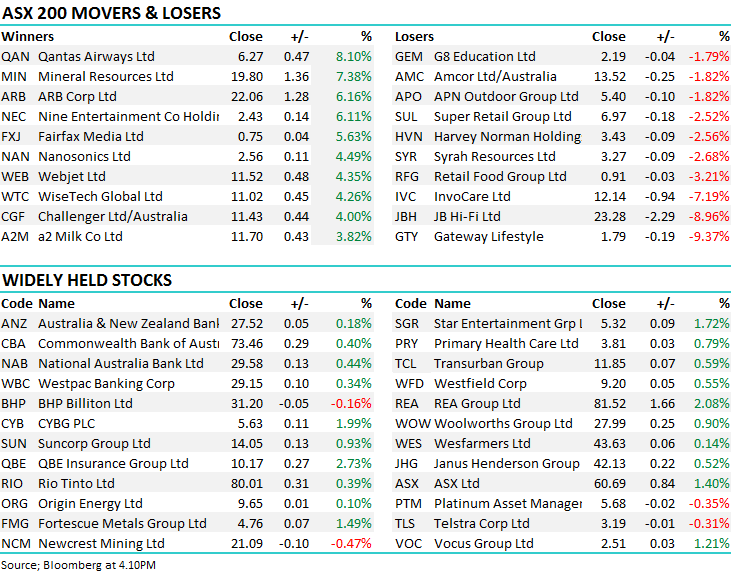

Poor guidance updates dampen an otherwise solid day (IVC, JBH)

WHAT MATTERED TODAY

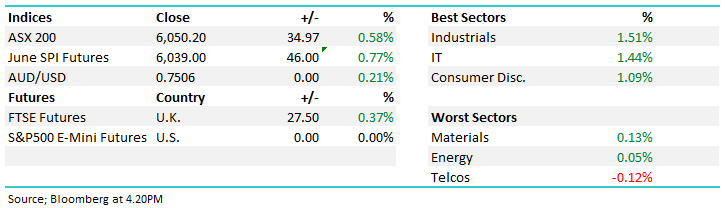

The bourse pushed higher again today, now up 140pts/2.4% in 4 the trading days since the close last Thursday. Each of the big four banks were higher again today – with CBA now over 2% higher when doomsayers were pronouncing APRA’s report would be the end for the banks performance just yesterday morning – not a huge move but significant from a confidence perspective.

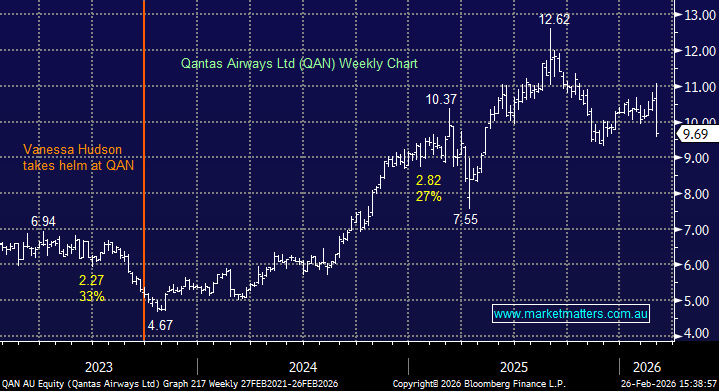

Qantas lead the industrials higher, adding 8.1%, with an impressive Q3 trading update that showed revenue had tracked over 7% higher in the quarter, and 5.2% per seat kilometer – likely more buybacks on the way. Mineral Resources was second only to Qantas today when they revised resource estimates within their Wodgina development. Invocare and JB Hi Fi were punished after both downgraded numbers in their Macquarie Conference presentations – more on these later. Gateway was the worst performer on the index after the residential developer also downgraded guidance citing delays between sale and settlement. GTY also completed the acquisition of two South Australian sites today.

Overall, the index finished 35pts higher, adding +0.58% to 6050.

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker Moves; No major moves from analysts today, all eyes remain on the Macquarie Conference.

- Xero Now ‘Less Risky;’ Stock Could Reach A$100+ in 5-Years: UBS

- U.K. rules changes to drive cloud accounting software use

- CBA Can Handle APRA Penalty But Buyback Less Likely: Street Wrap

- Uncertainty about ongoing regulatory issues likely curbs cap. mgmt

- Australian TV Advertising Keeping ‘Head Above Water’: Macquarie

- Migration of ad spend to digital, social platforms may be slowing

- Mineral Resources Could Miss FY18 Iron Ore Guidance, MS Says

- Ore grade discounts remain elevated; MinRes stockpiling material

- Xero Upgraded to Neutral at UBS; PT A$42.50

- Clean TeQ Holdings Resumed Outperform at Macquarie; PT A$1.80

- ANZ Bank Reinstated at Shaw and Partners With Buy; PT A$30

- Link Administration Rated New Neutral at JPMorgan; PT A$8.17

JB Hi Fi (JBH) $23.28 / -8.96%; fell sharply today after downgrading profit guidance by $5-$10mil to $230mil for FY18. While not a huge downgrade, only a drop by ~2%, it does change the landscape for the retailer who has consistently beaten guidance for some time. Blaming unfavourable weather conditions (seems to be the throwaway line for underperforming companies, e.g. Village Roadshow) impacting the home appliance market for the Good Guys business. They did however maintain sales guidance at $6.85bln for the year, signalling the downgrade stems from falling margins with sales being driven by discounting. The announcement was snuck into their Macquarie Conference presentation that was released to the market this morning, and the CEO Richard Murray did little to ease investors’ concerns during the speech this afternoon as selling continued throughout the day.

While JB Hi Fi is a solid company that will likely ride out the many challenges it faces across its business, whether it be Amazon coming after small goods, or the housing market impacting the whitegoods, or now weather apparently being a factor, it seems margins will continually come under pressure as sales are driven by discounting. This smells like the start of a downgrade cycle for JBH. We have no interest here, a break of $23 targets ~$21.

JB Hi Fi (JBH) Chart

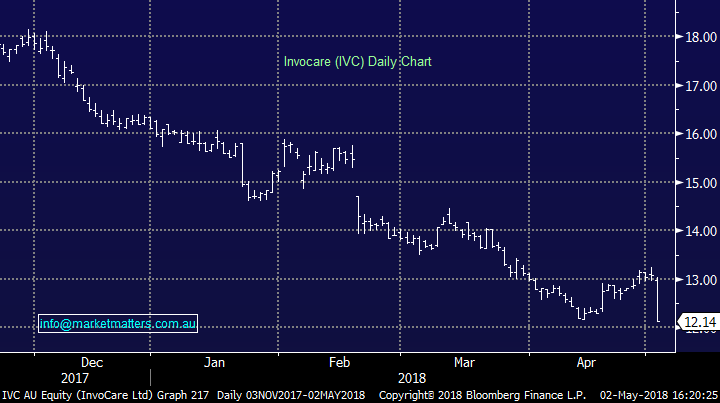

Invocare (IVC) $12.14/ -7.19%; Another example of a (presumably) very low risk stock that has come under intense pressure over the past year or so, trading from ~$18 down to ~$12 today. The demographical tailwinds (a nice way to put it) were the obvious story for the funeral provider IVC, however increasing competition and a flat spot on new clientele over recent times – (and this will continue for the next year or so) has prompted some flattening in earnings. The company today once again downgrading full year numbers while at the same time talking up future innovation / developments in the funeral business to provide a more contemporary offering as they say. I’ve liked this business for a while but became weary when a new player – Propel Funeral Partners (PFP) listed on the ASX with an aggressive growth strategy.

For those that want a sneak peek into the funeral home of the future, below provides it. A one stop shop it seems…

They also put in an image of the past which I can’t help but think they’ve pulled from the depths of the archive…

We currently have no interest in IVC trading on 18x with no growth in the near term.

Invocare (IVC) Chart

OUR CALLS

We sold Macquarie from the Growth Portfolio today, taking a ~9% profit on Macquarie Group (MQG) at $106.90 and switching into Independence Group (IGO) with a 3% weighting. We had an original target in Macquarie of $110 however short term momentum is starting to wain and as discussed yesterday afternoon, two broker downgrades and the relative valuation of MQG v global peers has us on the sell side today, locking in a profit.

We had covered IGO this morning, expecting downgrades to come through after yesterday’s update. That has started to play out yet the stock price has remained resilient – a sign of underlying strength. We therefore decided to ‘pay up’ for IGO around $4.90 with a 3% allocation. We will increase that allocation should IGO pull back to $4.60

Markets are fluid and todays trades highlight that a fluid approach remains key!

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here