Phew its Friday, only 4 more days until the US election!

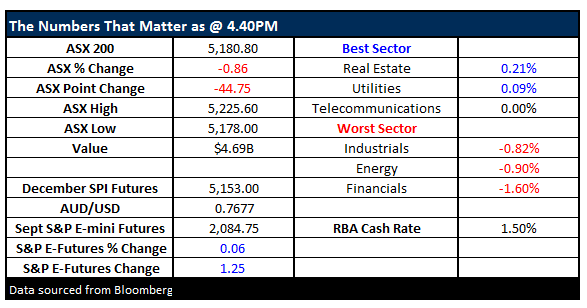

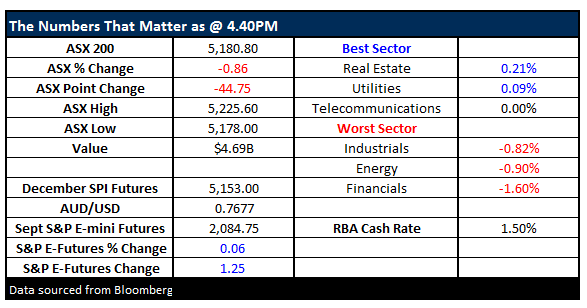

What Mattered Today

Another very disappointing day for the local market as we fell 45-points (0.9%), the US appears scared of a Trump victory BUT we feel almost petrified! The local market has closed down 103-points (1.9%) for the week while the Dow is only down 1.3% going into tonight's session and they have not particularly benefited from the rally in gold stocks.

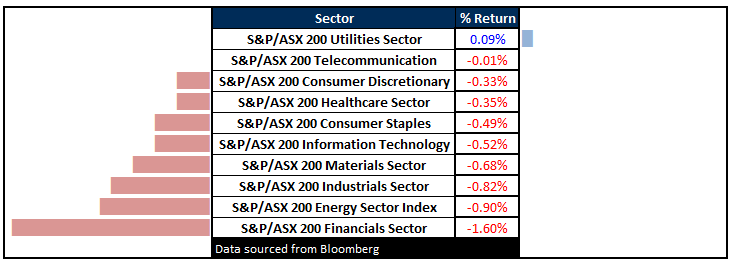

Today was a very lacklustre session with a complete lack of buying pushing the market lower as opposed to the aggressive selling that we have seen of late. NAB fell 2.5% more than its dividend today a typical phenomenon for November that we have pointed out recently. The Energy Sector was also weak today falling over 1% as investors lose confidence with OPEC. After the recent BREXIT surprise investors feel very concerned of a Trump victory next week.

More hand grenades were yet again thrown at local investors with the 2 unfortunate standouts Mayne Pharma Group (MYX) falling 15.5% and Flight Centre not too far behind down 8%. At least there was one standout on the positive front as Orica made fresh highs for 2016 after announcing a healthy $340m profit.

ASX 200 intra-day chart

Mayne Pharma was smacked after climbing 7% yesterday as investors fled the stock following news of a US Department of Justice Investigation into price collusion in the generic drugs market. This is in the too hard basket for us especially as many investors were bullish the stock making aggressive buying of weakness feel unlikely - they are currently long and wrong and we feel for them.

Mayne Pharma Group (MYX) Monthly chart

Flight Centre (FLT) has become a serial dissapointer recently and the stock is down ~50% from its 2014 highs. Today FLT fell after the travel agent warned its annual underlying profit was likely to fall because airlines are offering so many discounted international airfares. FLT is another stock we would rather avoid at present.

Flight Centre (FLT) Monthly chart

Oricas strength today comes from yet more cost cutting but the stock remains clearly neutral to us, especially after recent gains.

Orica Ltd (ORI) Monthly chart

Sectors

ASX 200 Movers

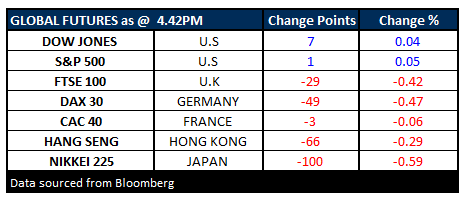

What Matters Overseas

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/11/2016 5.25PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here