Oz Minerals out with decent production numbers (OZL, CPU, DHG)

WHAT MATTERED TODAY

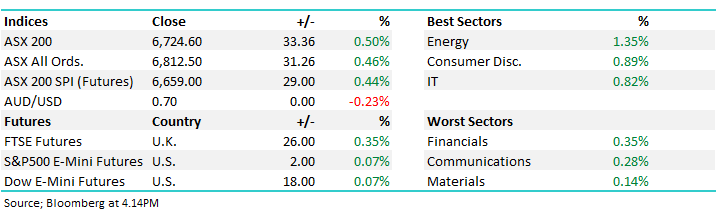

A fairly upbeat sort of day for the Australian share market with a strong open backed up by reasonable buying throughout the session. The Energy sector was best on ground while the Materials lagged, however all sectors closed higher implying good, broad based buying across the bourse.

Asian markets were reasonable, the Nikkei adding +1.17% while the rest of the region edged higher. US Futures were marginally higher into our close.

Overall, the ASX 200 lost -9pts today or -0.14% to 6691. Dow Futures are trading up +31pts / +0.11%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Oz Mineral (OZL) +1.19%: Posted quarterly production numbers today along with an update on Carrapateena, Brazil and West Musgrave growth projects. In terms of production, Prominent Hill copper production at ~27kt (104kt annualised) is tracking ahead of required FY guidance rate (mid-point 100kt) and costs (AISC) tracking below FY guidance range, $1.10-1.20 . Brazil production looks on track to meet FY guidance although 2Q costs were abnormally high ($2.88).

Here’s the bullish take from our Resource Analyst, Peter O’Connor… What an incredible journey … when the new team started at OZL in early 2015 – led by CEO Andrew Cole – the market viewed OZL as a disappointing “one trick pony” with a short mine life (~2022) with just one asset, the challenging Prominent Hill. The latest position has Prominent Hill churning out extraordinary CF to 2030 (2018 EBITDA ~$600m). The “one trick pony” has now made way for a myriad of growth options that could be delivered across the companies “province strategy”. OZL has a LONG term valuation tail that the market hasn’t yet fully grasped, let alone valued – top line growth could hit ~200 % over the 7 year period to 2026/27. Do the math, that’s a CAGR (%) of ~15% vs. RIO and BHP at ~1-3% and pretty much internally funded to boot. So in the near term copper price tribulations will whip-saw the share price but long term the company valuation will grow with future CF.

Oz Minerals (OZL) Chart

Computershare (CPU) -3.57%: The market never likes a CFO resigning just ahead of an earnings result and that’s what happened with CPU Today.CFO Mark Davis intends to step down from his position during the coming year after almost seven years in the role and 19 years with the company. Importantly, the company reaffirmed earnings guidance with EPS for FY19 in constant currency is expected to increase by around 12.5% on FY18. They report FY19 earnings on the 14th August. Not sure why the announcement was made today instead of then which is the likely reason for the SP decline.

Computershare (CPU) Chart

Broker moves;

Domain (DHG) -6.21%; walked into the fire of the UBS analysts dropping their rating a level to a sell ahead of the full year result. They noted the company had ‘robust’ longer term prospects, but the near term showed a number of challenges facing the real estate tech play. Analytics house CoreLogic suggests that listing volumes had continued to deteriorated and are tracking below market analyst expectations and UBS suggest that Domain will be forced into talking down FY20 expectations at the full year. Many pundits have taken the house price bottoming as a sign Domain will reap the benefit of an improving market, however volumes remain light which is key to earnings. UBS see upside if Domain can execute outside of NSW where it has been most dominant.

- Event Hospitality Downgraded to Hold at Ord Minnett; PT A$13.99

- Domain Holdings Downgraded to Sell at UBS; PT Set to A$2.75

- Reliance Worldwide Rated New Neutral at UBS; PT A$3.75

- Saracen Mineral Cut to Underperform at Macquarie; PT A$3.50

- Saracen Mineral Downgraded to Sector Perform at RBC; PT A$3.50

- Navigator Global Downgraded to Neutral at Macquarie; PT A$3.62

- Oil Search Upgraded to Overweight at Morgan Stanley; PT A$8

- Janus Henderson GDRs Cut to Neutral at Evans & Partners

OUR CALLS

No changes locally today.

**Netflix**, which is on the International Equities Portfolio and has been hit after earnings is now being closely watched. It disappointed at their recent result thanks to a surprise reduction on subscriber numbers, it gapped down and now the selling seems exhausted, While we are now on the sell side of this holding, sellers seem exhausted in the short term and we may see a bounce from here. We are now running stops on a close below US$300.

Netflix (NFLX US) Chart

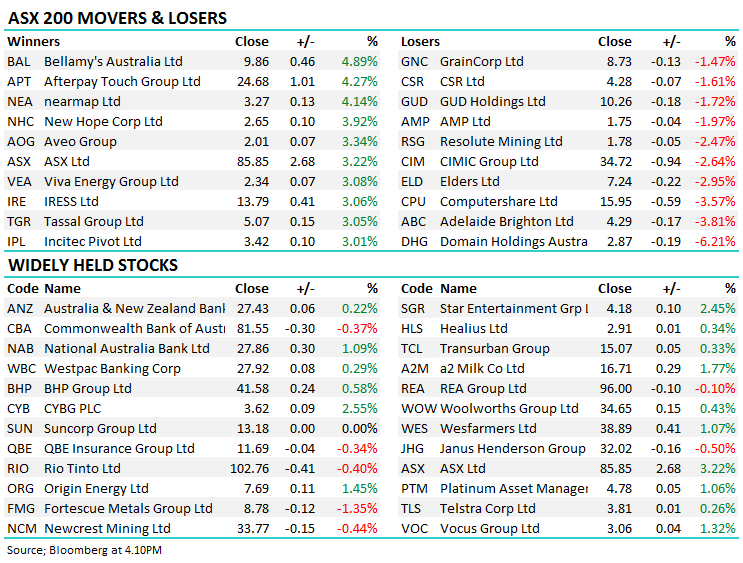

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence