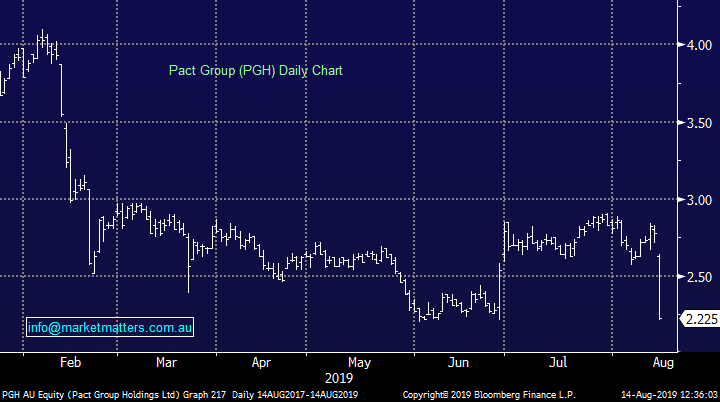

Pact Group (PGH) shares trade near all-time lows

Stock

Pact Group (PGH) $2.23 as at 14/08/2019

Event

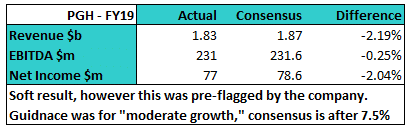

The packaging manufacturer has slumped today, trading 19% lower in the session as the share price heads towards 52-week, and all time, lows. Pact Group’s fall comes as a result of full year results announced this morning.

The result was more or less in line with updated guidance where the company pushed the market towards the lower end of the $230 to $245m EBITDA range. As such, FY19 showed little surprises with the company reaching marginally above the lower end. The statutory figures show a worse outcome, with a number of one-off items dragging the full year to a $290m loss, down from a $74m profit in FY18.

The FY20 outlook for Pact Group was a little behind expectations – depending on your interpretation of “modestly improve” on an EBITDA line. The market was expecting EBITDA growth of around 7.5% for the 12 months, and for mine the outlook statement doesn’t read like a company confident of hitting mid to high single digit growth.

Shares are now trading back to near levels seen prior to the spike where the company reconfirmed guidance and also extended the debt maturity profile. The average maturity extended from 3.4 to 3.6 years at this result and debt levels are being closely watched here.

At 3x gearing, many suspect the company has a balance sheet problem, and the statutory number today isn’t painting a pretty picture going forward. The company did try to ease investor concerns saying the input costs that had caused problems to profits in recent times appears to have peaked and margins should recover going forward.

Pact Group (PGH) Chart

The FY20 outlook for Pact Group was a little behind expectations – depending on your interpretation of “modestly improve” on an EBITDA line. The market was expecting EBITDA growth of around 7.5% for the 12 months, and for mine the outlook statement doesn’t read like a company confident of hitting mid to high single digit growth.

Shares are now trading back to near levels seen prior to the spike where the company reconfirmed guidance and also extended the debt maturity profile. The average maturity extended from 3.4 to 3.6 years at this result and debt levels are being closely watched here.

At 3x gearing, many suspect the company has a balance sheet problem, and the statutory number today isn’t painting a pretty picture going forward. The company did try to ease investor concerns saying the input costs that had caused problems to profits in recent times appears to have peaked and margins should recover going forward.

Pact Group (PGH) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook