Packer gets the feature – cha ching! (CWN, SGM)

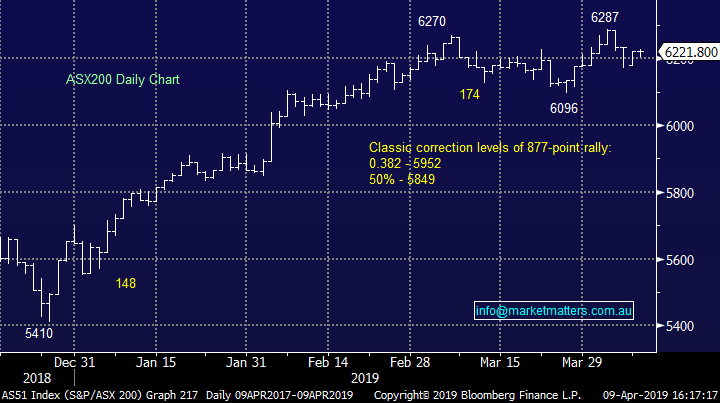

WHAT MATTERED TODAY

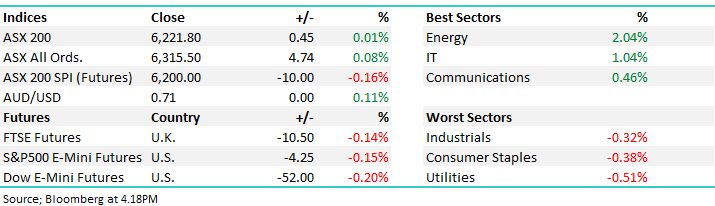

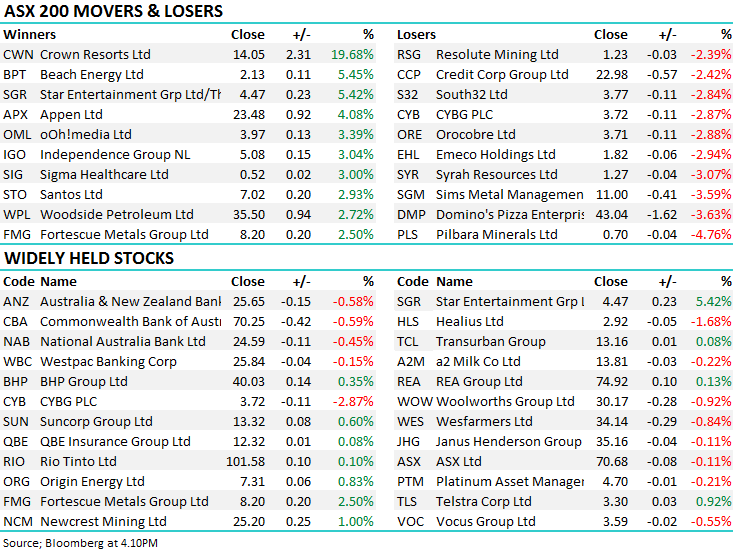

The market ebbed and flowed around 6220 handle on the ASX 200 today – the positive influence from the material stocks offset by some selling amongst the banks – CBA the weakest link after cutting rates on their fixed mortgages, the stock down -0.59% at $70.25 although it traded back below the $70 handle in early trade. Jamie Packers’ Crown Resorts (CWN) was a standout, adding ~20% after Wynn Resorts lobbed a $10bn bid for the local operator, more on that below however Star Entertainment (SGR) was also up +5.42% in sympathy – this could well be the circuit breaker for the local casino operators after a tough 12 months.

BHP traded up through $40 today, and closed above - the first time it’s traded there since August 2011, just before the US debt downgrade scuttled the mkt while energy stocks more broadly were bid up strongly - Woodside (WPL) adding +2.72% while Santos (STO) put on +2.96%. Asian market were fairly flat today while US Futures tracked marginally lower. Locally, the longer the market hangs around / consolidates the 6200 area, in our view the greater the chance of a move down into the 6000 handle.

Overall today, the ASX 200 ended unchanged while Dow Futures are trading down -55pts / -0.21%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

As expected, Crown (CWN), +19.68%, rallied on the back of takeover talks with US based Wynn. We suggested in the morning report that the deal may have legs, and the market certainly bought in today although there still remains a ~5% discount to the current 50/50 cash and scrip offer that values crown at around $14.75/sh, close to $10b. It is hard to see value in buying shares here, but also tough to be on the sell side with plenty still yet to play out. Star Entertainment (SGR), +5.42%, caught some of the residual buying with the bid for Crown as the casino space became a little harder to get access to. We like Star, but closer to $4.

Crown Resorts (CWN) Chart

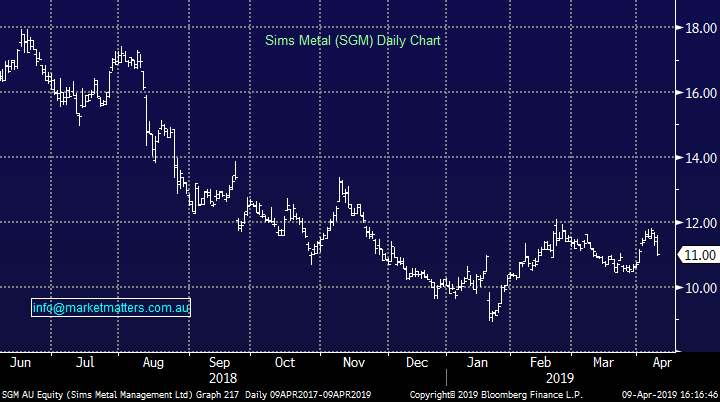

Sims Metals Management (SGM) –3.59% – The largest metals recycler in the southern hemisphere was hit today and to a lesser degree yesterday following a strategy update and site tour. The crux seems to be around a large increase in capital expenditure as Sims targets more aggressive growth to expand their US business plus additional investment in turning waste and landfill into energy . There was some in the market looking for capital management however clearly SGM sees an opportunity and is spending up to take advantage.

The longer term payoff’s look good, however the higher near term capex has provided a weight on the share price. The rationale for buying SGM last week was about higher scrap metal prices – the market here looks to have bottomed and SGM is very much leveraged to it. The rationale remains intact for now.

Sims Metal Management (SGM) Chart

Broker Moves:

· Flight Centre Downgraded to Sell at Morningstar

· South32 Downgraded to Sell at Goldman

· Oil Search Downgraded to Neutral at JPMorgan; PT A$8.65

· Senex Upgraded to Neutral at JPMorgan; PT A$0.40

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.